INSIDER: August 14th, 2021

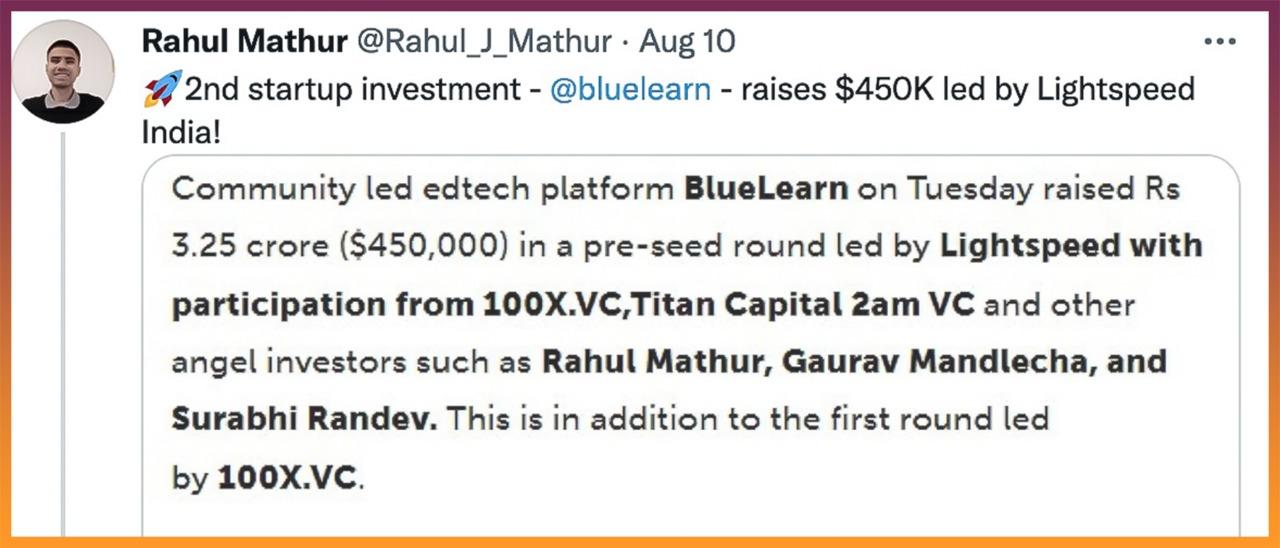

Dear Reader, you must have heard that earlier this week Blu Learning raised their pre-seed round from the likes of Lightspeed, Titan Capital and 2am Ventures.

However, what I want to highlight here is the other angels who participated in this round - at a much smaller ticket size as compared to the VCs but certainly at the same terms. One of the angels is the 23 year old founder of 6 months old startup Bima-pe, Rahul Mathur.

How, you should ask, did a young in-experienced angel investor (by his own admission this was only his 2nd startup investment) get a position on the cap table alongside the biggies. The answer is - the value he is bringing on to the table is perhaps much greater than just capital.

There’s a term doing the rounds these days to describe these value angels - Operator Angels.

Who are Operator Angels and why are they a rising tribe? In our Favcy Review section this week, Pranavharan unravels the world of Operator Angels. Do give it a read if you are aspiring to have a career in VC or simply want to grow your clout as an angel investor.

