Red flags in early stage deals

Dear Reader, you know that feeling of immense pride that engulfs you when someone you groomed surpasses you? That’s the exact feeling that I have for the past few weeks now. We started this newsletter with the intent of providing relevant content to our angel investor community. Our efforts were always focussed on bringing information that matters to you and helps you in your investment journey, put together in the simplest way possible. And we are grateful for the love that you have shown - 30%+ open rates consistently (these are by the way unheard of figures for a newsletter).

To maintain this consistency, we needed top quality content, themes and presentation. And the credit for pulling this off goes to the entire team. Especially to Khushdeep, our content strategist, who has been leading this from the front. In today’s edition, I would formally like to pass on the baton to her. She is going to be the new editor for Insider by Favcy starting from this edition.

Happy Reading!

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Yamika

Additionally, I hope all of you have registered by now for today's Opening Day session with SpruceShine. I promise it's going to be a stellar show with the founder's energy and journey. So Join in.

_1.png)

Register to receive the Investor Dossier

If it comes down to investors v/s founders, who really wins?

This is the Founder's Curse.

Boardroom disputes between founders and investors are common, but the tussle between Bharatpe Co-founder Grover and the company's investors is prompting some to wonder, "Who really owns a startup?"

Read on to find out!

.png)

The Ghost of ‘Covid Learning Gap’ - A True Marketing Story

- Concerned parents and teachers and even the news cannot stop talking about the COVID Learning Gap!

- But have you given thought to the fact that it might not be what we think it is?

- This week in Favcy Review, we dissect how Edtech firms are capitalizing on the fear of a 'COVID Learning Gap.

Read on to find out!

How To NOT Paint The Town Red - Red Flags in Early Stage Deals

By Ninie Verma, Content Associate, 1stCheque by Favcy

_1.png)

- What are the things that make investors want to 'ABORT MISSION' when listening to a pitch?

- Are they a deal breaker or is there scope for improvement?

- While your friends may watch out for the red flags in your romantic life, we are here to scout out the red flags in your investments!

- In this week’s Favcy Review, we dive into potential red flags in early-stage that may result in investors passing and how to work around them.

Read on!

-

In the world of millennial dating, people play a game called ‘spot the red flag’. The idea is that when you are in the early stages of getting to know someone, they show you an idealized, perfect version of themselves, hiding bad habits and behaviours that may make you dislike them. If you spot the red flags on time, you save yourself from a potential dating disaster.

The joke goes that when you’re interested in someone romantically, you’re seeing the world through rose-coloured glass. So every red flag just looks like an attractive shade of hot pink initially. It’s much later on that you realize it’s a 10 feet high, crimson red flag staring you in the face all along and this is not Switzerland and you should have run away at first sight.

Similarly, while pitching themselves, startups present themselves in the best light in order to maximize the chances of accessing early-stage capital. It’s essential to validate optimistic figures and statements underlying a company’s selling points to ensure they accurately represent the company.

Here in Angel Bytes, we are always talking about things we DEFINITELY want to see in the startups we invest in, but what about things we are hoping NOT to see - aka red flags?

A tweet we came across recently got us thinking about red flags that investors find in early-stage deals that make them go ‘I’M OUT’.

So we decided to club together the most common red flags and divide them into four criteria.

