The Digital Rupee and the Crypto-nite Tax

- This year’s budget was a rollercoaster ride, to say the least, and not a pleasant one for most but when is it ever?

- One of the most interesting pieces of news disclosed during the Budget by the Finance Minister, Nirmala Sitharaman was India’s very own Digital Rupee.

- And one of the most controversial announcements made was about the tax to be levied on cryptocurrency gains!

- The coin that is beating around the bush and the tax that baffled all, make a debatable duo.

In this week’s Favcy Review, we decipher the Digital Rupee and this tax that might prove to be kryptonite for the blockchain ecosystem!

.png)

The Coin With Personality Issues

Cryptocurrency? India’s own Bitcoin? Just digital money? What exactly is it? These were thoughts most of us had when we first heard about the Digital Rupee.

So what is the Digital Rupee going to be?

CBDC! That is, Central Backed Digital Currency! Essentially, digital currency or rupee is an electronic form of money that can be used in contactless transactions. It shall be the digital equivalent of normal cash issued by the RBI and will therefore be sovereign backed!

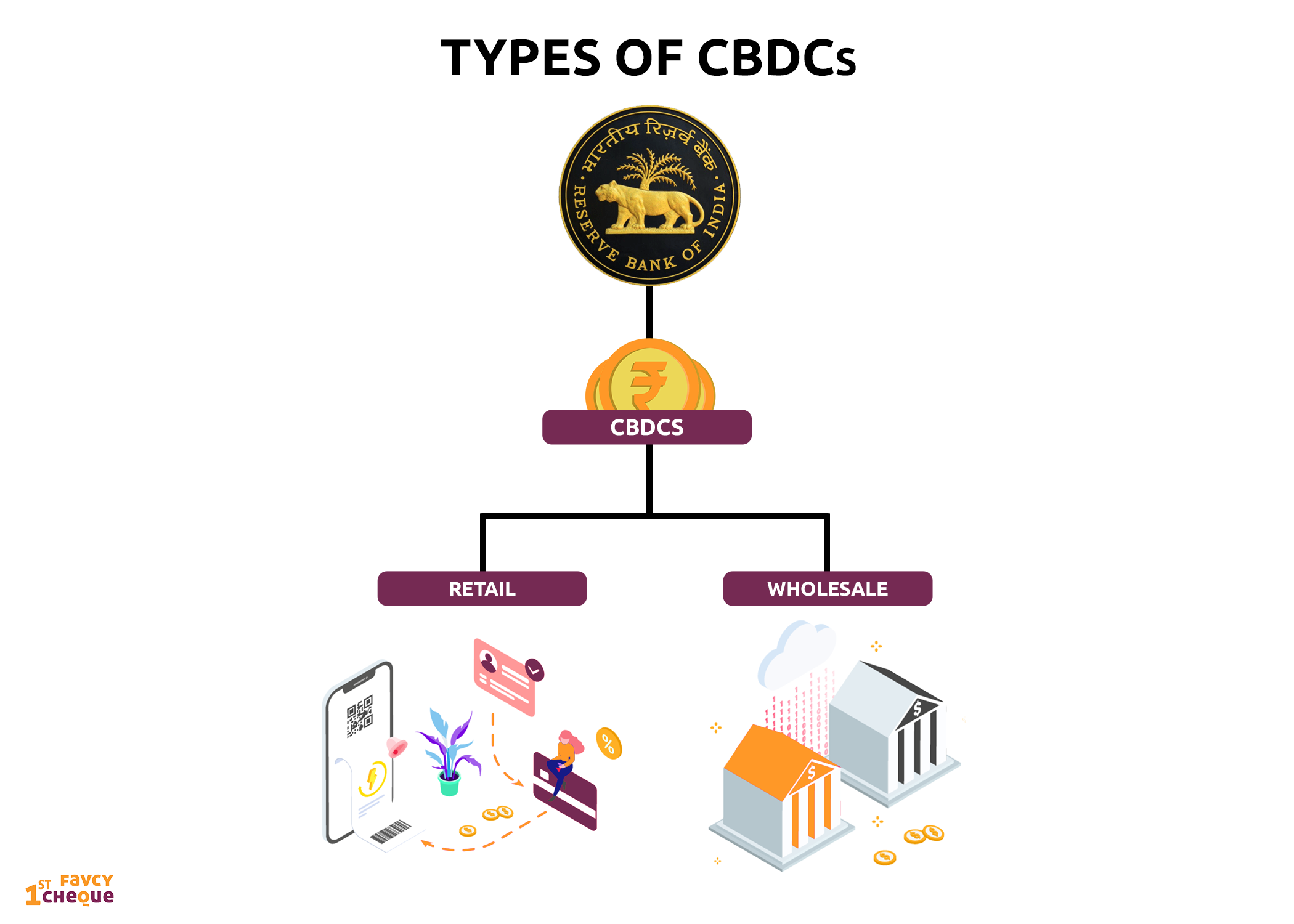

There shall be two types of CBDCs - Retail and Wholesale.