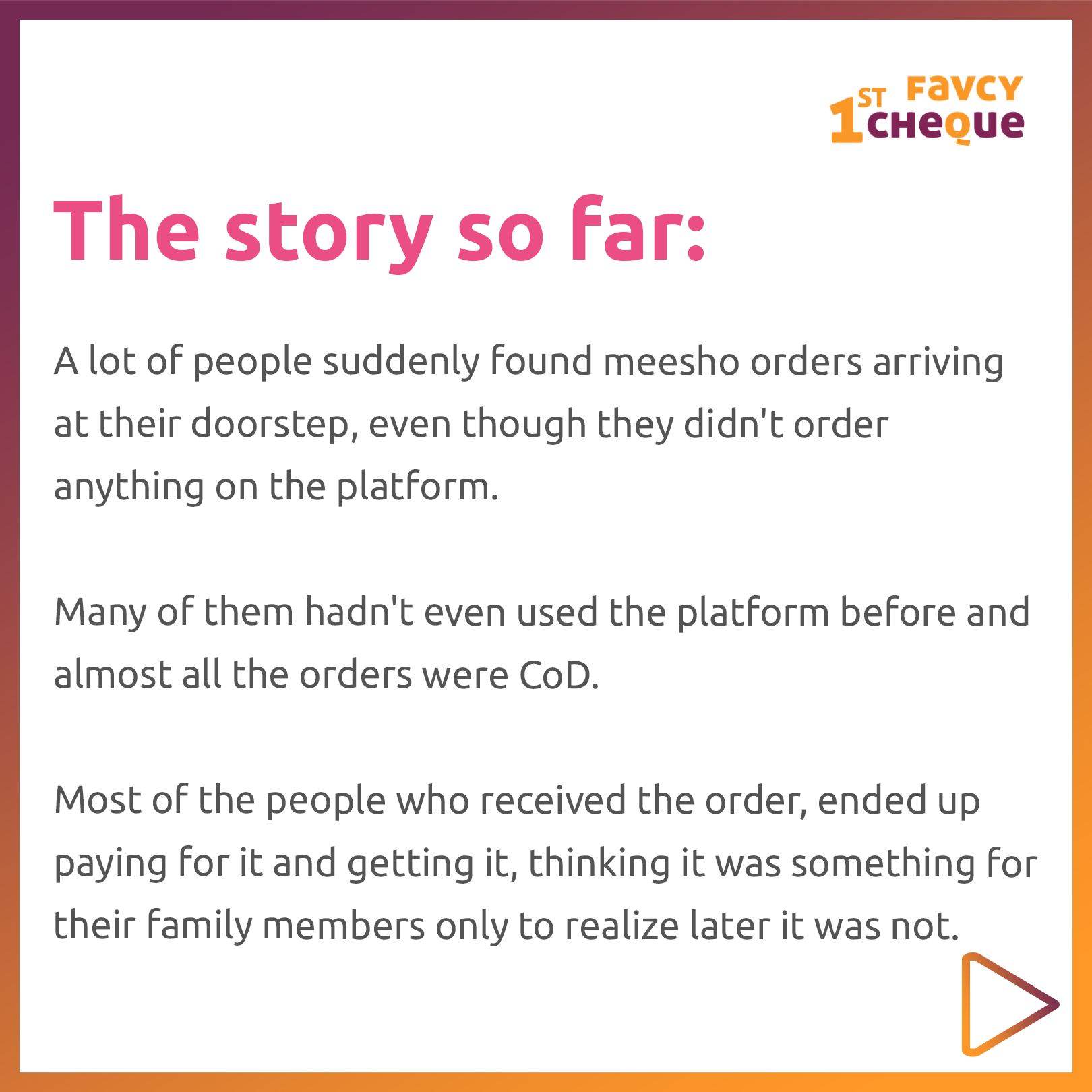

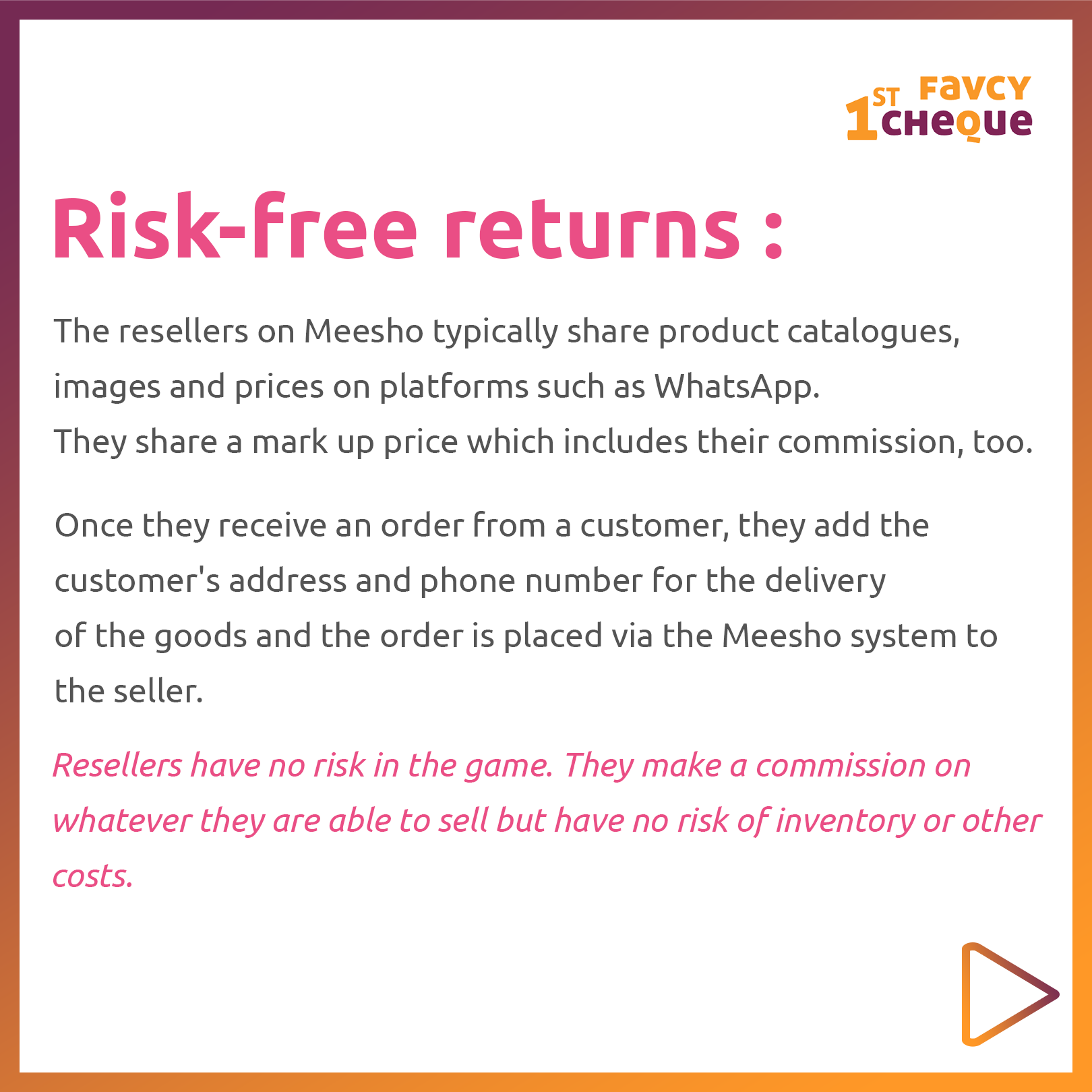

In our Short Take section, we look at the ghost orders that a lot of people are receiving from Meesho resellers.

Want to know how does an angel investor think while assessing deals or how do they make their investment decisions? Angel Bytes brings to you this week excerpts from our interview with Kaushik Bagchi, VP at ASG Technologies who is an investor on our 1stCheque network.

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Yamika

Surprising packages arriving at your doorstep?😱

That's what many people have been witnessing recently with meesho.

Many who never even signed themselves up on the app have been subject too. We uncover this mystery in this week's short take.

.png)

.png)

_2.png)

The Rise of Operator Angels - A more involved approach towards start-up investing

by Pranavharan Mohanasundaram, Favcy 1stCheque

|

||

Acquire Expertise in Angel Investment and read our well-researched and in-depth topics about startups and investing

If you do it right, Money will come to you

One quick question!

Did Angel Bytes start to feel like Dal Rice for the rest of your life? Same old jargon, numbers, assets! Give me a Break 😑

Though the experience was worthwhile, I hope so 😇 It’s time to add some good old punjabi tadka to it.

This week,

We have an exclusive candid conversation with one of our investors, Kaushik Bagchi, who is a die-hard startup enthusiast and angel investor.

We talked about his investor journey. What does he look for in a startup? What are the hottest sectors to invest in? And so on.

So let’s get right into it!

