The Science of 'Carried Interest'

By Ninie Verma, Content Associate, 1stCheque by Favcy

- 'Carried Interest' is a term we often come across in talks of VC and private equity.

- But do you know the economics behind 'carried interest'?

- And if we were to look at the bigger pictures, have you ever thought about how VC funds actually make money?

Read on!

Where’s the source of the money stream?

Venture Capital firms help individuals invest money for returns and companies mint money but have you ever wondered how Venture Capital funds make money?

A VC fund earns money in two ways: Management Fees and Carried Interest.

The Management Fee is an annual fee charged by fund managers to oversee and operate the fund. This charge is often calculated as a percentage of the total capital invested in a fund. The Fund Managers use this money to engage a team of analysts, search for investment possibilities, do due diligence, and eventually invest.

The Carried Interest or “carry” is a success fee that Fund Managers charge based on the success of the investments. Usually, the carry is given to Fund Managers after they have returned all of the capital invested plus a premium, this premium is called Preferred Return. Once the Fund has returned all of the capital to its investors plus the Preferred Return, then the Fund receives their carry. This carry is typically a percentage of the surplus.

In this article, we’re going to explain in detail the economics of “carry”.

2 Cents about the 2 and 20 model

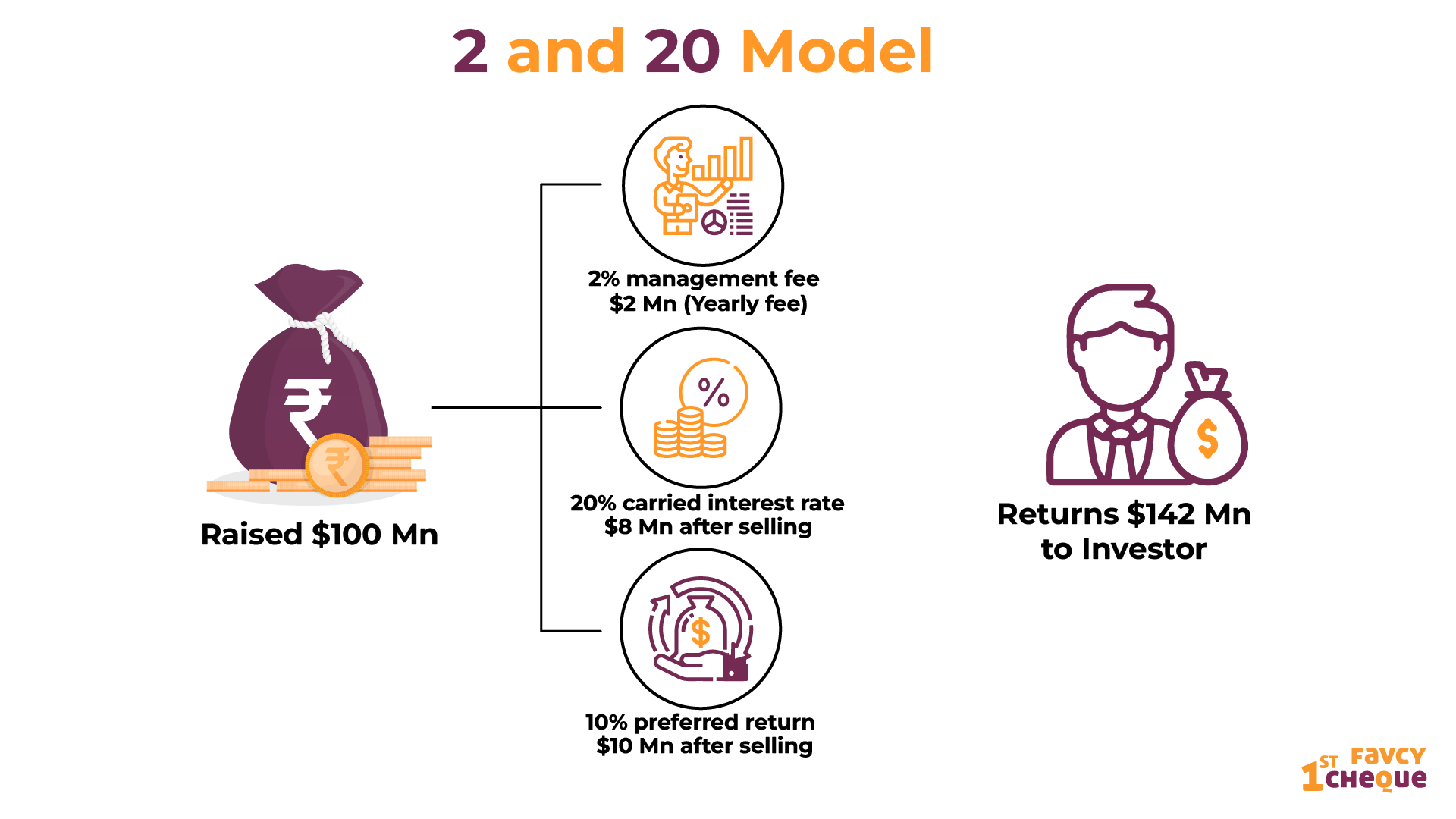

To give you an idea about how it actually works, let’s take a look at an example.

