Does your investment portfolio need a tech upgrade?

- Portfolio management softwares are the new buzz in the ecosystem. But what exactly do they do?

- Have you been considering getting your new investment portfolio organized? We’ve got some tips and tricks up our sleeves that we’re willing to share!

- This week, in Angel Bytes, we get into the fundamentals of a good investment portfolio management software and help you decide whether you need one or not!

.png)

It is always a sunny morning in SaaS land. Every day brings a new dawn and new software in its wake. And we’re not complaining!

Who are we to complain when bespoke software allows us to order pet food, an Uber and book a weekend home all from the convenience of our smartphone screen?

However, when we learned that there is software out there that helps angel investors manage their investment portfolios, our interest was naturally piqued, to say the least!

Truth be told, it is no surprise. In this world where there's software for everything, wealth management software has been around for a while now. But recently venture capital management software has gained popularity.

What is investment portfolio management software?

Portfolio management refers to the process of managing and maintaining your investments. So instead of doing it manually, the software keeps track of your shares and investment ventures.

Some stop just there, as a form of a detailed ledger that stores documents, keeps track of important dates and stay up to date on company progress, while others go a step further and help you in managing risk in investment performance, assessing the future of existing investments, and identifying the next investment by quickly assessing the impact on your portfolio.

Baffled? So were we.

What exactly does the portfolio management software buffet cater to?

The fact of the matter is that, like how any well-balanced diet requires a healthy portion of all food components, a well-balanced investment portfolio management system also requires some fundamentals. And this is where most of these softwares are lagging behind.

