The Bible for First-time Angel Investors

By Ninie Verma, Content Associate, 1stCheque by Favcy

- Sometimes, we wish certain things in life had a cheat code. A fixed rulebook to follow so nothing ever went wrong.

- What is the holy grail cheat code for every first-time angel investor?

- In this week’s Angel Bytes we bring to you verses from the Bible of Angel Investors that every first-timer should memorize by heart.

Read away!

Dear first-time angel investor,

You must be aware that the year 2021 was like no other for the Indian startup ecosystem — be it in the volume of fund inflow or the number of startups entering the coveted unicorn club.

Experts say that this momentum is likely to continue well into 2022 — and the value of angel investors in the ecosystem is only set to increase.

You are called ‘angel’ for a reason, no? Angel investors are the ones making early bets on startups, offering the venture wings to start flying.

In 2021, there were certainly a lot of positives for the angel investor community and an increase in their investments.

It feels good to see more and more people venturing out to start the investment journey of their lives. So this week, we go back to the basics.

What is the holy grail for every first-time angel investor? And what are some ‘angel investment’ verses they must swear by like it’s a Holy Book if they do not want to risk experiencing hell?

Let us start from the very beginning.

Mentally “write off” your investment as soon as you write the check.

We’re not saying you shouldn’t care for the investment. The idea is that nobody should invest money they cannot afford to lose. According to industry-standard metrics, only one out of every seven companies will succeed. With proper due research and a competent team behind the organisation, you can significantly raise this result—however, that number must still be considered. You should also avoid going all-in on a single company with your allocated funds for such investments. Write smaller checks to a greater number of organisations in order to cast a broader net for a possibly significant return.