The fact that it is government-issued makes it pretty clear that it is not private, volatile and unsanctioned like all other cryptocurrencies.

However, the government is yet to disclose the technology behind this digital currency. It may not necessarily use blockchain technology.

The RBI has been maintaining a lot of hush-hush around the core aspects of the technology of the digital rupee. It has not taken help from any private players about the currency.

But, for the central bank to retain control of the digital rupee — and given that most banks would like to keep their competitors from prying into their liquidity tactics — it would require a permission system for its planned CBDC.

Guess only time shall reveal the answers to these questions!

A new chapter in digital payments? But we’ve still got good old UPI…….

Since we already have a robust digital payments infrastructure, do we need the Digital Rupee?

When we analyzed it, there are more benefits than drawbacks -

- CBDCs can replace large cash usage, and the costs associated with printing and distributing cash can be minimized to a great extent.

- Tokenization and distributed ledger technology (DLT) can make financial systems efficient and resilient.

- CBDCs shall allow effortless transactions across borders.

- Surging UPI failure rates have become a cause of concern. UPI payments have a technical decline rate of 1.3 to 1.43 per cent.

This shows the digital rupee has more pros than cons. The biggest concern with CBDCs other than the potential risks of cybersecurity is that once all payments become digitized, the concept of financial privacy will cease to exist as every transaction shall leave a digital trail.

Talking of privacy and online transactions brings us to the disputable topic of the Crypto-nite tax, as we’ve taken to calling it.

"There has been a phenomenal increase in transactions in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime," Sitharaman said in the Budget speech.

Every ‘virtual digital asset’ undoubtedly includes cryptocurrency, NFTs and all other blockchain assets that possess any inherent value online. And the gains from these virtual digital assets shall be charged with a 30% tax

While this is the first time the Indian government has defined a broad digital asset that includes crypto, the 30% tax seems to be excessive.

The only upside is that at least cryptocurrency is not getting banned.

But apparently, it is the same as betting on horses?

This taxation framework treats crypto assets the same way we treat winnings from horse races, gambling and other speculative transactions! And we’d be laughing if the ‘regulatory’ tax was not a tight slap.

To give you an idea, here’s an example.