Assume we raise a $100 million fund with a 2% management fee, a 20% carried interest rate, and a 10% preferred return. For simplicity, let us also imagine that we put the whole amount in one investment (which is something you should never do in Angel Investment! Portfolio diversification, hello?!)

To begin, funds charge a 2% management fee, which allows them $2 million to handle the fund for the full year. They have to rent office space, hire people, pay for internet, power, water, coffee, you get the picture…

They also have to hunt for investment possibilities and study them to the point where they are ready to invest with that money. They now only have $98 million to spend because even though Fund was worth $100 million, they paid $2 million on management fees.

They spend $98 million and sell for $150 million in exactly one year. Excellent investment! They give their investors their $100 million (yes, they have to pay back the Management Fee) plus $10 million of their preferred return of 10%. So they're down to $40 million. They pay their investors 80% of the $40 million and receive 20%, for a total of $32 million for them and $8 million for the fund

Summary: $100M fund, Manager charges $2M a year and gets $8M in carried interest. Investor puts in $100M gets $142M back.

The Economics of Carried Interest

Carried interest can be defined in one of two ways, with the first being the most common in venture capital funds:

- Whole fund. Carry is applied to the entire overall fund-level returns (also known as the "European waterfall").

- Deal-by-deal. Carry is applied on a deal-by-deal basis (also known as the "American waterfall").

If we go by the 2 & 20 model, the industry standard is 20% carry. However, many fund managers take a lesser Carry, particularly the newer firms that are still building a credit track record. Carry over a hurdle rate is frequently accepted by managers (A minimum IRR).

What is a ‘carry hurdle’?

Carried interest is never guaranteed. Even after the fund returns the investors' principal, it must exceed an agreed-upon rate of return. This rate of return is often referred to as the "carry hurdle" or "hurdle rate." If the rate is not achieved, the fund manager does not receive carry.

Let’s try to wash it all down with an example.

For example, it’s the $100 Mn VC fund. Let's say 25 investors have committed $4 Mn each. The fund manager invests this $100 Mn fund over 4.5 years. Investors don't have to give $4 Mn on day zero. They just commit $4 Mn to the fund and transfer money whenever the fund calls for it.

Here’s what the investment timeline would look like: Year 0 = $1 Mn, Year 2 = $1 Mn, Year 3 = $1 Mn, Year 5 = $1 Mn.

Because they do not invest everything on day one, fund managers take funds in stages. They invest when they come across promising businesses that suit their theory. The average fund lifespan is ten years, and most fund managers deploy the whole fund by year five or six.

The fund can earn a return on investment (sell its shares to another investor) as early as the third year and as late as the tenth year. Some investments result in a 0 return, while others result in a 20x return. When the fund exits an investment, the fund manager pays the gains (minus Carry) to the investor (sells its shares to another VC).

So, in Year 4, a fund manager can return $3 million to an investor from a Year 1 investment and then request $1 million from the same LP in Year 5 for fresh investment. Investors see erratic cash inflows and outflows during a fund's existence (10 years).

Using these cash flows, we calculate the IRR (which is utilised for the hurdle rate and carry).

