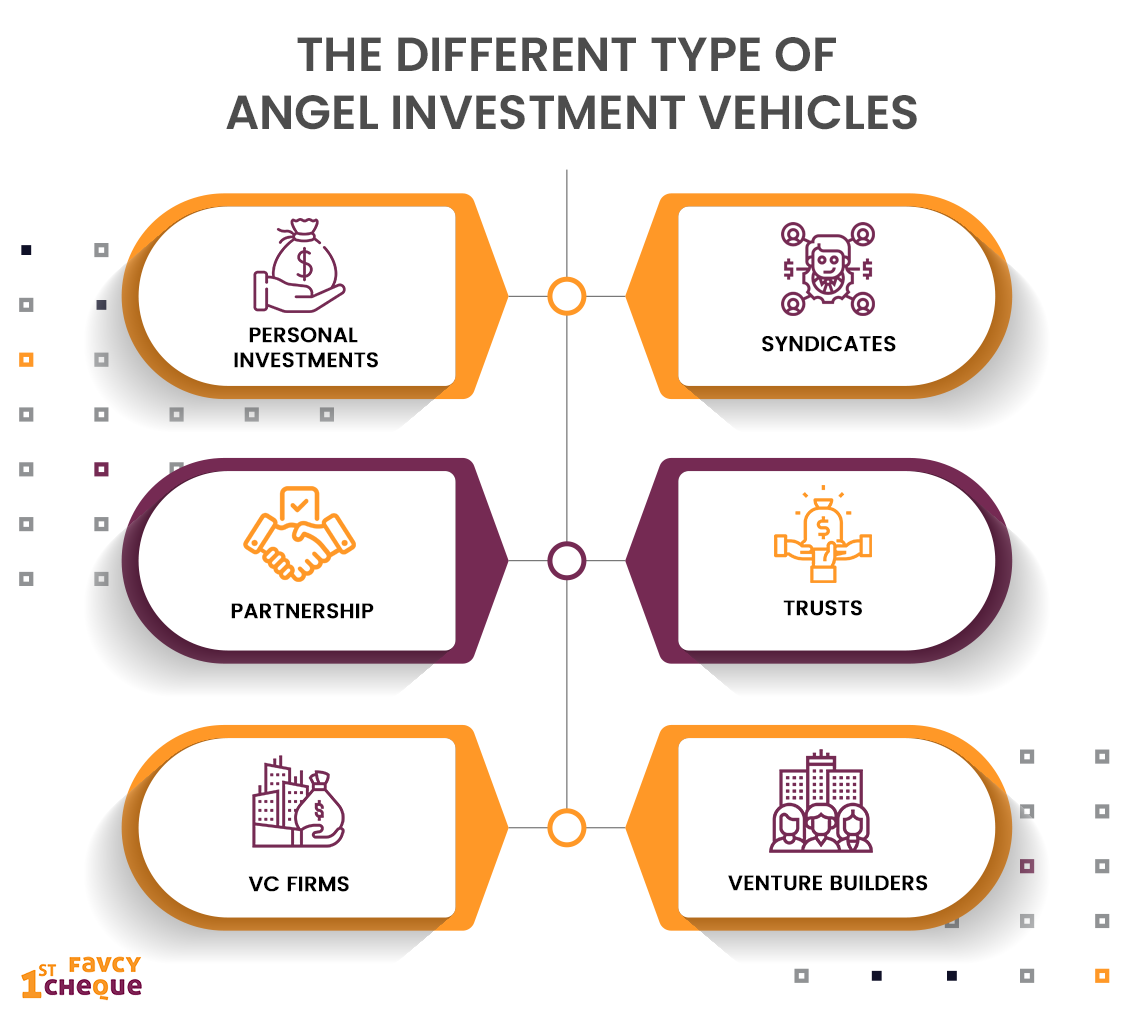

The Pros and Cons of Different Angel Investment Vehicles

Angels are the Indy 500 racers of the investment world. When great investment opportunities arise, they’re the first at the finish line. And like any great racer, a crucial part of the process is choosing the right vehicle.

Before you write your first check as an angel investor, you need to decide which angel investment vehicles will work the best for you, as each one has different features and advantages.

#1) Personal Investment

A direct personal investment is the most basic angel investing mechanism. This is the Mercedes AMG of angel investment vehicles: expensive but high touch. You meet with the business, sign the purchase agreement, and wire money to make this type of investment.

After receiving your payments, the firm will counter-sign the purchase agreement and email you a copy. Done!

Personal investments are made through a brokerage or bank account, and it is the most common tool among the plethora of angel investment vehicles available. Quick to complete, personal investments have the fewest hassles. That means dealing with fewer investment institutions, fewer forms, and shorter wait times compared to partnerships, trusts, and IRAs (more on these shortly).

However, direct investments usually mean a high minimum investment to participate, which can be an intimidating prospect for beginning investors. Typically, the minimums are in the range of $25,000 per check. Implication: to build a diversified portfolio, you will have to shell out a lot of cash! You will also have to manage all of the paperwork and communication with the startup, so if you choose this option, be prepared to be proactive in terms of engaging with the management team.

#2) Syndicates

Like Tesla’s vision of making the electric car a reality for all, syndicates are a prime example of angel investment vehicles, and they make angel investing accessible for more people. Steadily gaining popularity in the investment world, syndicates lower the minimum investment required from $25,000 to as low as $5,000, allowing you to spread your money over a broad range of startups and thus create a more diverse investment portfolio. Being part of a syndicate also makes it easier for you to participate in future rounds since syndicates often negotiate what is called pro-rata investment rights, which give an investor in a company the right to take part in subsequent rounds of funding.

Syndicates work differently on different platforms and you should make sure you are aware of the fee structure. Check to see if the syndicate charges an annual management fee and be clear with how much.

#3) Partnerships

This is a lot like buying a car with a co-signer. A partnership allows for another level of liability protection. It also opens up the possibility of shifting tax gains and losses to the different parties in the partnership. This can be a useful tool for offsetting gains and losses from other capital investments.

However, a partnership can take time to build, but it is easier to use compared to other angel investment vehicles if it is already established ahead of time. Again, if you take this approach you’ll need to invest the minimum set by the company, which often starts at $10K – $25K depending on the type of startup.

#4) Trusts

Next is a trust; this is the prized roadster passed down from one generation to the next, hopefully with the brakes and steering intact. Trusts are often used for investments and allow for one generation to protect, control, and pass assets to future generations without invoking the estate tax – a big advantage for high net worth investors. Making an investment through a trust is similar to making a personal investment, but this can take time if the trust is not set up ahead of time.

#5) VCs & VBs

Venture Capital firms fund and mentor startups or other young, often tech-focused companies. Similar to private equity (PE) firms, VC firms use capital raised from limited partners![]() to invest in promising private companies.

to invest in promising private companies.

Venture builders or venture studio is an organization who build startups using their own ideas and resources. These separate dedicated institutions support their ventures along the entire value chain. What distinguishes them is a proactive approach to building, establishing and growing their ventures while consistently applying a clear roadmap during the entire development and growth process.

This is what sets Favcy apart. Favcy dentifies, develops, launches, and scales startups by providing a centralized mix of services, including capital, in exchange for equity. It starts right from idea validation, business modelling, product building to post product revenues and investments.

And the best part about investing in startups from Favcy's portfolio? The deals are pre-vetted, risk-mitigated and most importantly - backed by a Venture Builder!

In Conclusion

Depending on your personal preferences, these methods may be the right angel investment vehicles for you. But as with any vehicular purchase, we suggest getting some insurance by means of doing your own research before making a final decision!