Are you a jack of all trades?

Dear Reader, did you have a splendid Holi weekend? While I landed up in the pink city which was a blasting, colorful experience. Holi is a small highlight of my ongoing trip to Jaipur. The city is filled with culture, tradition, and lastly generational businesses; a few of which really peaked my “Startup Keeda”. You’ll find endless self-made businesses (generational and new) with no external funding. One of them is “Gulab Ji Chaiwala”. Started with a small cart in 1947, it is over 70 years old and now is one of the most famous ‘Chai’ places in Jaipur. What’s special about this place is the fact that they never had a single penny invested from outside.

This brings us to this week’s Short Take section where we are celebrating the lesser-known bootstrapped start-ups that have been sneakily making their way to the top but barely get any media recognition!

Furthermore, did you know that you can now float a loan online on an app that directly puts you in contact with verified money-lenders?! No banks involved. But at what cost? And how do they balance their book? Money idioms aside, in Beyond The Bottomline this week, Saurabh Kashyap dissects the P2P money-lending platform LenDenClub.

And to keep the idioms streak going, this week in the Angel Bytes section we are sharing critical skills that every angel investor needs to master to make themselves a *drum rolls*- jack of all trades!

The world is your oyster! (Last idiom, I promise)

Happy Reading!

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Khushdeep

You've obviously heard about the bootstrapped bigwigs Zerodha and Zoho!

The minimalistic business culture of bootstrapping has taken a back-seat in today's funding-centric startup ecosystem.📉

But here are some lesser talked-about startups that are creating big waves the bootstrapped way.💯

Read on!

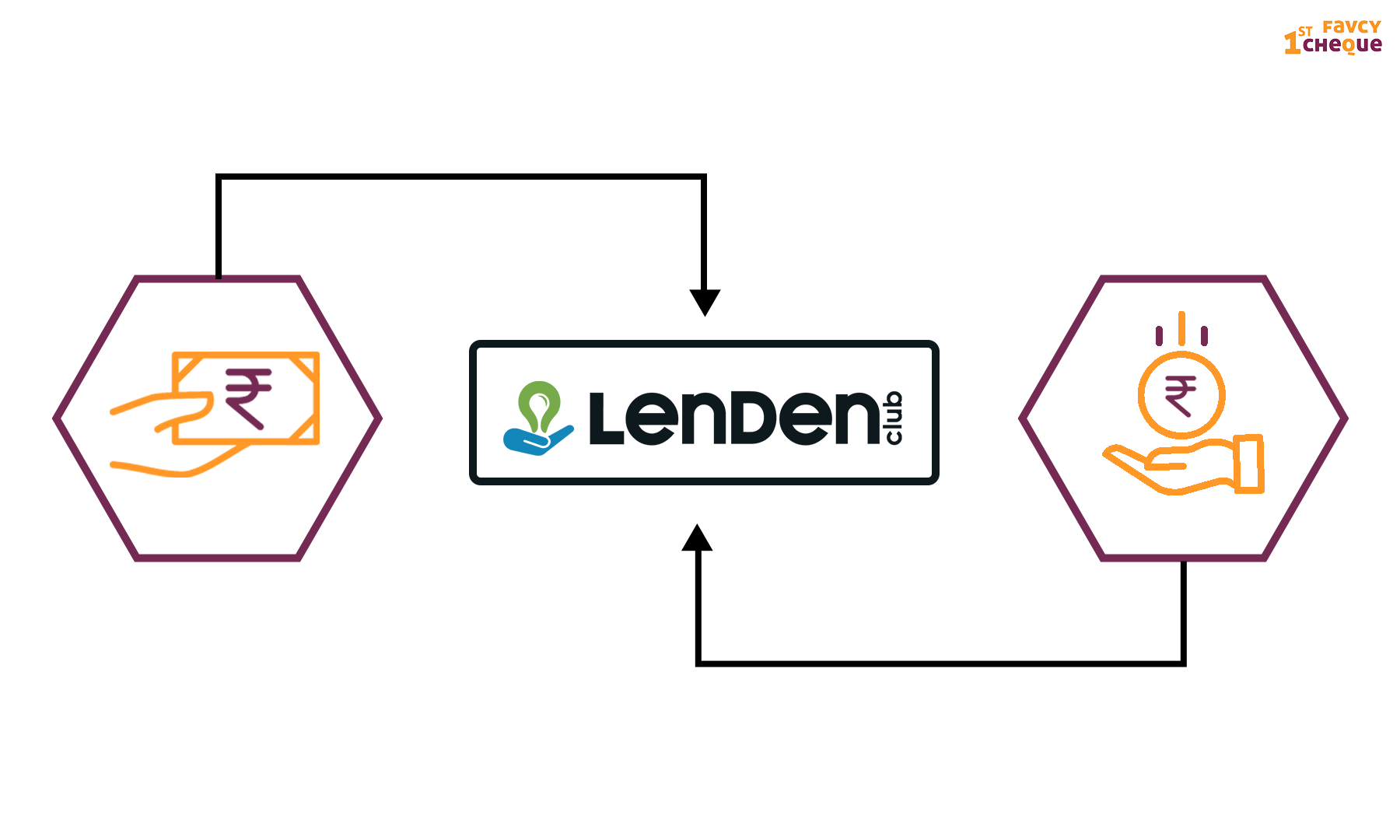

LenDenClub: Loans Without a Bank?🤔

- Gone are the days when only family members or trusted acquaintances would lend you money outside of banks!

- In this digital economy, it is but obvious that peer-to-peer money-lending was bound to get digitized too! But aren't you curious how it works?

- This week in Beyond the Bottomline, we dissect India's biggest P2P money-lending platform LenDenClub!

Read on to find out!

A Jack of All Angel Investing Trades

By Ninie Verma, Content Associate, 1stCheque by Favcy

-

Have you heard the saying ‘A jack of all trades is a master of none’? We disagree.

-

If you have a finger in every pie, you get to eat even more dessert! And there's nothing like too much dessert.

-

So this week in Angel Bytes, we are set to make you a jack of all investing trades - a master of all critical skills an investor needs! Read on!

‘A jack of all trades is a master of none…’

We are all aware of this idiom. But did you know that this is just the first half of the original saying? The entire saying goes ‘ A jack of all trades is a master of none, but better than a master of one.’

And isn’t that so very true? It is far better to know a little of almost everything than to know far too much about a single thing. An all-encompassing skill-set is the first prerequisite in your repertoire in today’s age and times.

We want you to master all things angel investing, so this week in Angel Bytes, we bring to you 4 critical skills every Angel Investor needs to master!

These are essential skills in the religious book of Angel Investing that every investor needs to possess to cross the river of dead startups and reach investor heaven:

- How to evaluate a startup’s management team

- How to evaluate products and market opportunities

- How to stage financial capital and make sure a company is properly financed

- How to plan, optimize and manage an angel portfolio in a tax-efficient and organized manner

Only a golden hen can lay a golden egg, or vice versa depending on whether the chicken came first or the egg.

In this case, the golden hen you should be looking for is the management team of the company. Good ideas come for a dime a dozen. But what truly sets apart a good idea from a great one is the team working on turning it into reality.

There's an old proverb that says something like this... "I'd rather put my money into an A team with a B plan than a B team with an A plan."

Maybe we just made the proverb up but that doesn’t mean it is not true.

Without a question, we believe this is the most critical issue for investors to understand. The more you grasp how important the team is to a good conclusion, the more successful you will be as an investor.

So what should one look for in this team?

At the risk of sounding trite, integrity and tenacity are a definite must. From the initial meeting with the company, during the due diligence process, and finally while negotiating the deal, you want to make sure the CEO is being honest and negotiates in a fair manner. Not only this, the pressure to succeed is immense, and CEOs battle on a daily basis to encourage their teams. A CEO's perseverance enables them to fight for success even when others would give up in despair.