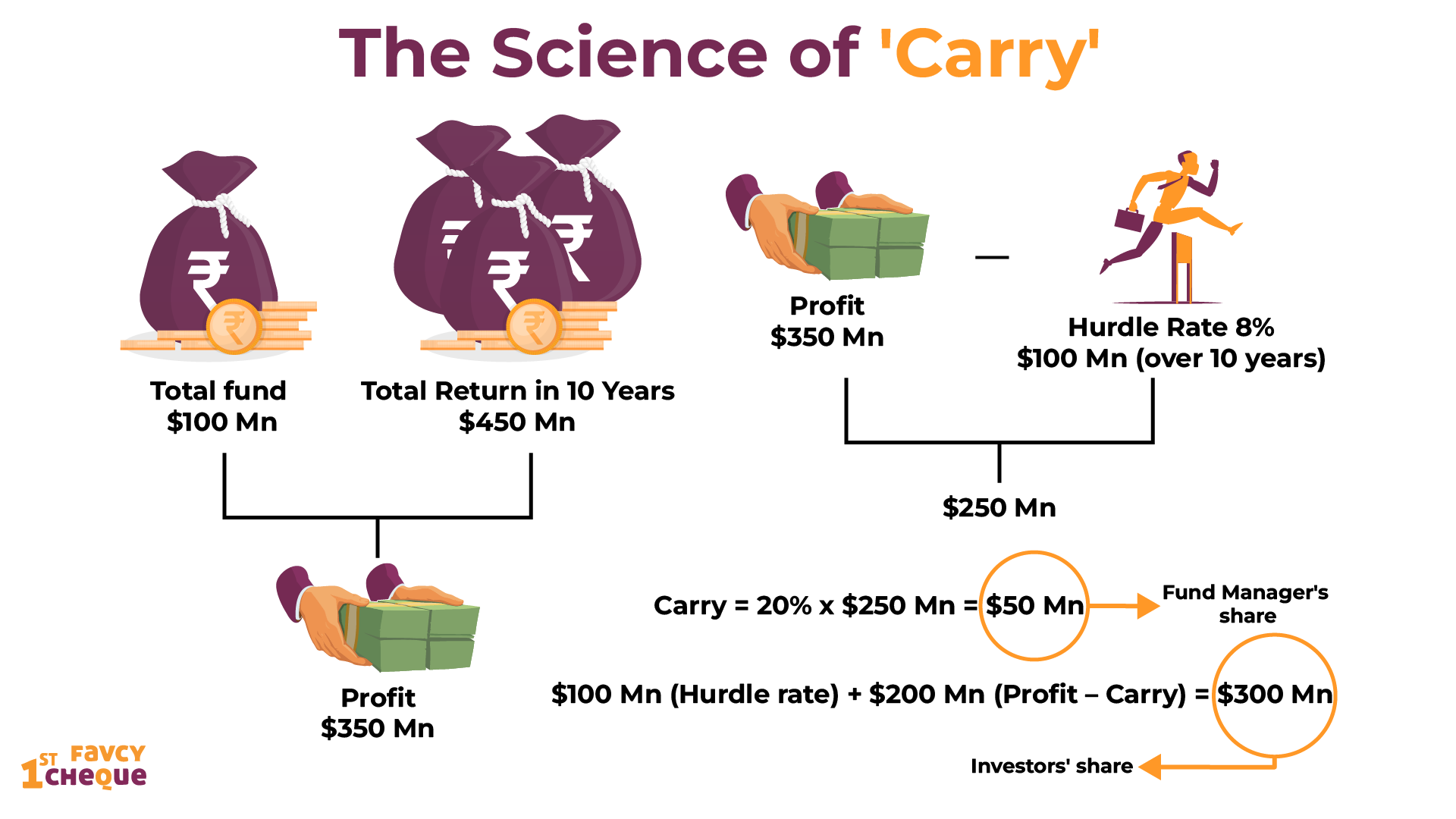

Let’s go back to the example.

Fund Size = $100 Mn

Total Return in 10 Years = $450 Mn

Profits = $350 Mn

Hurdle Rate = 8% (Let’s assume it comes out to be $100 Mn over 10 years)Profit - Hurdle Rate = $250 Mn

Carry = 20% x $250 Mn = $50 Mn

Investors' share = $100 Mn (Hurdle rate) + $200 Mn (Profit – Carry) = $300 Mn

Fund Manager's share = $50 Mn (Carry)

[ Note: Here, we assume that there is no ‘catch-up clause’. A fund manager can get a carry on the entire profit only if he meets the hurdle rate. This is called a catch-up clause.]

With a catch-up clause, the fund manager will get $70 Mn (20% of $350 Mn) & investors’ share will be $280 Mn.

The Final Rundown With *drumrolls* TAXES!

The above-mentioned figures are before taxes. Investors have to pay Capital Gains tax on this $300 Mn profit. LTCG tax in India on unlisted shares is 23.92% (20% Tax + 15% Max Surcharge + 4% Cess) for the highest category.

Thus, Indian investors will have to pay 23.92% LTCG tax on this $300 Mn.

For every investor - Investment = $4 Mn, Return = $12 Mn ($300 Mn divided between 25 investors), Tax = $2.87 Mn

After tax return = $9.13 Mn

So an investor makes a cool $9.13 Mn on an investment of $4 Mn during these 10 years.

Summing It Up

The economics of a fund have been simplified and the detailed technicalities behind these transactions are overlooked. Many details have been obviated to make this post as simple, easy and comprehensible as possible. There are many more factors that can affect every aspect of calculating carried interest.

Lastly, for fund managers, Carried Interest provides an economic incentive for them to help their investments succeed. For investors, it’s the price they pay for access to profitable investments.

|