Do you like your whiskey neat? Dilution and How Funding Rounds Can Affect Your Investment

By Ninie Verma, Content Associate, Favcy 1stCheque

Have you wondered what happens to your investment if the company you invested in goes on to raise another round of funding in the future? As an angel investor, one of the concepts you want to fully understand is dilution.

From an investor’s perspective, the first thing that often comes to mind when one hears the term ‘dilution’ is ‘Future rounds are going to dilute my participation so you should allow me a larger share now to prevent this from happening!’

That is not always the case. Is your head already spinning in confusion? Don’t worry. We are going to start off with the absolute basics -

What is a funding round?

While I’m aware you may already know what funding rounds are, just to take it off the table - a funding round is the money startup founders raise to grow their business from different types of investors - usually accelerators, business angels, and VC funds. Depending on the development stage of the startup, they can raise funding through pre-seed, seed, series A, B, C rounds, and beyond.

What is dilution?

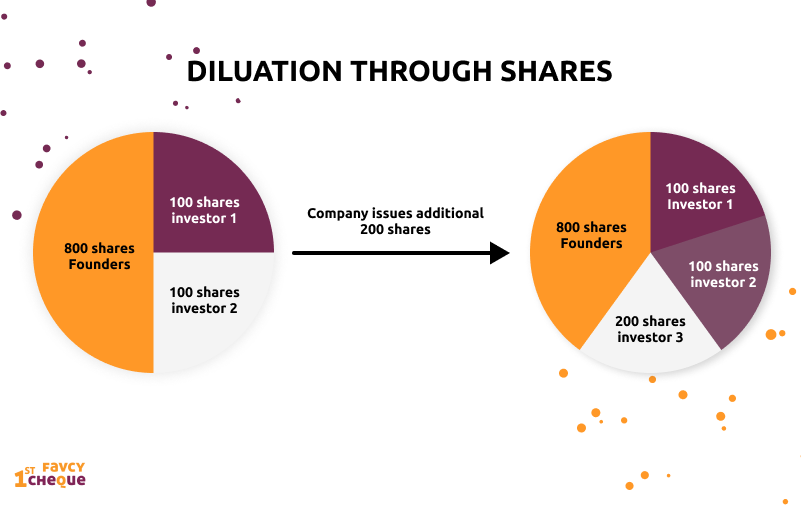

Dilution occurs when a company conducts another funding round in the future and issues new shares to investors. When the total number of shares held by all investors in a company increases, each shareholder ends up owning a smaller, or diluted, percentage of the company.

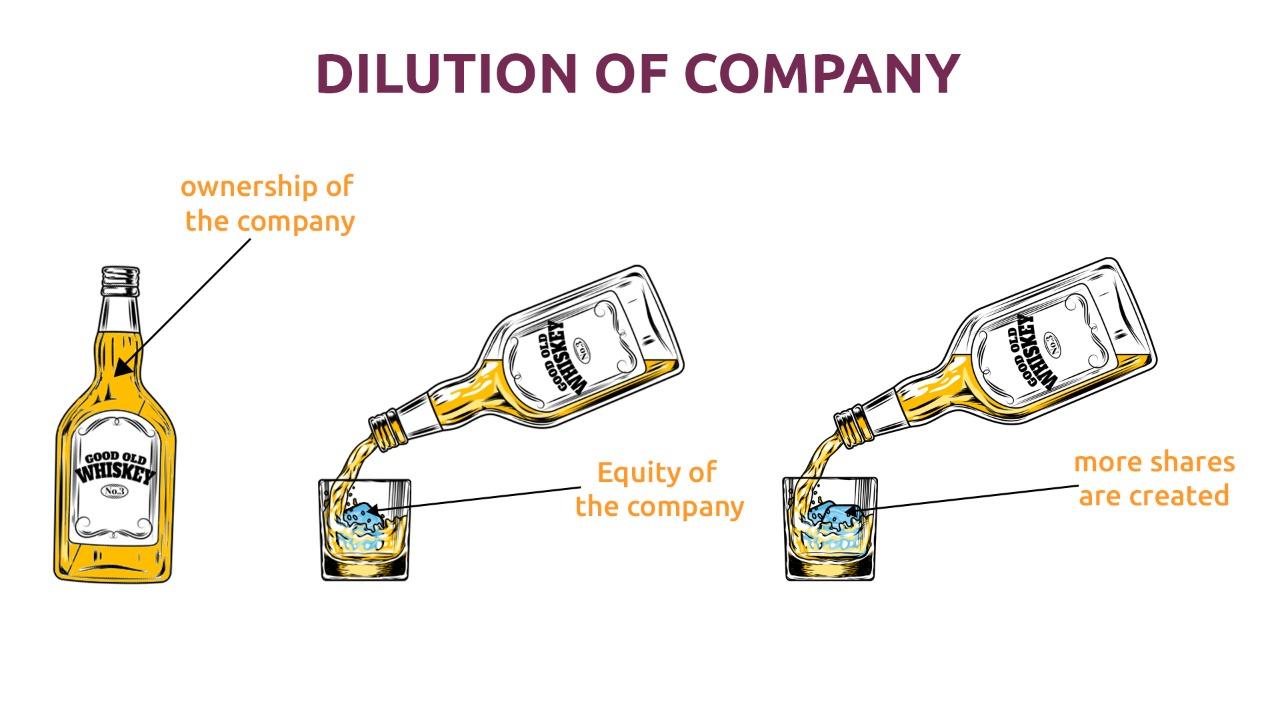

The Whiskey Example

Imagine a bottle of whiskey. The more water or ice you add to it, the more diluted it becomes. The more you dilute it, the more glasses you will be able to pour from a single bottle.

