Is the sky the limit? Deconstructing TAM, SAM & SOM

-

Pitches have a tendency to showcase the Total Addressable Market. The sky then, seems to be the limit for the product.

-

But that is obviously not how large the prospective company's consumer-base is going to be. That is why, in this edition of Angel Bytes we explain everything about TAM, SAM and SOM so that you can make informed decisions when assessing a startup's market-fit!

Read on to find out why!

How big is the ocean? Or is the sky the limit?

There are big shark and tiny fish, potential clients, all swimming in your potential marketplace's sea. To capture your fish, you, the lone fisherman, must build a net. Should your net be huge and thick, demanding more time and money to weave? Should it be tiny and delicate in order to catch fish that would otherwise slip through the net?

Market analysts frequently use TAM, SAM, and SOM when performing market sizing. But what exactly do these abbreviations imply, and why are they relevant in evaluating investment opportunities?

The size of a market is one of the most crucial evaluating factors for a company plan. If it is too tiny, the investment will be in vain and the concept will not be realised. As a result, a market size estimate is a required component of every business case or business plan that must be presented in a corporation or by a startup in order to acquire funding for the development of the idea.

Overstating the size of the (SOM) serviceable attainable market is the most common mistake many entrepreneurs and investors make in the early phases of planning.

You're undoubtedly aware that this is the real market you're measuring for your product or service, because it is confined to people who use or can utilise your offering, as well as those you can reach. Those planners frequently mention the size of the serviceable available market (SAM), which is so huge that it is out of reach but yet within the overall scope of your product. Some even cite the total available market (TAM), which includes market data for an entire niche - for items or services that are vastly different from yours, but may have the same consumer base.

