Is your portfolio the fairest of them all?

Dear Reader, by now you might have sipped the shocking downfall of Lido Learning. While it came as a shock to the startup community, it surfaced many different faces of the same.

On one end, we witnessed the supportive side of the ecosystem as many companies came forth to support the sudden unemployment faced by all the employees of the company.

On the other side of the wall, we saw the dark, blindsided part of the ecosystem.

|

||

|

||

|

|

Three evenings before today, we were served scalding hot tea with a side of shock! 😳

LIDO Learning shut down its operations and declared a 'financial crisis'! Hoards of unpaid employees and parents took to social media to unfurl their wrath!

In this week's Short Take we dissect the demise of Lido and undercover the reason behind why startups who fly too close to the sun too soon end up getting burnt! ⬇️

.png)

Angel Investing — S01E03 "Tails, You Win"

- This week, we have our guest writer back on our platform!

- Kiran Karthik, an active investor with 20+ startups in the last year, across multiple sectors like FinTech, Blockchain, D2C, Gaming, Edtech, and Media.

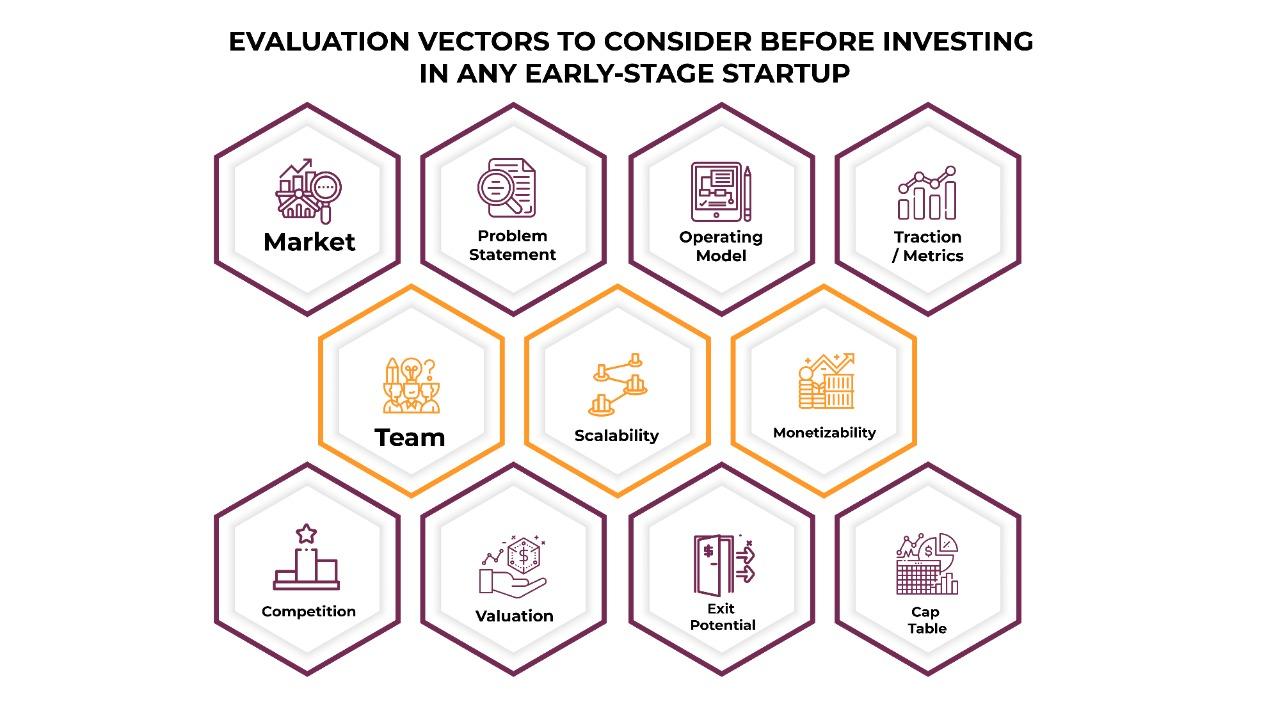

- In his last article, he shares his two cents on how to evaluate startups and if angel investment is the right choice for you!

- In this article, he talks about due diligence and evaluation vectors he considers before investing.

-

Read on to find out!

Mirror, mirror on the wall, Is my portfolio the fairest of them all?

(The portfolio of a successful angel investor)

By Ninie Verma, Content Associate, 1stCheque by Favcy

- Have you ever put your investment portfolio under a magnifying lens? Don’t you wonder what spice could you add to it to get the perfect blend of success?