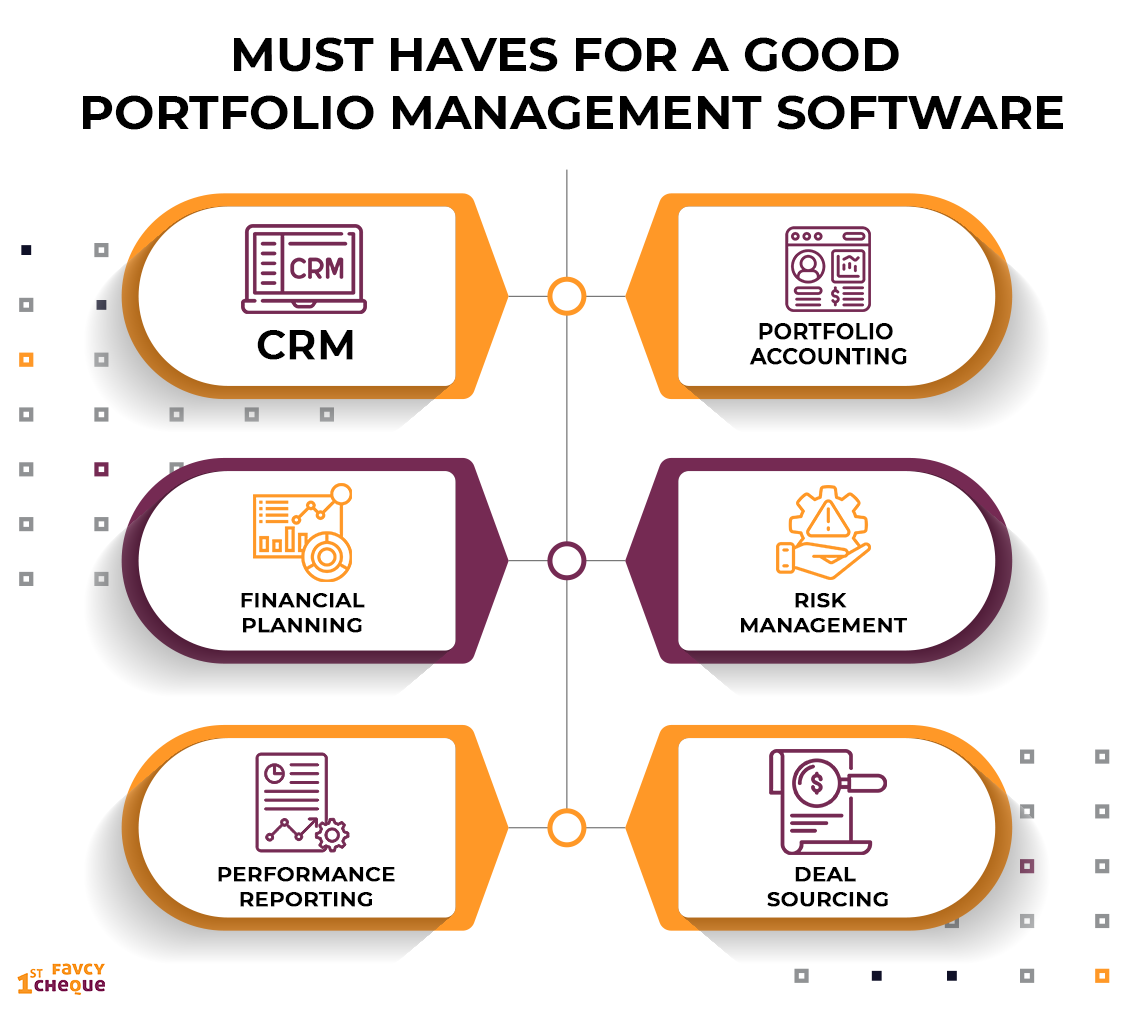

A good portfolio management software must include:

- CRM

- Deal Sourcing

- Model management

- Portfolio construction

- Portfolio accounting

- Financial planning

- Portfolio rebalancing

- Trading

- Risk Management

- Email Integration

- Intelligent Recommendations

- Performance Reporting

Most software often bites off more than it can chew. This leaves the market full of two kinds of venture capital portfolio management softwares - 1) ‘best of breed’ which offer one aspect of wealth management in the best possible way, and 2) ‘all-in-one', which offer a serving of a little bit of everything.

After how many investments should an angel consider before adopting an investment portfolio management software?

If you are comparatively new on the investment bandwagon, it is probably wise to not directly jump into the techie parade. You can if you wish to, but it won’t be that useful until your portfolio becomes vast and diversified.

For investors that have been in the game since many unicorns, IPOs and market waves and own hefty and diverse portfolios - this is a tool you must definitely consider. At the end of the day, if it all makes the investor journey easier for you to tread, it is worth it.

Which players can you consider betting on?

Some of the well-known names include 4Degrees, eFront, Vestberry, Carta and Ledgy.

But regardless of everything, you must conduct your own research. See firsthand what each software offers, and what gives one software an edge over another. In the race of efficient service, you don’t require the fastest racehorse, you require a healthy stallion that can stick by you through thick and thin.

New angel investors, we’ve got your back too!

Softwares and cap tables can be pretty overwhelming when you’re new to all this jazz of maintaining detailed investment portfolios. One of the most difficult problems for early-stage investors is assembling a portfolio of investments that would return more than double the original amount put in the overall portfolio.