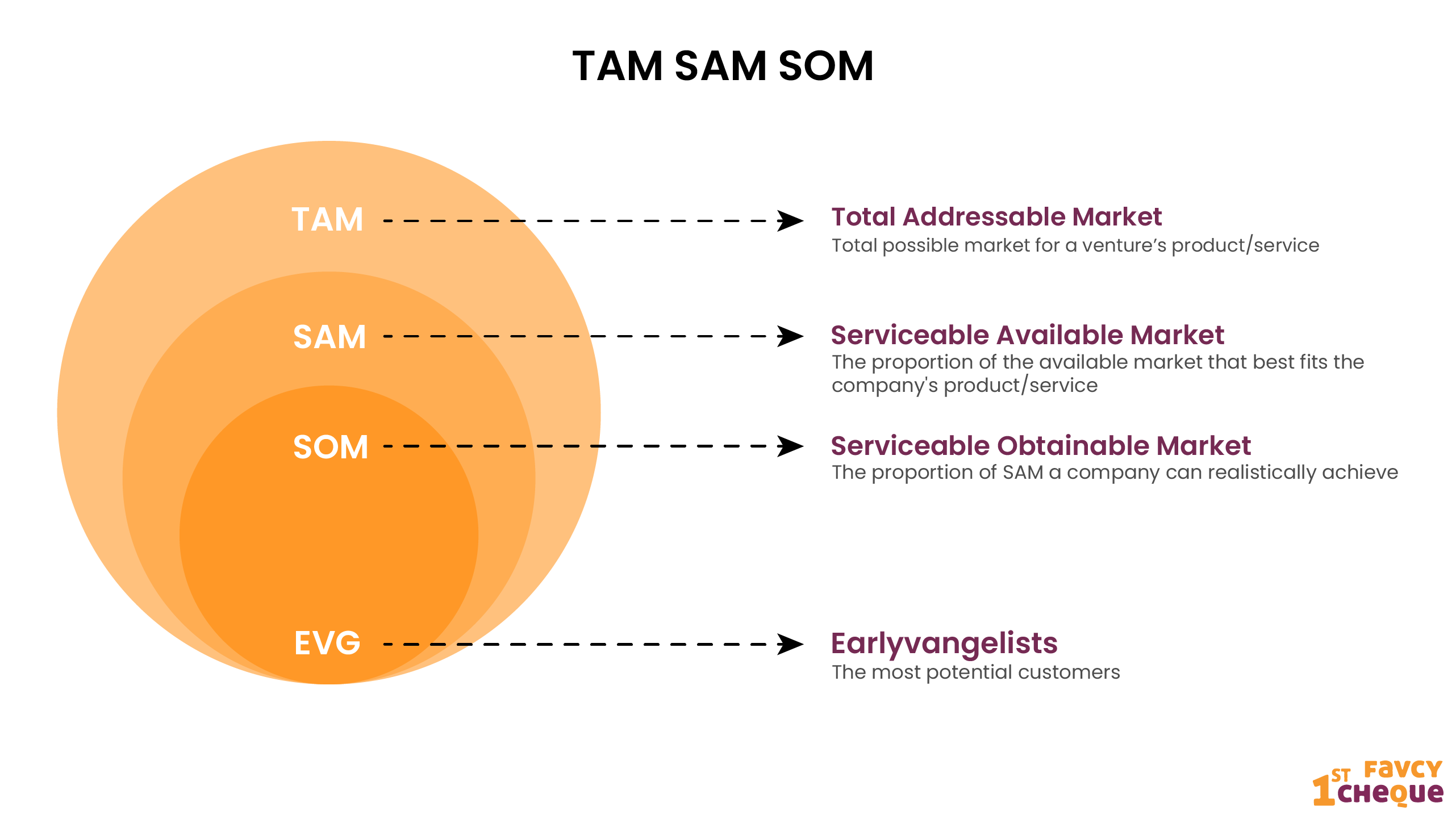

TAM, SAM and SOM?

These are acronyms that represent different subsets of a market.

- TAM – Total Addressable Market / Total Available Market. This is the total market demand for a product and/or service.

- SAM – Serviceable Addressable Market or Served Available Market. This is the segment of the TAM within your geographical reach that you can target with your products and/or services.

- SOM – Serviceable Obtainable Market or Share of Market. This is the portion of SAM that you can realistically capture.

TAM

The Total Addressable Market (TAM), also referred to as the total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved.

The Total Addressable Market (TAM) is important for startups and existing businesses because the estimates of effort and funding required allow them to prioritize specific products, customer segments, and business opportunities. TAM provides a viable value proposition and helps answer the question about who could (theoretically) buy the product? In other words, it describes the total revenues that a company could theoretically make, if it had an all-encompassing monopoly with its product or service.

SAM

The SAM (Serviceable Addressable Market) answers the question, “for which part of the TAM is our product appropriate?” The SAM describes the market that you can address with the current business model. It answers the question, what portion of the market participants will realistically buy the products or services, either from us or from someone else? In other words, which part of the TAM would realistically buy our products/services?

It’s important to understand that TAM is not a number of customers but rather dollars per year. SAM covers the willingness to pay – a key estimation metric.

SOM

The Serviceable Obtainable Market or Share of Market is the part of the SAM that the business can realistically serve. The SOM answers the question, “What part of the SAM is realistic for our business model?” It also helps answer the question, “Who will buy the service from us?” In other words, SOM helps identify the part of the SAM that is most appropriate for our business model. Thus, the SOM shows which sales can be achieved by the business. The SOM is a subset of the SAM that is restricted by:

- Natural barriers such as distance or language

- Limited capacity, for example, production capacity or marketing reach

- Loss of market share to competitors

In Conclusion

Early-stage start-up investors should know the viability of the business and to assess the startup's potential for growth. TAM, SAM, and SOM are helpful indicators that can answer many questions about the potential of a startup. For example, these indicators help you discover:

-

- Upside potential - Is the company part of a big market. Most investors will likely invest in a business that has a huge upside potential.

-

- Current viability of market - Investors need to make sure that the target market is growing in size and revenue.

-

- Current viability of startup - Investors should also know if the startup has the revenue to sustain itself.

If you know the basics, you'll be able to understand these terminologies when assessing a startup.