1. How did you get started as an angel investor?

People like us come from the generation of FDs, buying houses and paying EMIs. Very late in my life, I started investing in mutual funds and stock markets. Apart from the risk capital, there was something lacking in my entire investment experience, that was personal connection. That’s when my interest peaked in Angel Investing.

When you invest in stocks or mutual funds, you’re quite distant. You don’t get to play any part in the future of the company.

Somebody like me, who has 25+ years of experience can not only just invest but also give direction and help the startups to grow. That’s how I got into angel investing.

Thereafter I was looking for Venture Builder companies where I came across Favcy and found my right fit.

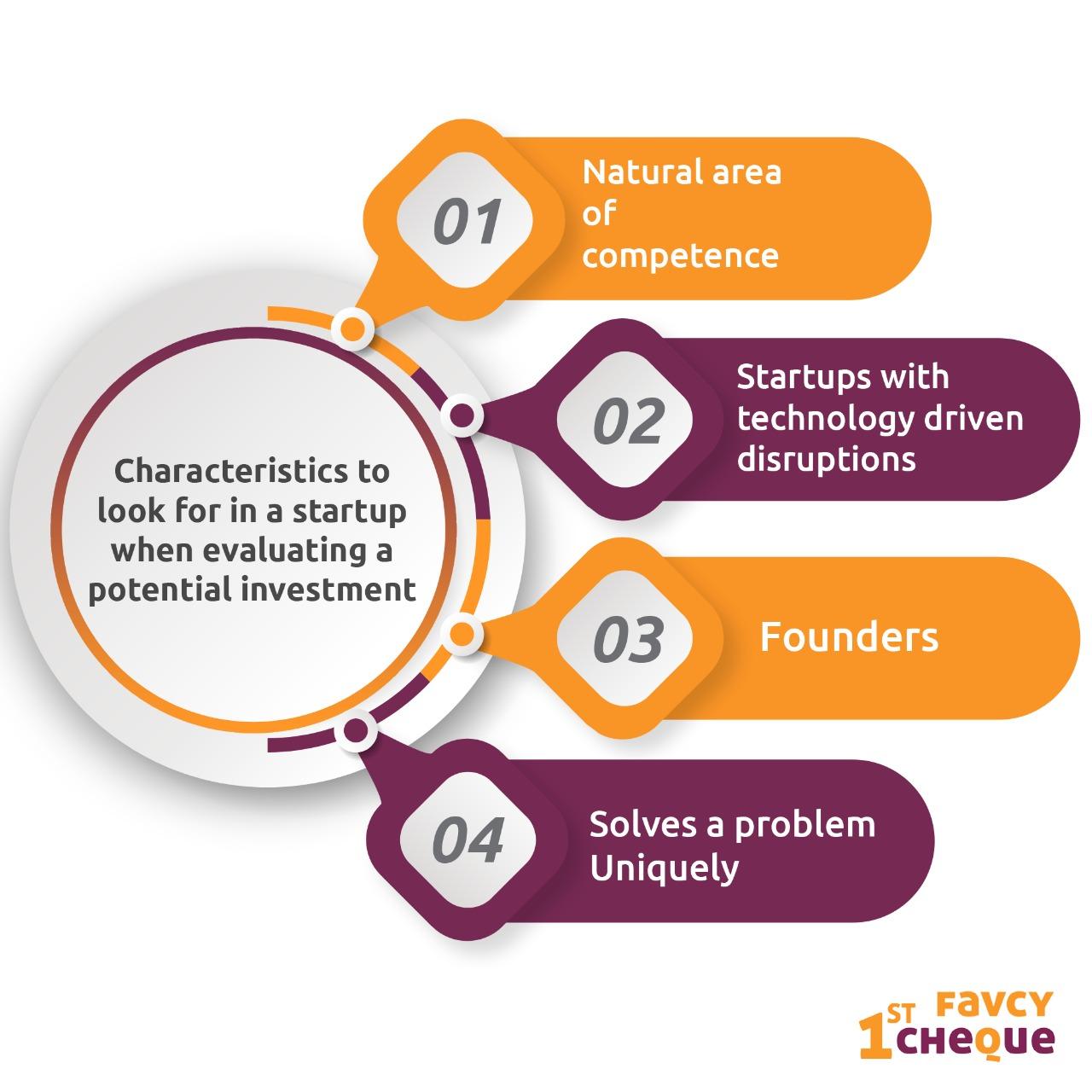

2. What characteristics do you look for in a startup when evaluating it for a potential investment?

I generally try to focus on 4-5 areas that make the most impact for a potential investment.