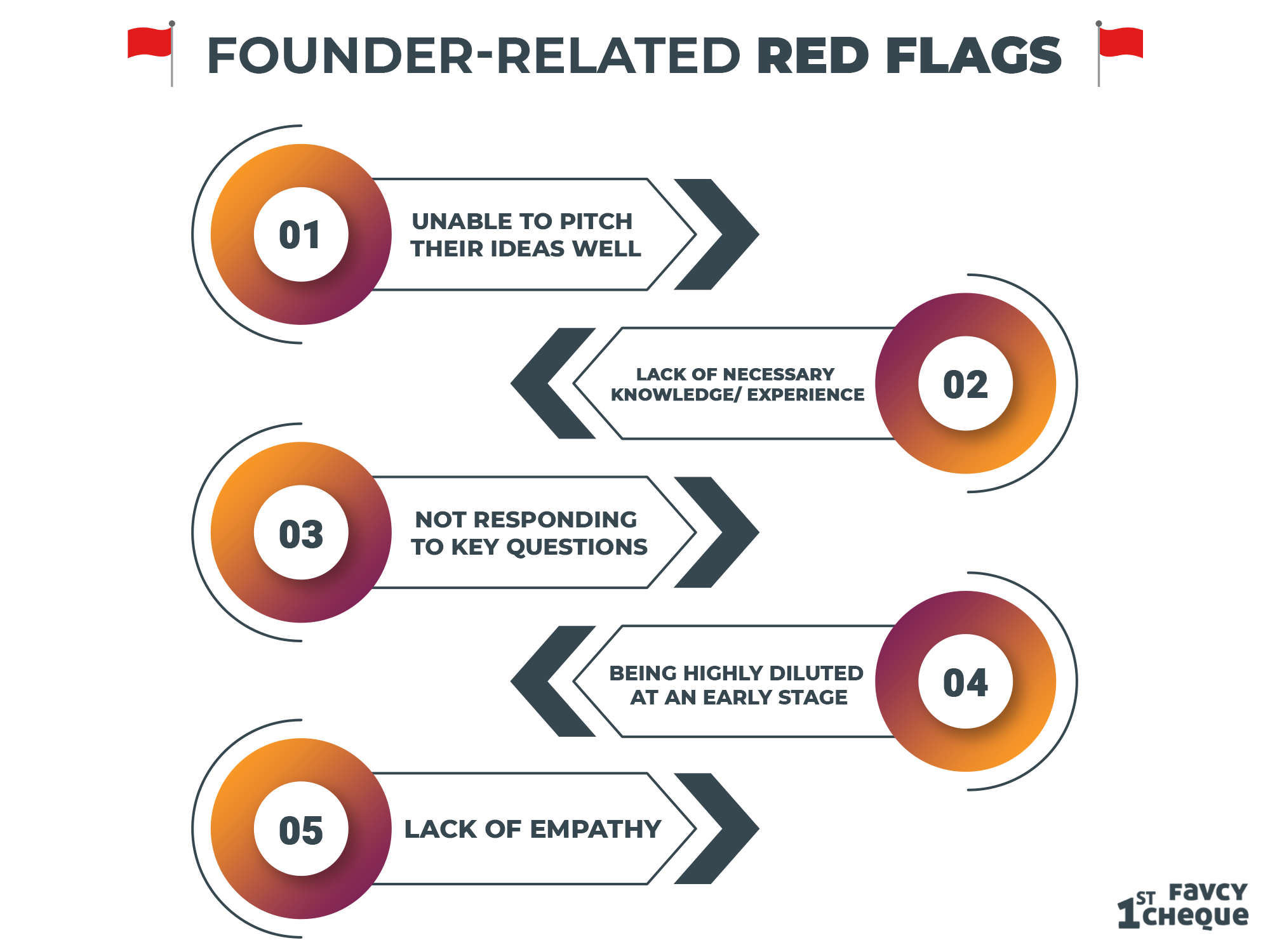

Founder-related Red Flags

- Unable to pitch their ideas well: It’s their brainchild. They should be able to talk about it in their sleep. Yet sometimes, founders are unable to describe the value proposition or the business model well. If it is too complicated or too difficult to understand, there might be some problems with the proposition or the business model itself. A founder must be capable of defining their idea in a clear, summarized version.

- Lack of necessary knowledge/ experience: Don’t get us wrong, we love first-time entrepreneurs. However, that might work for tech or SaaS startups, which compete primarily by their technologies, but not for execution-driven startups, which compete by the team. For a B2C startup working in the retail space, for example, it might be a red flag if none of the founders has any experience in supply chain or logistics.

- Not responding to key questions: Some founders are unable to answer key questions like "how do you differentiate," "what is your vision for the company in five years," and "when do you think it will break even." There can be two possibilities: either the founders do not know the answer or are attempting to avoid addressing the questions.

- Being highly diluted at an early stage: For a seed round, investors anticipate that the founding team will own at least 70% of the company after the round. We expect that the founding team will retain a significant portion of the firm following the series A investment, such as 40–50 per cent. However, on a few rare occasions, the team gives up too much and too soon for convoluted reasons. This is a major red flag because the founding team may not be motivated to work while the company is still in its early stages.

- Lack of empathy: Everything can be changed as a company grows, but there is one thing that will never change: the team. If the team is unsure how to improve the technology, enhance the product, or build the GTM strategy, there are several external resources available to assist them. However, if the founding team cannot take good care of their employees and partners by standing in their shoes, there’s nothing that can help. Earning respect from employees, partners, and customers will sharply increase a startup’s probability of success.