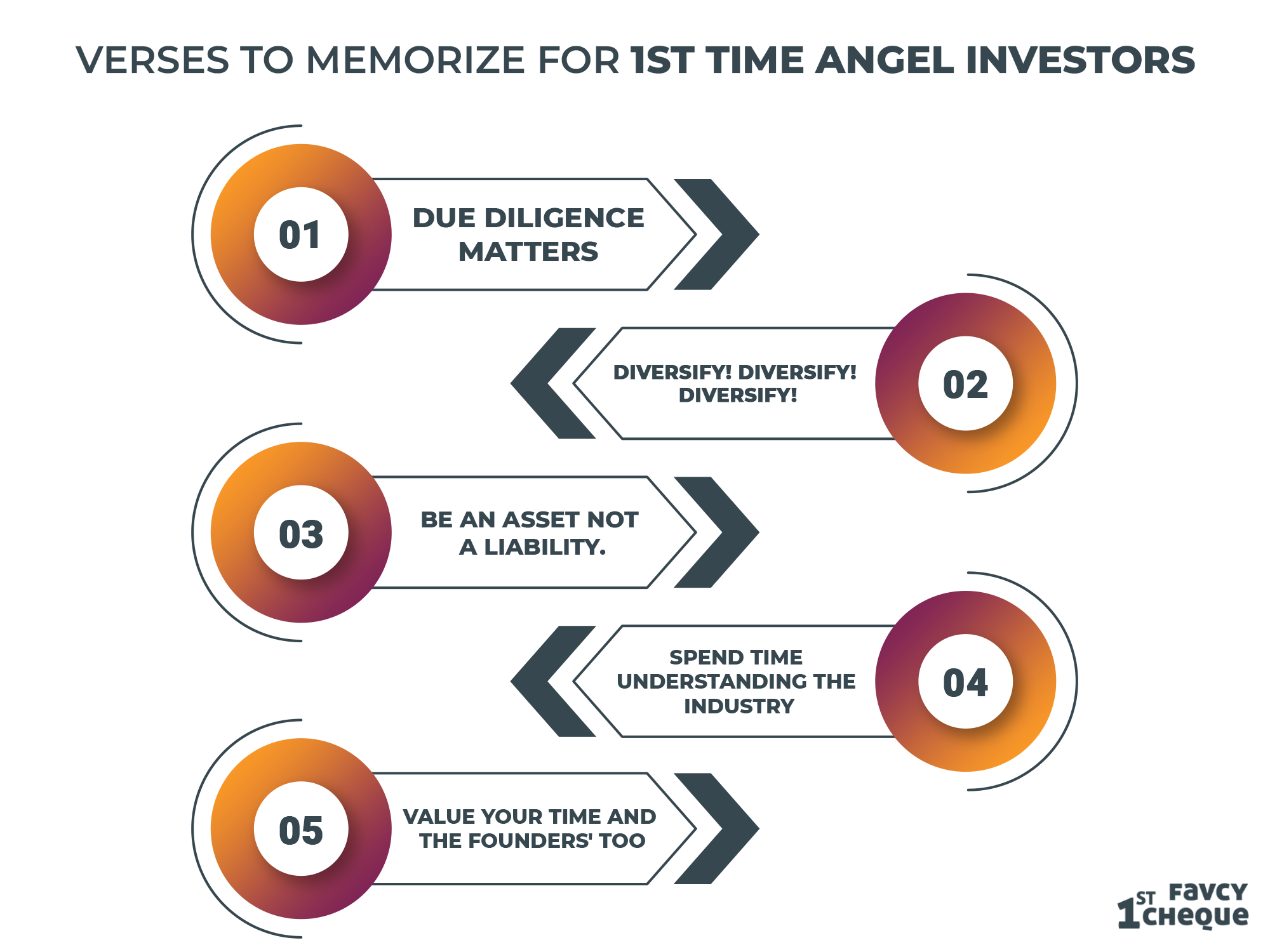

When considering an investment in a startup, conduct more due diligence on the people behind it than the idea or product itself.

It’s the company’s founders and executives who are going to see the concept become a reality, grow sales and profits, keep margins in line, and maintain a motivated and capable workforce.

Hello, you must still perform exhaustive due diligence on the business.

In addition to the above-mentioned people's due diligence, you should educate yourself on as many aspects of the business, industry, competitors, and hazards as possible to help improve your chances of success. You must 'look under the hood' on as many aspects of the business as you can comprehend in order to be truly comfortable when it comes time to write the check.

Diversify! Diversify! Diversify!

If only we got a dollar for every time we have emphasized this in the Angel Bytes section…….. maybe we could have renamed the section Angel Bytes with an Angel Investor! ;)

The key to reducing the risk and hitting a home run is diversifying your portfolio ! Read all about it here!

An angel investor must also be an angel of an asset, not a liability.

What resources do you have to offer? What kinds of doors can you open? What resources do you have at your disposal to assist them? This not only protects your investment but may also open new possibilities for you. You could wind up aiding the firm enough that you can negotiate some alternatives or remuneration for yourself in exchange for your help.

Understand the Industry!

Before you invest, it is important that you have knowledge about the industry. Proper research can help in risk mitigation. This means you want to dedicate proper time to tracking trends, researching sectors, and forecasting the next boom. When deciding to become an angel investor, market research is critical, and it certainly pays to devote time early on to learn about the history and future of a certain sector.

Your time is valuable, too!

In an attempt to be an angel investor that contributes his 100%, Spending half of your week fretting about a firm that isn't going anywhere is a waste of time. Helping portfolio companies, ironically, saves time if you manage your inclinations — founders are the busiest people alive! The five minutes you spend creating one email for your best company in order to obtain an introduction to one major client - those are the things that count!

The Final Verses

You’ve got to trust us. We follow the ups and downs of angel investing for a living. These are some principles, which, if you commit to heart, will prove to be great for your angel investment journey. The best-performing startups tend to have angels who are dedicated and easy.

Lastly, being an angel investor may be a rewarding and hazardous experience. You'll have a far better chance of success if you study as much as you can about the process ahead of time. This Bible is always here to help.