Natural area of competence

For me, It’s B2B, SAAS and technology. I’ve worked in this field for a long time and I have an in-depth knowledge of the space and I feel there’s still a lot of scope for disruption and innovation and will be for a long time ahead.

Another thing that plays a significant role is if it addresses a large market?Does it solve a problem Uniquely? There’s some way the startup solves the problem uniquely. As in the case of Skillskonnect.

Startups with technology driven disruptions

There are some startups out there that are solving one particular problem diligently.

Founders - It is one of the most important factors to consider. They need to have demonstrative evidence of understanding the domain, a thought of clarity.

Ask your founder if s/he can summarize their pitch in 2 minutes. If they do, then it's evident that they have a clear thought process.

The key areas, in my perspective

are -

Has he thought it through? Does he have a sense of strategic clarity? Does he have the greed for execution? And ofcourse honesty and integrity.

3. What is the hottest sector to invest in during the pandemic era, in your opinion?

In my opinion, it depends on the person who’s investing. For me, B2B and SAAS will always be hot.

What I see as an important area is Technology, Tech as B2B or Tech as SAAS, HealthTech, EdTech, FinTech and social commerce

In the case of HealthTech, I feel there’ll be a lot of disruptions in the industry as there are a lot of problems to be solved in this space. For example, You can’t expect one single AI engine to scan the whole body in one go, this is where the disruption lies. Lot’s of companies need to specialise on a particular problem of a particular part of the body.

When it comes to fintech, I feel, there’s no end to it.

Within Social Commerce, I believe there’ll be a lot of collapses in the space, i.e, lots of money will move in but once a few of them will be the industry leaders, sort of like a winner takes it all situation.

What additional support does an angel investor offer?

Firstly, you help with ideation. As they look to scale their business, sometimes they need a little nudge of redirection which we as investors can help with.

The biggest thing you can do for the founders is the connection of dots/ filling in the gaps

For example, one of the startups I've invested in, Skillskonnect, helped the founders get a direction of how they can disrupt so many different sectors and become one definitive solution and create a major value proposition for the customers.

One of the other biggest support an investor can offer is Synergy, So, the startups that I’ve invested in, they don't know each other,right? But I know whether one can be useful for the other. There Are so many crosses today, right? It’s about finding the right interplay between your portfolio startups.

4. How has your experience been as an angel investor?

The best part of my investment experience is the research, discovering and understanding opportunities and seeing them grow.

If you do it right, Money will come to you

The reason I love investing is research, interaction, and engagement. It’s about when you see a small company, you see potential, you invest and when it grows in 3-4 years, that’s worthwhile!

It’s a validation to your thinking and judgement plus the money doesn't hurt 😉

5. What are unrealistic expectations of startups toward angel investors?

I’ve come across startups with unrealistic expectations all the time. As they are investing their whole future, founders can be really ambitious to the point of being delirious. It is very natural that passion is obvious.

If you shoot for the moon, you’ll obviously reach the top of the building. Unless your plans are audacious, you’ll never reach anywhere.

There’s a difference between mature aggressive thinking and living under illusions. That is your judgement as an investor when you speak to the founder, their thought process and clarity of the concept.

6. What are the mistakes that all novice angel investors make?

In my perspective, all beginners make mistakes, even when I started out I made a lot of bumps. What investors do is, they overinvest. They start putting money anywhere and everywhere. They Feel the massive FOMO.

Investing with lack of sector knowledge - Just because some big name or some VC is investing doesn’t mean you have to. There’s where I feel 1stCheque helped me make well informed investments.

7. How did you come across 1stCheque?

I knew Yamika from Linkedin and I liked what she’s doing. One day, I simply connected and now here we are in a long term relationship with 1stCheque.

