Angel Investing — S01E03 "Tails, You Win"

- This week, we have our guest writer back on our platform!

- Kiran Karthik, an active investor with 20+ startups in the last year, across multiple sectors like FinTech, Blockchain, D2C, Gaming, Edtech, and Media.

- In his last article, he shares his two cents on how to evaluate startups and if angel investment is the right choice for you!

- In this article, he talks about due diligence and evaluation vectors he considers before investing.

Read on to find out!

In my previous posts in this series, I had shared my perspectives on why I embarked on Angel Investing, as well as how you can get started. Linking both posts in the comment section below.

In this post, I will share my views on making choices from the plethora of investment opportunities that come our way, using a mix of both objective and judgment-based parameters, ranging from market size and unit economics to founder strength, conviction, and so on.

Bear in mind, it is easy to due-diligence our way out of pretty much every investment opportunity we evaluate. Ultimately, every startup investment is a calculated bet and long-term success is a coin toss. But, as Morgan Housel mentions in his popular book, The Psychology of Money, you can be wrong half the time and still make a fortune.

So, let's get to it.

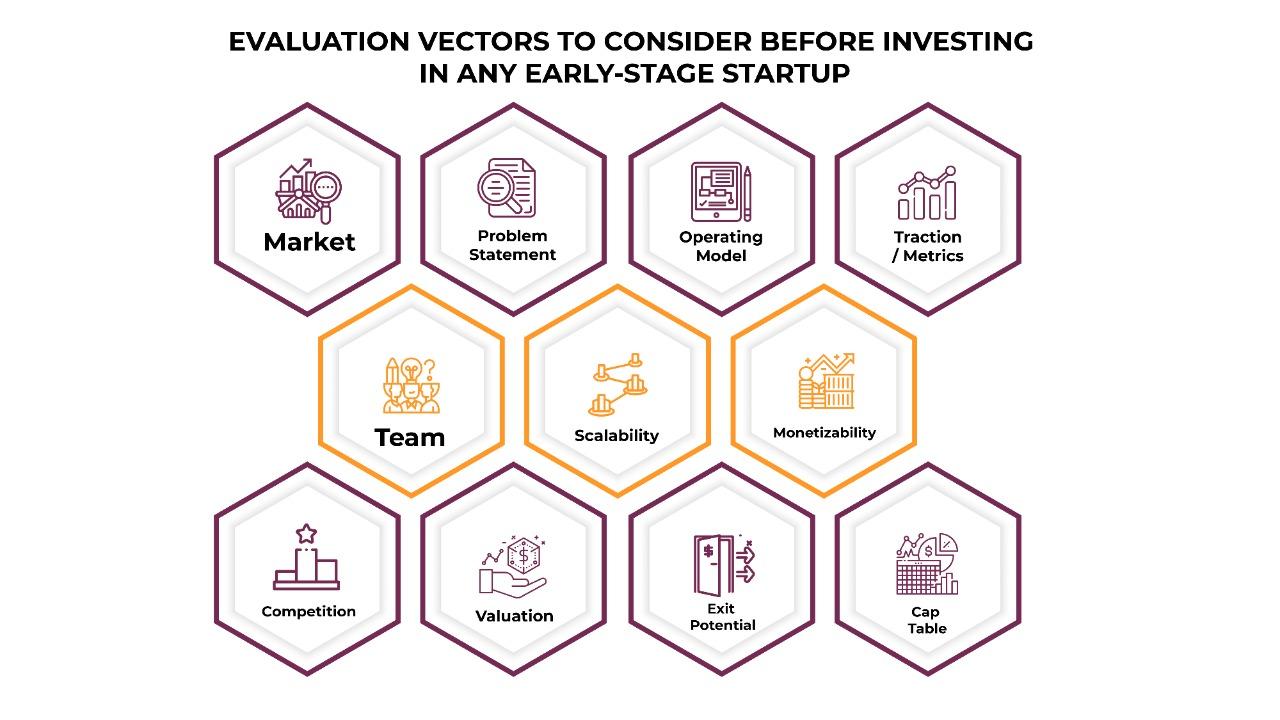

Broadly, my evaluation vectors to consider investing in any early-stage startup, in order of importance, would be:

- Market

- Problem Statement

- Operating Model

- Traction / Metrics

- Team

- Scalability

- Sustainability / Monetizability

- Competition / Moats

- Investment Stage / Valuation

- Exit Potential & Timelines

- Cap Table

For each of the above vectors, let's now look at potential questions that we should seek deep answers to, as part of the evaluation process:

Market:

- How large is the market and how quickly is it growing?

- Of this market, what is truly addressable?

- What are potential market disablers? - Regulatory, Technology Obsolescence, etc.

- How deeply do you understand this market? Can you be deeply passionate about contributing to this market?

Problem Statement:

- Is this a real customer problem statement?

- Do alternate solutions exist for this problem statement?

- Is this a durable problem statement for the ages?

Operating Model:

- Is the model a full-stack model?

- If yes, is this a barrier to scale? Can the team execute well across the entire stack?

- If no, how are incentives aligned with ecosystem partners? How is e2e customer experience managed?

Traction / Metrics:

- Does the team have a working product or at least a Minimum Viable Product (MVP) to test the market?

- How are key customer metrics (MAUs, DAUs, Conversion, CAC, LTV, Repeat Rate, ASP, AOV, Churn Rate, NPS, etc) progressing over time? Relevant metrics would vary based on B2B vs B2C, industry, etc.

- How much of the current business is organic vs through paid marketing channels? What would happen once marketing costs get rationalized?

- Does this model have a network effect by design?

Team:

- First time founding team or previous founding experience? If no founding experience, does the founding team have startup experience?

- Is it a single founder or multiple founder team? One could argue that single founder teams are riskier than multiple founder teams.

- What is the origin story / eureka moment for the founders? How deep is their conviction and purpose to address this problem statement?

- How does their education and work experience tie in with this industry and problem statement?

- Is the founder team complementary in skill set? What is the division of responsibilities among them?

- How long have they known each other? Have they worked on startups as founders together in the past? Have they been through large failures collectively?

- How much of the company's equity do the founders own? - Skin in the game

Scalability:

- How quickly can this business scale?

- Can the scaling be digital-first or would it necessarily require physical levers like sales teams on the ground, offline centers to cater to customers, and so on?

- As a thumb rule, the more physical levers, the harder the scaling journey. Not that, it cannot be done but is simply harder in my view.

Sustainability / Monetizability:

- What do the unit economics look like today?

- How does this change with scale expected in the next 12-24 months? At peak scale and efficiency, will this company be operationally profitable?

- Will consumers be willing to pay? If yes, how much?

- If the model is full-stack, are there additional revenue streams to tap into in the future?

Competition / Moats:

- Who are the key competitors in this space?

- How large are they in terms of scale, customer base, and valuation?

- What are these competitors valued at? Are there marquee VCs backing them? Have any of them made the journey to IPO?

- What are the key points of differentiation vs competitors? How much of this is defensible through high entry barriers?

Investment Stage / Valuation:

- What stage is the current round at? Seed vs Pre Series A vs Series A etc. Earlier the stage, higher the risk as well as potential returns.

- What is the current round's post-money valuation and at what dilution?

- What is the multiple for current valuations vs revenue? Is this multiple in line with other startup valuations in this industry?

- With this entry valuation, what does a theoretical exit multiple for you look like within your investment time horizon? Is this multiple worth taking this risk?

Exit Potential & Timelines:

- How have startups exited in this industry historically? Through M&As, IPOs?

- What have been the timelines for these exit scenarios?

- Is this startup durable enough to survive through those timelines?

Cap Table:

- Are there any other marquee names in the cap table?

- Would these names add value to the founder on business, fundraising, etc in the future?

- If nothing else, this adds confidence that trained, neutral eyes have also done due diligence and found this opportunity to be investable.

Investing in early-stage startups is a risky business and doing as detailed due diligence as possible increases your chances of making your overall portfolio succeed. A common limitation to doing this level of due diligence is that, individually, each of us would have experience and expertise in a few industries. This is where leveraging your network and speaking to connections with experience in your target industry can go a long way in doing your due diligence right.

Please do share your thoughts in the comment box below. Would love to hear from you on how you would approach due diligence when evaluating early-stage startup investments!

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us:

Liked the article, Share it with others!👇🏻