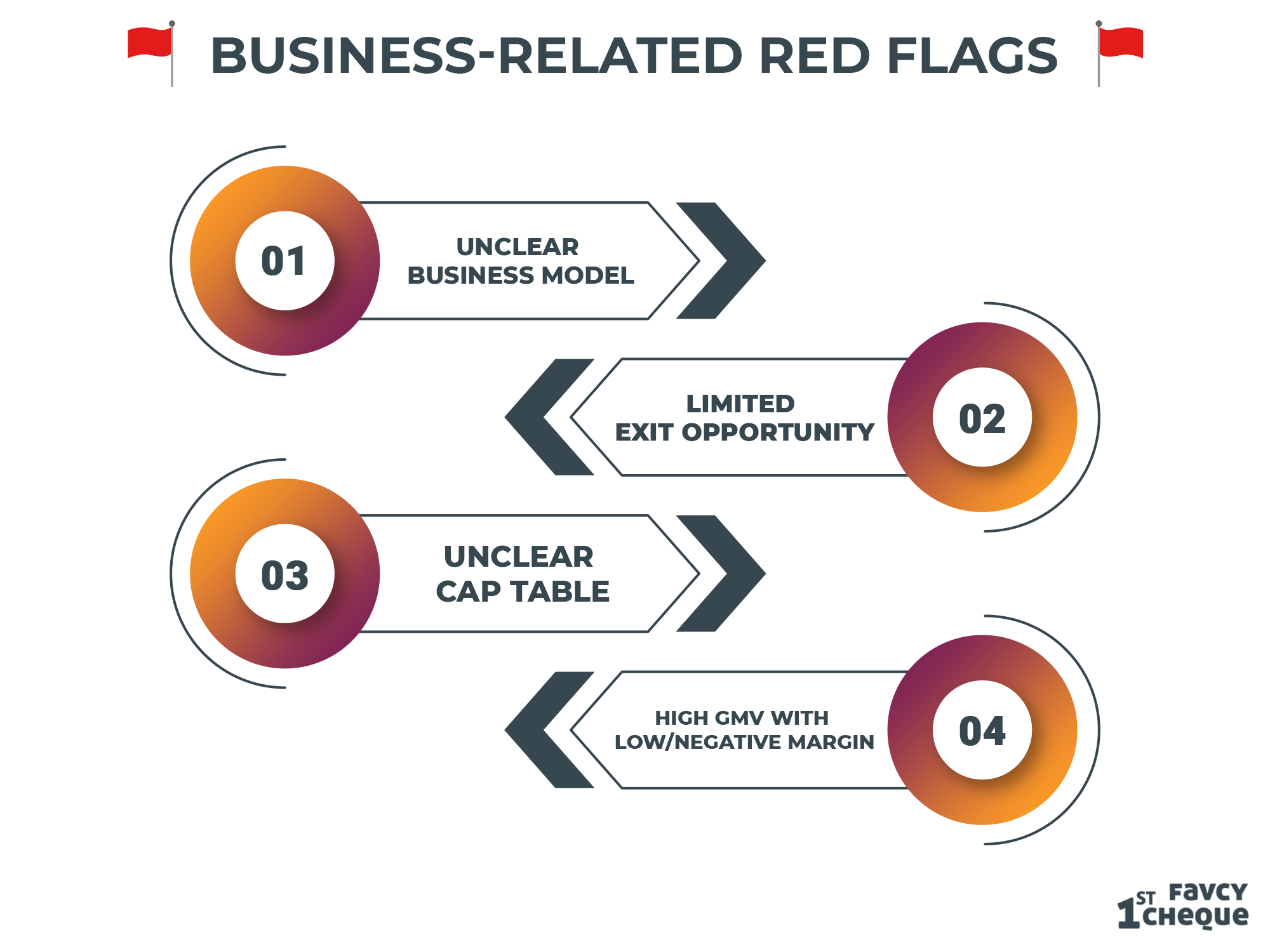

Business-related Red Flags

- Unclear Business Model: This goes without saying. Some startups like presenting captivating "stories" in order to expand their total addressable market size and raise their valuation. For example, a failing business may persuade individuals that they will be able to monetize the data they have acquired in the future. The data monetization idea, on the other hand, is exceedingly dubious – who will need that data? How much will potential consumers be willing to pay? Many questions remain unsolved.

- Limited Exit Opportunity: Don't only concentrate on the Total Addressable Market (TAM). In many cases, even though the TAM is large, the prospective exit may not appear appealing to investors. Consider where the startup will eventually go - does it have the potential to go public? Or will it most likely be purchased by a company in the industry? If an acquisition is planned, who are the potential acquirers, and how much do acquirers typically pay for this sort of technology? An acquisition is more likely than an IPO, in certain sectors. And the exit price is greatly influenced by the possible purchaser.