.png)

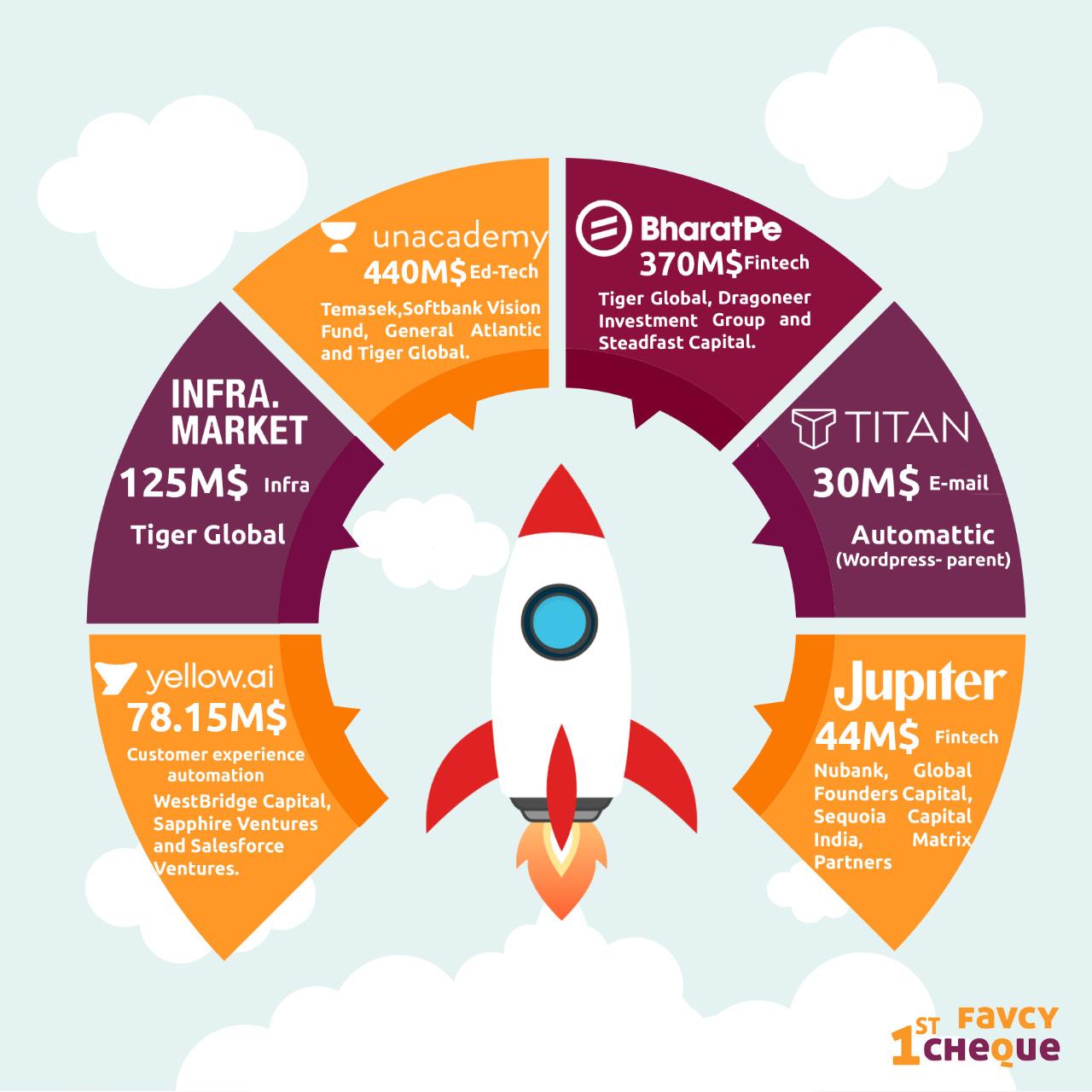

Here are the events of this week:

- OYO guns for $1.2bn IPO, hires merchant bankers

- UpGrad graduates to unicorn batch with $1.2 Bn valuation

- CoinDCX is first crypto startup to enter unicorn club after $90M fundraise led by B Capital

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us: