Movies, Digital Assets & Carbon; The new asset classes?

By Ninie Verma, Content Associate, Favcy

|

If you want to make above-average returns, you must invest before the average arrives. Once an investment is obvious to everybody, it is only a matter of time until the majority of people will invest — and you’ll be late to the party.

In Crossing the Chasm, Geoffrey Moore outlined how new technologies become part of society. “The law of the diffusion of innovation,” he called it. Moore suggested consumers fall into five groups:

- Innovators, who jump on new ideas as soon as they’re available. These are the first 2.5% of the population to interact with a new technology.

- Early adopters, who are willing to give new tools a try even when they’re not perfect yet. These are the next 13.5% of the population.

- The early majority, who’ll only change their habits when an invention has proven to be of benefit to them. This large, 34% chunk of the people will push an innovation into the mainstream.

- The late majority, who waits for the early majority to convince them after they’ve made a change. This party represents another 34% of the population.

- Laggards, who resist anything new until the world practically forces them to adapt. These are the last 16% of people to get the joke.

If you mined Bitcoin in 2011, you were not just an innovator — you were an absolute pioneer. You had to be at the very forefront of tech, money, and cryptography to know it even exists. Up until 2014, barely anyone had even heard about Bitcoin.

The point being that when it comes to new asset classes forming, being early beats almost everything. If an entire industry grows from $10 million to $10 billion to $10 trillion, that’s two 1,000x jumps! If you make 20 investments, even if 19 of them go to zero, the one that survives will easily repay all the others.

What are some new asset classes you need to know about?

1. Idea stage startups

Even throughout 2022, a year that has been slow for all investments, idea-stage and early-stage startups have shown a solid growth curve.

Get your hands on equity in the latest emerging ideas in trending sectors and you could be sitting on a pile of green in the next 5 to 10 years.

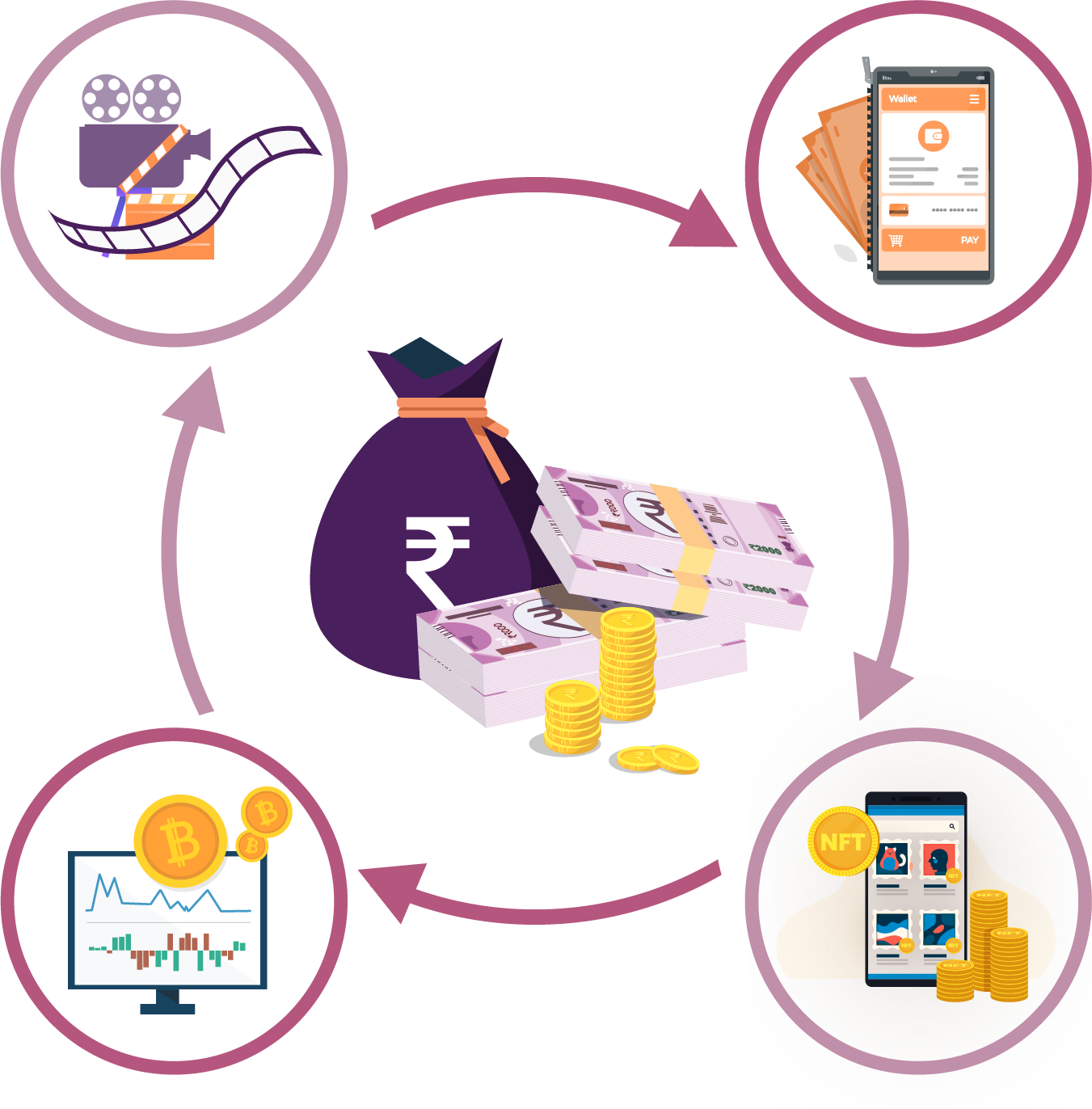

2. Movies

Yes! Film-financing has been a closed-door affair since ages, but now it is possible to invest in movies & OTTs.

Whether you do it for the multiple-X returns or just for the sake of creating art, investing in movies is a brand new asset class worth discovering.

Luckily for you, PayTamasha, a Favcy portfolio startup, is building India's first fundraising platform for movies & OTTs.

Find it intriguing? Fill this form to view the entire pitch.

3. Digital collectibles

A digital collectible is a unique or limited-edition copy of a virtual item. Typically there's a visual element such as digital art, a video clip, or a digital trading card. Theoretically, it could be anything represented by 1s and 0s such as digital music recordings.

Digital collectibles were all the rave in 2020. And they still will continue to be, with the rise of AR/VR and Metaverse.

4. Carbon trading

Carbon trading, also known as carbon emissions trading, is the use of a marketplace to buy and sell credits that allow companies or other parties to emit a certain amount of carbon dioxide.

In an attempt to reduce carbon footprints, mammoth companies worldwide are looking to trade carbon, which is being promoted by many governments.

Which asset class surprised you the most?

To Do: Pick a new asset niche to research in depth, then make an appointment with yourself to do it

Whichever of these ideas intrigues you the most, commit to spending some more time researching it. Finding good investments takes time. There’s no way around it.

Schedule a one-hour meeting with yourself. What will you look at in detail? Crowdfunding movies? Idea stage startups? NFTs? Whatever you pick, your best investments will likely begin where you poke your nose just over the edge of the known and into the new.

If you want above-average returns, you can’t afford average timing.