- All successful investors follow some practices that make them the best at what they do.

- Curious about what makes an investment portfolio spotless and an angel investor successful?

-

We’ve got answers! Read on to find out!

There’s a reason why we call what we do ‘seed funding’. You are sowing the grain to reap the crop. Regardless of rain or shine, it takes the interplay of a concoction of factors for a healthy harvest.

You will agree with us when we say there is no Jack & the Beanstalk here. The only magic beans are coffee. No overnight miracle shall take you to the land of your dreams.

But once in a while, your seeds have the possibility of turning out to be super seeds.

Truth be told, we have all got our own expectations. While one company making it big from your portfolio sums up success for you, it may just be a warm-up for someone else. To each, his own definition of success.

But some statistics remain common for all angels that become successful. It goes without saying, there is tact involved. This is not gambling, one cannot place a few bets and hope for the best. Or put all their funds in a single basket.

The portfolio of a successful angel is backed by a successfully executed portfolio strategy.

The chances of you identifying and investing in the next Uber (and making a 50X or 100X return on your investment) are next to none. Hey, we’ve got our fingers crossed too but there is no playbook for finding these companies. That doesn't imply that with a lot of research and hard effort, you can't produce incredible results (substantially outperforming the markets while getting the satisfaction of being part of growing a successful business).

At what temperature is a successful portfolio forged?

For starters, most successful portfolios are cultivated in an ecosystem rich with entrepreneurship where the angel is connected with other angels in some form or another.

In an Angel Network, you can:

- Attract deal flow in a very systematic way,

- Share the load of evaluating companies,

- Work together on deal terms and filling a round, and

- Share the load of supporting companies with board service, networks, advice, and introductions.

This is one of the areas yours truly 1stCheque pioneers at (apart from great risk mitigated deals) which is to create a community of angel investors that help, support, and grow fellow investors and the startup ecosystem as a whole. If you’re still not a part of the community, you can always join now

If you want to build a carefully-constructed portfolio that is big enough to reach the level of highly probable positive returns, it is hard to imagine doing that outside of a highly functional group operating in a busy entrepreneurial ecosystem.

How to pick apart a diamond from a piece of glass? What does a successful portfolio consist of?

There are many multitudes that lead to the creation of a successful portfolio. Tunes to a song whose lyrics we strive to figure out as we proceed.