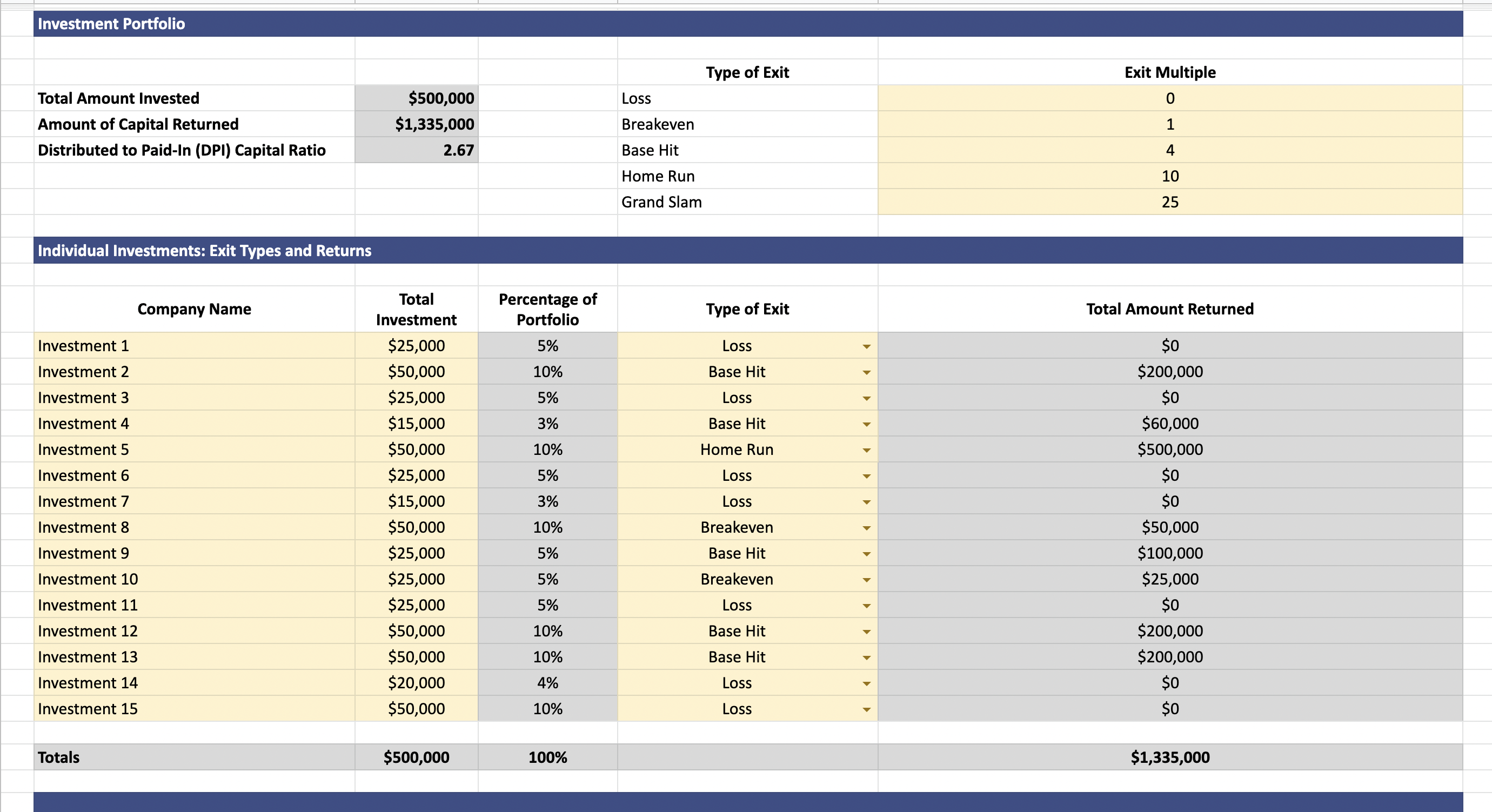

So, we’ve brought to you an easy-to-maintain Google Sheet template that shall help you track your investments, and keep an eye on the total money invested as well as the returns gained. Keep in mind that this is a basic beginner’s template.

How do you go about using this portfolio modeling tool? To start, we created a sample portfolio of 15 companies for you to work from. For each company, there are two variables that you need to set.

- First, you will need to put in an amount that you invest in each company. In a portfolio of 15 companies, you might have the same amount invested in each company.

- Second, you will need to choose or “model” the type of exit for each company in the portfolio.

Here is where you determine the multiple of capital each company will return to your portfolio. Since we are dealing with early-stage companies, you will have a real mix of returns. If you want a realistic model that will be predictive of probable real-life outcomes, we recommend that you set approximately half the portfolio to total losses (i.e. no capital returned). The rest of the portfolio can be a mix of moderate successes with maybe one or two bigger wins.

There is one other variable that you can control on this sheet. In the upper right quadrant of the sheet is a section for the Exit Multiple for each type of exit. Feel free to change these numbers to fit your needs.

Once you set the two variables for each company (and make any changes to the Exit Multiples), take a look in the upper left quadrant of the Google Sheet. There are three important metrics that are calculated for you in that section.

- Total Amount Invested: This is the sum of all the investments you made in the portfolio and lists the total.

- Amount of Capital Returned: This is the sum of all the returned capital based on the types of exits you set for each company.

- Distributed to Paid-In (DPI) Capital Ratio: This represents the multiple of capital your portfolio returns. Remember, a solid DPI is 2 and a top quartile investor will have a DPI of 3 or greater.

So, as we discussed above, a DPI of 2X is a good target to aim for. And 3X is even better and puts you in league with the best VCs.

One final thought to keep in mind. This tool is helpful to determine your overall multiple of returned capital. However, it does not factor in the amount of time it took for this capital to be returned. As you are building your own early stage portfolio, make sure you watch out for how long it takes to get a return on your capital.

Lastly, the million-dollar question that remains is -

Can you substitute these softwares for traditional venture capital firms and investment advisors?

We’d like to believe that for now, this is one of those fads - like eating almonds for enhanced memory. Here’s why.

Is eating almonds good for your overall health? Yes! But do they actually boost memory? Not really.

These portfolio management softwares for venture capital and private equity are more or less the same. Do they actually help manage portfolios? Yes. They help organize, maintain and provide access to your portfolio anywhere. But can they really replace financial advice determined after thorough manual market research, risk analysis and years of experience? Not really. Most of them don’t.

However, many venture capital firms utilize these software smartly, connecting investors to advisors via the software - bringing to you the ultimate investment portfolio management experience that gives you the best of both worlds!

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us:

Liked the article, Share it with others!👇🏻