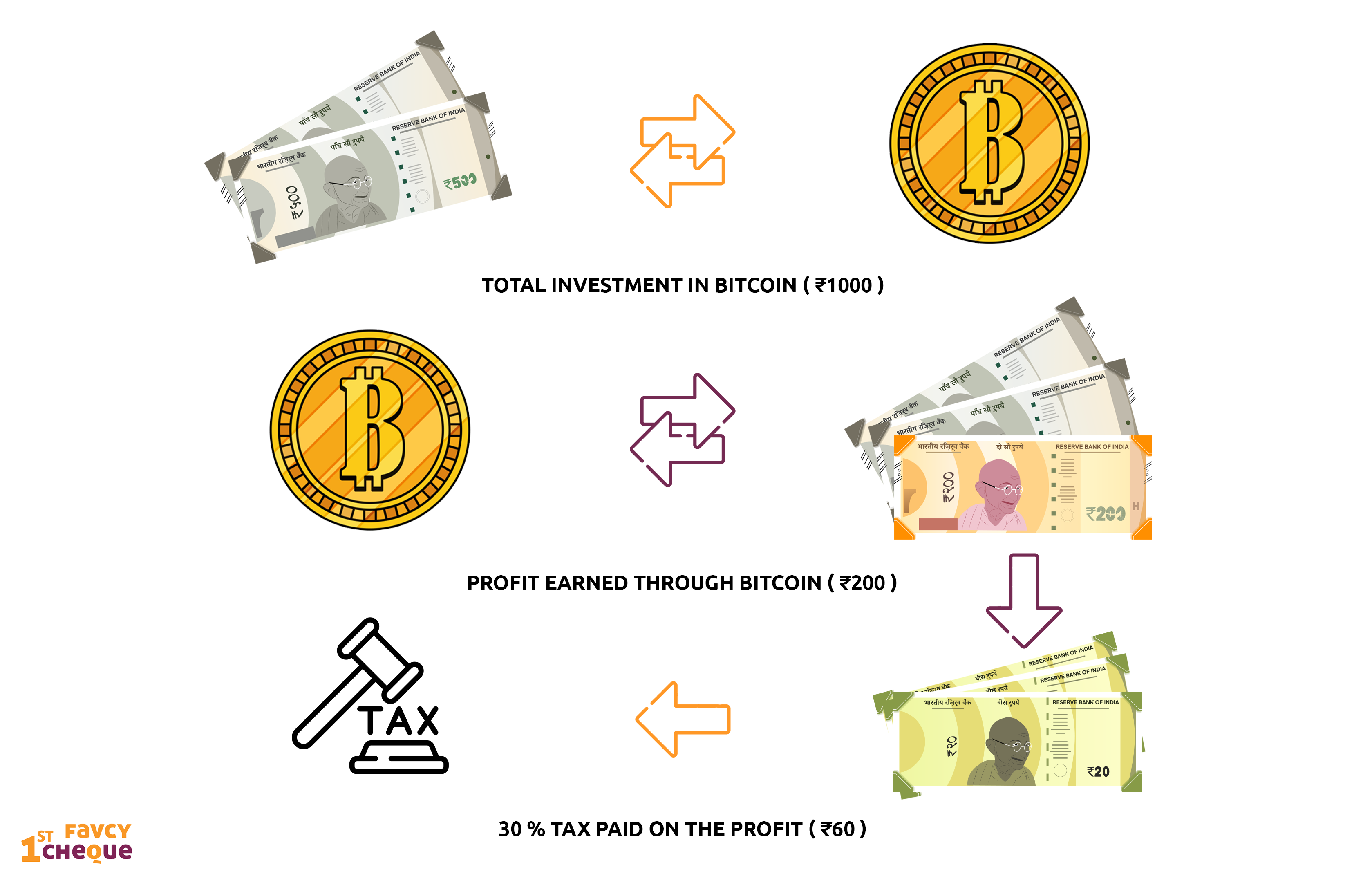

Any income from the transfer of any virtual digital asset will be taxed at the rate of 30%. Plus, the rest of the income will be taxed as per the existing slabs.

Assume you invest INR 1,000 in a crypto asset, say bitcoin, and then sell it for INR 1,200. According to the most recent tax proposal, you would be required to pay a tax of INR 60 on the amount of INR 200 obtained from the transaction. NFTs will be subject to the same tax rules.

To understand how it would reflect on the annual earnings, let’s take the example of a crypto user Mr Singh who earns INR 10 Lakhs annually. Out of INR 10 Lakhs, Mr Singh earned INR 1 Lakhs from crypto investments. In such a case Mr Singh’s income will be divided into two parts and taxed accordingly.

Income from other sources: INR 9 Lakhs to be taxed at 15% or 20%, depending on the tax regime

Income from crypto/NFT investments: INR 1 Lakhs taxed at 30% tax, Mr Singh will thus have to pay INR 30,000 tax solely on crypto income and 15% or 20% tax on the rest INR 9 Lakhs of income.

Furthermore, it has been proposed that 1% tax must be deducted on every crypto transaction to keep track of all transactions in the country.

As the joke goes, apparently if you want to make $1 million through crypto, you’ve got to start with $2 million.

Not Addressing the Cryptomining, Crypto Startups (Elephant in the Room)

Fuelling confusion, the government decided to keep mum on the mining and staking of cryptocurrencies or how crypto miners shall be taxed. There was also no appearance of the rumored Crypto Bill.

There is also no clarity for crypto startups. These businesses currently pay 18% GST on the commission of crypto exchange. But more importantly, not all run on crypto exchanges. Some are just brokerage firms that sell and hold cryptocurrency as their service bouquet. If 30% tax is levied when they convert these holdings into fiat money, the business shall cease to be viable.

The chaos is palpable as key players and common men in the industry alike face confusion and uncertainty.

Will this prove to be kryptonite for the ecosystem?

DC fans know how kryptonite was Superman’s weakness.

Similarly, the 30% tax could deter retail investors. There might be movement in people liquidating their crypto portfolios and moving to the equity market.

But if you look at the greener side of the grass, self-declaration of crypto ownership and tax filing appears to be a progressive step that demonstrates the government's commitment to monitoring, verifying, and regulating the expansion of the crypto economy.

So in a way, the high tax regime is going to force people to double-check their investment strategies. One cannot do high-volume, low-margin trading anymore. People will hesitate to invest in the short-term, while on the other hand, long-term holders might continue to invest.

Bottomline

The Digital Rupee and its hoard of mysteries shall only be solved with time. It remains to be seen what neo technology shall they base the digital currency on, but we have a feeling that it is going to be blockchain technology.

As for the Crypto tax, from chaos to clarity to confusion and chaos again, we have come an entire circle since the government announced its stringent disapproval of crypto back in 2018.

Only the next chapter shall disclose the climax of this digital revolution in India.

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us:

Liked the article, Share it with others!👇🏻