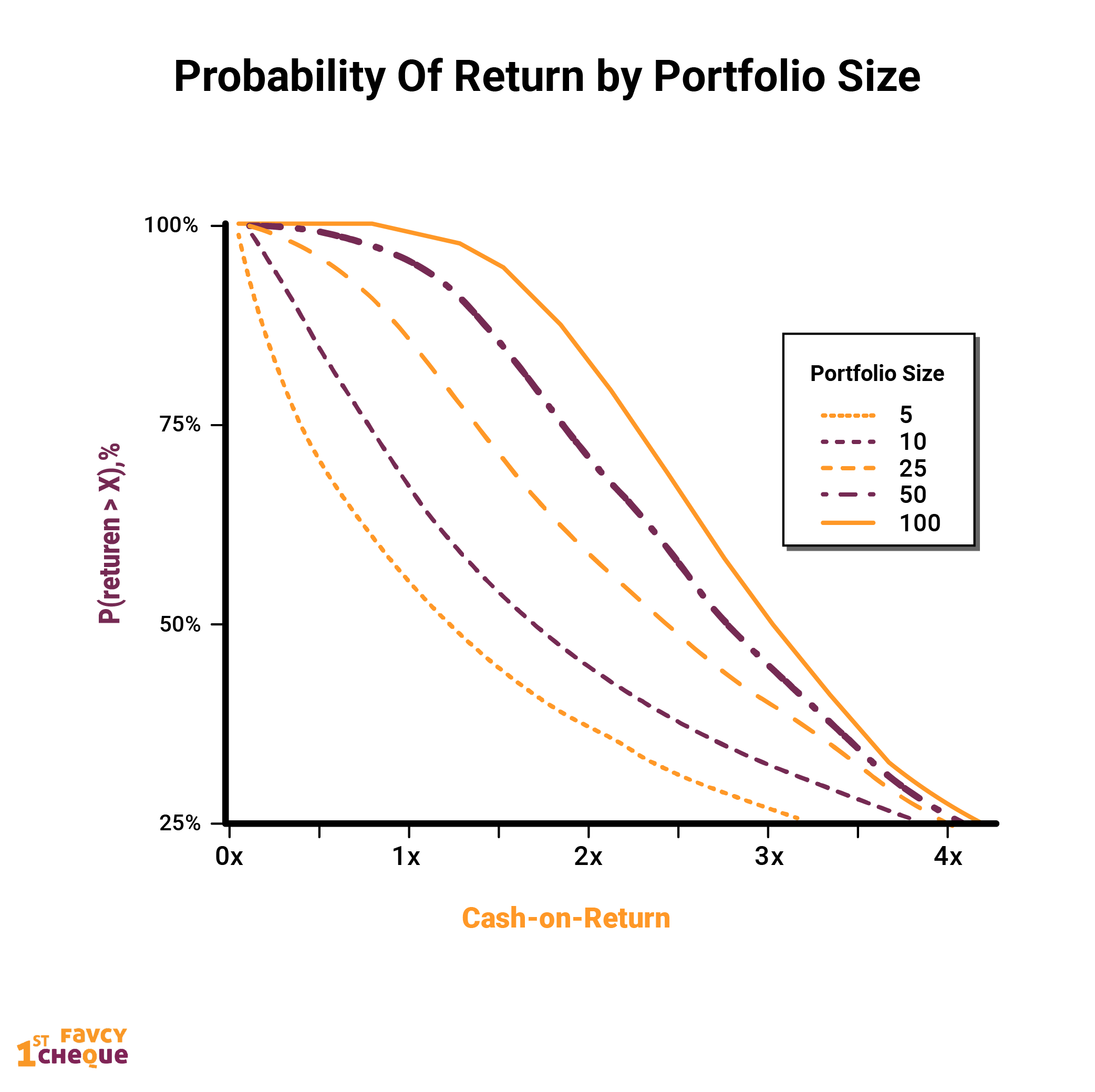

Firstly, there is no fixed number of investments that a good portfolio will have. But there does exist something called The Law of Large Numbers.

As the chart shows, the probability of return depends upon the number of companies an angel invests in. In general, the more companies in your portfolio, the higher likelihood of a good rate of return. For example, with a five-company portfolio, the 50 percent probability mark intersects at 1X, which is where you make your money back. But that probability increases as the number of companies increases.

But the larger the number of companies in your portfolio, the more difficult it becomes to keep track of them. You cannot do due diligence on, say 100 companies. And there is a direct correlation between angel investors who do due diligence and those who experience a good rate of return.

Therefore, a successful portfolio has a limited range of companies, but they must be highly diversified. Diversification is key for a successful portfolio. Smart angels allocate their many eggs to many different baskets.

But do you just invest in a bunch of companies and then sit and warm the eggs, waiting for them to hatch?

Not really.

This is the part that follow-on investments come into frame in a successful portfolio. The one-and-done idea often does not work to an angel’s advantage. Sometimes the company is doing well and has an “up round” where another investment better ensures your stock ownership position at the exit. If a company needs follow-on money later, doesn’t get it, and then goes under, you have a loss and your portfolio suffers.

Thus, successful angel investors often divide their initial investment into 2 or 3 parts. For example, if you plan to invest a total of $10,000 in a deal, invest $5,000 initially and hold the other $5,000 for follow-on. During follow-on rounds, you have greater visibility into a company’s performance.

And lastly but most importantly, these portfolios don’t just focus on hitting a home run. Most of the portfolio consists of good deals that have the potential to provide a great and steady rate of return. Multiple investments that give solid returns, that too, over many years. And if, in the meanwhile, the portfolio comes by a unicorn while shooting for the stars, all the more good.

And if I were to do it Stephen Covey style, these would be the 6 Habits of Highly Successful Angels:

- They strive to discover great companies.

- They manage risk efficiently.

- They own a diverse portfolio.

- They have realistic expectations for the timing/size of exits.

- They invest in financial and human capital.

- They keep track of their investment portfolio

Almost all successful angels follow these habits religiously. If you are a new angel investor, you can start by inculcating at least some of these habits into your investment regime.

Boiling it down,

Angel investment is an art as well as a science.

It takes time and experience to learn the ins and outs of angel investing and appreciate its nuances.

And like every true art piece, a successful portfolio takes grit, sweat, honest patience, and determination to make.

.png)

Here are the events of this week:

-

GraphQL developer Hasura turns unicorn, secures $100M in Series C funding

-

Hasura a GraphQL developer startup raised $100 million in a Series C funding round led by Greenoaks

-

Neobanking start-up Niyo raises $100 mn in Series C funding round

|

|