- Unclear Cap Table: This is one of the essentials that NEED to be correct. Errors on a Cap Table will cause, at best, a delay in the due diligence process and perhaps need legal expenditures to resolve. At worst, a weak Cap Table may leave you unsure about who owns the firm, how much their investment is worth, and how they can depart. In other words, you wouldn't know the true value of your investment. Investors should constantly keep an eye on the cap table and any possible concerns with it. Are there any red signals that might cause issues in subsequent rounds?

- High GMV with low/negative margin: For some marketplace businesses, they may have a high GMV (Gross Merchandise Value), which looks attractive. However, it is the margin that matters in the end. If the company has not figured out a way to break even or make money, the business might not exist in the near future or need a lot of funding to sustain itself before it breaks even.

Market-related Red Flags

- A ‘Field of Dreams’ Go-to Market strategy: These companies believe that if they build the product, the users shall follow it automatically. As a result, there is no specific market they want to cater to and unrealistic expectations of there ever being a market. For eg, the ‘Naabhi (belly-button) shaper’ pitch from Shark Tank India.

- Overstating market potential: Be aware of outlandish claims! If a firm claims to have a large market potential (TAM), consider what percentage of that market is potentially appropriate to its product/service. The Serviceable Available Market (SAM) provides a more accurate picture of market potential than the total addressable market. Consider the market size and be aware of the founder's chosen data selections.

- ‘We have no competition…..’: Having a clear-cut idea of potential competition in the market is necessary. When a startup claims to have none, it indicates poor market research and unrealistic expectations. Investors want to know that you’ve not only done your homework on your direct competition but that you’ve also been thoughtful about potential substitutes. People have a finite amount of time and money to spend, so you’re most likely taking a consumer’s time away from using or spending on something else. Being thoughtful about this topic is the main thing, but knowing as many granular details about the company’s competition and how the product fits the market is always helpful as well.

- Having a huge incumbent addressable market: This might sound counterintuitive, but when you’re trying to build something new or disruptive within a huge existing market it can be much harder to get into a position of leverage and leadership than if you start with a smaller market and grow or reshape it over time. Facebook, Uber and even Google (in terms of the web search advertising market) are all great examples of this.