A similar thing happens to your ownership percentage in a company as the company raises more capital from investors. Just substitute the whiskey for ownership of the company and the water for equity in the company.

There are two core points to remember with dilution:

-

New shares are created when bringing in more investors or advisors, rarely will you transfer your existing shares.

-

The ownership percentage each shareholder will have after the investment is found by: Shares owned by Shareholder / Total Number of Shares Outstanding (including new shares)

Let’s say a bottle of whiskey represents a company called Whiskey Co. Every shareholder in Whiskey Co. gets a glass of whiskey from this bottle. Some shareholders get larger glasses than others, depending on how much money they invested (more money buys a larger glass), but everyone’s glass is poured from the same bottle.

As the company raises more capital by issuing new shares, water gets added to the bottle, so the bottle can fill glasses of whiskey for all of the new shareholders. In that process, the whiskey gets diluted.

So now when the whiskey gets poured into shareholders’ glasses, everyone has less whiskey in their glass (meaning everyone owns a smaller % of the company), but everyone still gets the same sized glass poured, based on the number of shares they own.

That’s equity dilution in a nutshell bottle.

What role does dilution play in funding rounds?

The reason you must pay attention to dilution is that startups typically conduct multiple rounds of financing, whether to reach a point of profitability or to finance accelerated growth. And with each round of financing, new shares are issued, which means percent ownership of all existing shareholders will be diluted. So, the earlier you invest in a company’s stage of development, the more dilution you will have to deal with. For this reason, it is wise for investors to learn the various stages of development a startup goes through.

Let’s walk through what this looks like in practice with our previous example Whiskey Co.

Pre-seed Funding Round

Let’s say the founders of Whiskey Co. value their business at $1M in a pre-seed funding round.

The company has 1,000,000 shares on its cap table. The founders set aside 800,000 shares for themselves (owning 80% of the company) and decide to sell 200,000 shares to investors at $1 per share and raise $200,000 in funding.

You invest $10,000 in Whiskey Company in this pre-seed round and receive 10,000 shares of stock.

As a result, following the above formula, you have a 1% (10,000 ÷ 1,000,000) ownership interest in the company.

Seed Funding Round

A year later, Whiskey Co. decides to raise more money. This time, they set a valuation of $5M and raise $1M at $5 per share.

However, all of Whiskey Company’s 1,000,000 shares are accounted for - the founders own 800,000 shares, and they issued 200,000 in the pre-seed round.

This means that the company needs to issue 200,000 new shares in their seed funding round, bringing the total outstanding shares to 1,200,000.

Previously, you owned 1% of the company (10,000 shares of 1,000,000 shares outstanding), but as a result of this new funding round, you now own approximately 0.83% of the company (10,000 shares of Whiskey Company’s 1,200,000 shares).

However, while you own less of the company than you did previously, your investment in this example is actually worth more. You invested when Whiskey Co. was valued at $1M, and the share price was set at $1. In their seed funding round, Whiskey Company set a valuation of $5M, so your initial investment of $10,000 is now worth $50,000 on paper (10,000 shares at $5 per share).

If the company grows and does well, then through each successive funding round, from Series A to Series B and beyond, your investment can actually increase in value even as the percentage of the company that you own decreases. However, that is not always the case.

Down Rounds

For example, let’s say that Whiskey Co. struggled to close its seed funding round. Almost out of cash, the company agrees to accept a lower valuation to raise capital in a bridge round and extend its runway for a few more months.

Whiskey Co. raises $320,000 at an $800K valuation. The company issues 400,000 shares in this bridge round, but this time they are sold at $0.80 per share.

As a result of this bridge round, your investment represents approximately 0.71% of the company (originally it was a 1% stake in the company), and your investment of $10,000 is now worth $8,000 (10,000 shares at $.80 per share).

Convertible Notes and Dilution

Another situation where dilution plays a role is when outstanding convertible notes are converted into equity. In pre-valuation funding rounds, the usual instrument used is convertible notes.

When those notes convert, they will create dilution for shareholders in the same way that new issuances of shares do. Convertible notes and equity vary in that convertible notes might have a discount on the conversion price, which has implications for dilution.

For example, let’s say you invested $10,000 in Whiskey Co. during their pre-seed funding round, which offered convertible notes not equity, and those notes included a 20% discount rate.

Two years later, Whiskey Company raises their seed round. The company sets a valuation of $5M and raises $1M at $5 per share.

For new investors in the seed round, a $10,000 investment would translate to 2,000 shares. However, with that 20% discount, holders of the convertible note receive 2,500 shares (the 20% discount means the original $10,000 investment would convert into equity at $4 per share rather than $5 per share).

The additional shares issued impact dilution for new investors while offering some protections for the upside of early investors by preventing their riskier investments from being valued equally to later, safer investments.

At Favcy, we are always mindful of the fact that our founders should have sizable equity in their startups as they move to larger rounds. Also, all our 1stCheque investors (that invest via convertible notes in the early stage) get cap table positions at the time of valuation that provides a glance at possible dilution and we provide options to avoid it too!

The Good and the Bad, but Not Necessarily Always Ugly

The fact of the matter remains that dilution shall occur every time the company issues new shares, but depending on how well the company is doing, and at what valuation the company issues shares, your original investment can increase (or decrease) in value independently of what % of the company you now own.

Should you be concerned about dilution? It all depends on what you’re looking to do with your investment.

The dilution impact may or may not affect you, depending on the sort of investor you are. If your goal is to have a "dominant" position inside the company, dilution will undoubtedly concern you.

However, if your primary goal is to make a profit on your investment, you should not be concerned. Simply determine if it is a worthwhile investment to follow up on your investment.