But these are common traits, many more things also come into play when evaluating the team - things like a deep market understanding and combined experience.

Does the team possess a passion for and commitment to their mission, along with the appropriate balance of business experience and skillsets? In our view, it is very important to assess the motivation of the leadership team and the strength of their connection to the core mission of the company.

The last evaluation criteria has to be communication. It is never simple to strike the correct balance between creating quantifiable stakeholder impact and running a flourishing business. It's much more difficult to communicate it concisely and persuasively. However, exceptional impact-oriented entrepreneurs can figure this out, especially if they are guided by seasoned impact investors.

Water, Aspirin or White chocolate? What’s the better investment?

You need to learn how to evaluate the product itself. The idea is to think carefully about what type of product the company is building. There are usually three types of products -

- Water: Products/Services that people or businesses can’t live without

- Aspirin: Products/Services that reduce a major pain but are not critical to survival

- White Chocolate: Products/Services that are considered luxuries and might be addictive

An ideal situation is a product that has a mix of all three types. A great example is a mobile phone which has aspects of Water (e.g. email, phone), Aspirin (e.g. maps, fitness tracking) and White chocolate (e.g. games, music).

How to evaluate if a product is a Water or an Aspirin? Is the product a ‘Nice-to-Have’ or a ‘Need-to-Have’? As we discuss above, Aspirin (nice-to-have) helps reduce pain but isn’t critical for survival. Whereas, you can’t live without Water (need-to-have). Keep in mind that this is a continuum and that the real difference between the two categories is just a market size question and a question about buying priorities - inevitably the water buyers are just a subset of the Aspirin buyers.

You can also ask yourself - What problem does the product solve for you? On your list of the top problems in your organization, where does solving this problem fall on your priority list? By asking these two questions, you learn a lot.

Due diligence is the next step and shall be very insightful if backed by experienced market researchers like the ones we have here at 1st Cheque by Favcy.

Organize, Analyse, Optimize: Staging Capital

A little analysis can go a long way in informed decision-making. Most investors have access to sophisticated analytics capabilities for their portfolios. You need to have a tentatively developed strategy of how much you intend to invest in a particular startup.

You can start off with a smaller cheque in the seed rounds, and then decide whether to invest in other follow-on rounds in the future.

With your initial investment, you should begin to closely track the company. You can revisit the early due diligence work performed before your initial investment and determine whether the company is addressing the challenges as well as you expected.

As an investor, you should have (or should I say - must have!) access to how the company is performing versus the original plan. For the top performers in your portfolio, you want to invest additional funds. As noted, you may pay a higher price than you did in the first round of financing, but your IRR is often the same or better. Mastering this skill, in turn, shall also help you optimize and diversify your portfolio.

This brings us to the last but nonetheless important critical skill.

The Portfolio Management Cheat Code

Stay invested, stay healthy is something we often come across but the key to a healthy and high investment life expectancy rate is proper portfolio management.

When you are just starting out, this may not be as important, but as you start investing more and more portfolio management becomes very essential.

Learn through experience. A good angel investment portfolio is one that has funds allocated to diversified startups after properly measuring risk-taking ability.

Managing a portfolio also includes actively investing at regular intervals of time in order to reap better returns in less amount of time. It also helps in planning regarding tax obligations.

A True Jack of All Trades

As you slowly but steadily embark on the journey of angel investing, you shall acquire these skills by chance, experience or requirement. These skills take time and many experiences to establish. The more entrepreneurs you talk to, the smarter you will become. The more investments you make, the better you will get at understanding early-stage company financing issues. With mastery of these skills, an angel investor has the tools needed to build a substantial portfolio based on solid investment decisions, not a collection of lottery tickets.

.png)

Here are the events of this week:

- ConsenSys raises $450M in Series D round led by ParaFi Capital

- Amagi Enters Unicorn Club after Raising $95 M In Funding Round

- BlueStone raises $30M from Hero Enterprise

|