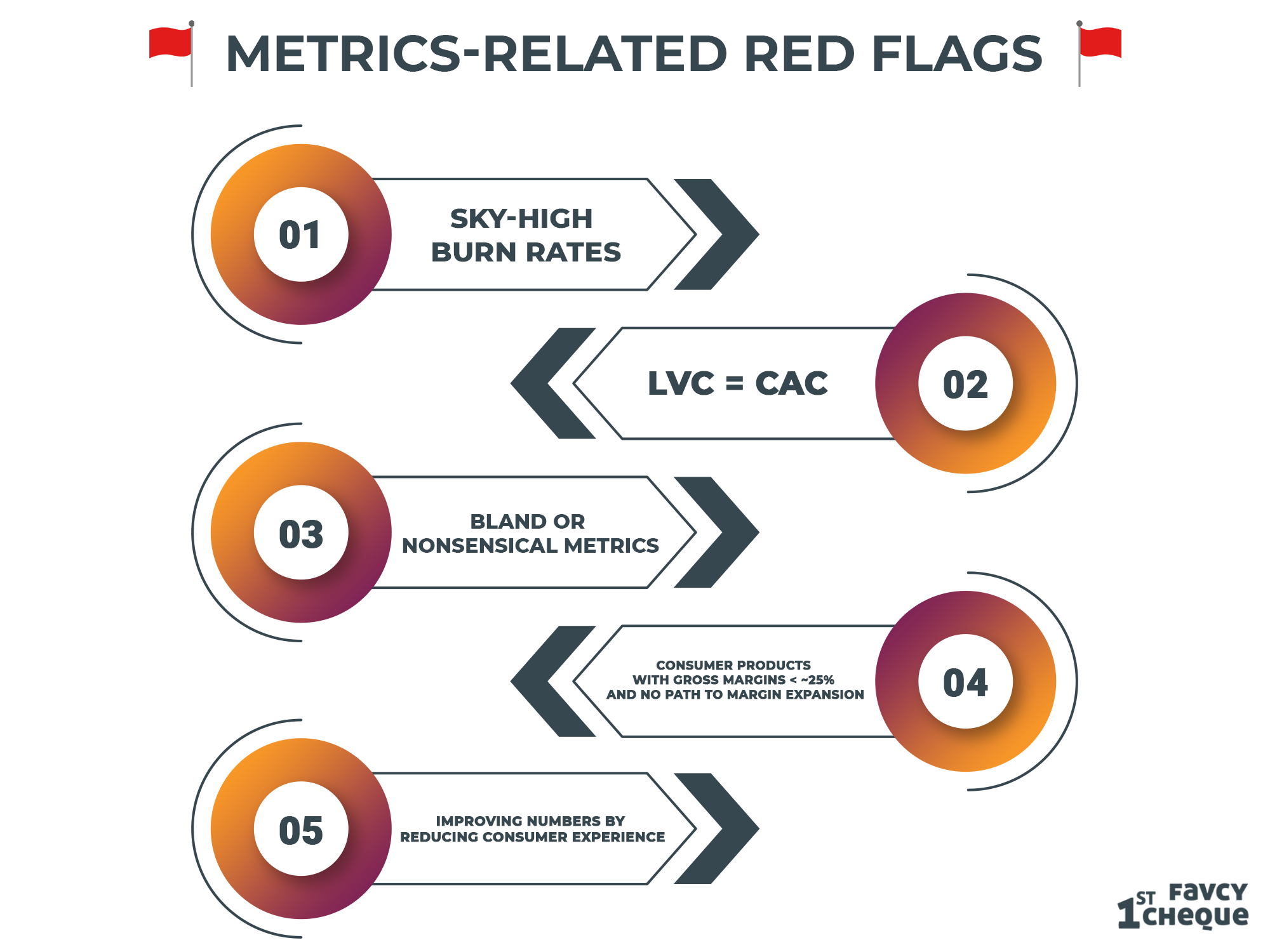

Metrics-related Red Flags

- Sky-high burn rates: Unlike values, which can be adjusted, burn rates are permanent." Founders must be mindful of their burn and be able to describe why each dollar is spent in a certain way. Capital inefficiency is a big red flag.

- Lifetime Value of a Customer (LVC) = Customer Acquisition Cost(CAC): It is self-explanatory. Investors expect an LVC of 4–5x. 3x should be okay but most businesses have fixed costs, and the 3 will quickly compress to 1.5–2 when you are doing several hundred million in revenue. Use this as a benchmark as this is a pretty strong rule of thumb. At Favcy, we work with startups whose ratios are more than 4:1 (Pure Digital Businesses) and 6:1 (Digitally Enabled Businesses). Reason being that India is still growing to adopt full-fledged technology and as compared to digitally-enabled startups, it takes a little more money to acquire customers with pure digital products.

- Bland or nonsensical metrics: If nothing is truly compelling in the metrics, there is no reason your startup stands out. Investors prefer a few points of greatness (e.g. CAC is really low even if other parts of the business aren’t strong yet) because their view is that one can improve things, but if nothing is great, then they question whether the company can ever be great. Similarly, weird metrics that don’t make sense - like a ‘Quarterly MRR’ or weird revenue streams are immediate flags.

- Consumer products with gross margins < ~25% and no path to margin expansion: Consumer products is a tough game to play and Founders can easily over raise and find themselves in a difficult position when it comes to generating returns for their investors and themselves. Having <25% margins will most likely hold you back from even getting there.

- Improving numbers by reducing consumer experience: Investors don’t want to see a “customer first” company making decisions that will improve margin, but throw their values down the drain. These types of shortcuts are not a good projection of the company in the long term.

Honesty, honesty, honesty

Whether it be a romantic relationship or a professional one, honesty goes a long way. Some red flags may throw investors off entirely but it is a known fact that one shall discover problems and challenges in every potential investment. It’s the way that founders approach the difficulties they face that will likely determine the success or not of their venture, and whether investors are willing to join them on it.

Spinning data will only lead to a deterioration of trust and hiding facts will leave any relationship broken down. Open, honest founders will find themselves in much better positions in the long run, even if the deal ultimately falls through.

And the reverse is also true. Honesty and integrity from the investors' side will lead to better outcomes for everybody – even when they are about the cracks in the cookie jar.

So, does this directly mean a white flag of surrender?

No, it does not! Red flags do not mean that nobody is going to invest in a venture. No red flag is a showstopper by itself. As a founder, being alert to and tackling the red flags in advance is smart. Correct them as soon as possible. As for investors, watch out for these red flags, but not every red sign is a stop sign.

.png)

Here are the events of this week:

- CredAvenue enters unicorn club with $137M funding

- Carl Pei-led Nothing raises $70M Series B round

- Loco raises Rs 330 Cr in Series A round led by Hashed-ET

|