Can startups make you immortal?

Dear Reader, who is the first person who you think can live up to more than 100 years?

I personally think it is Elon Musk. He just has that aura about him. His recent acquisition of Twitter certainly tells us that he is insanely tenacious when it comes to getting what he wants.

This brings me to an announcement – we know you love our Short Takes, so in case you’re missing them in the newsletter, we post them on all our social media handles! And the latest one talks about Musk's Twitter deal that has shaken the internet! Click here to follow us and get the juiciest takes on the most trending topics in the ecosystem!

In this week’s CurrentOpenDeals section we present to you *drumrolls* - Majig, a creative/social commerce platform that is set to transform “brand capital” in India. Find out how below.

And the Future@Favcy section has open positions here at Favcy, in case you’re looking to join our boat!

To tell you an interesting fact, scientists claim that the first person who might just live upto 1000 years has already been born! Baffling, isn’t it?

In Favcy Review, this week we talk about longevity startups and their quest to conquer death.

Lastly, in Angel Bytes we explain the science behind valuing pre-revenue businesses.

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Khushdeep

Come join our table!

The Favcy Family is growing faster than ever. With new investors joining us each day, the Opening Day allocations have started filling up faster. We have been swarmed with requests to increase the allocation pools across our portfolio startups. We hear you.

The 'Current Open Deals' section gives you access to deals that previously weren't available! From allocations in the latest deals to spots carved out just for you in growth-stage startups, all the information you need is here! An exciting investment journey lies ahead.

This week, we have Majig in the house!

Do you even realise how many content creators you endorse consciously and unconsciously in a single day? Statistics show us that 2 out 5 purchases in India are influenced by celebrities and influencers!

And if that isn't mind-blowing enough, Social Commerce is set to become a $607B industry by 2027 growing at 32% CAGR (compound annual growth rate), with creators and solopreneurs commerce plays a fundamental role in this growth.

Enter Majig

Majig is the platform for Brands/Influencers/Creators to launch successful private labels and build a social-commerce tech enabled distribution platform.

Majig helps celebrities and influencers sell merchandise to their fans and assists manufacturers, solopreneurs and resellers in creating quality product and scaling distribution.

Want to know the secret sauce that sets them apart from the competition?

Stage: Pre Product 1st Cheque

Industry: Creator Commerce X Social Commerce

Access other Current Open Deals here

Looking to become a part of a work-culture that is inclusive, transparent, and experience the joy of working together to create something wonderful? We’re looking for people who are as excited as we are to help build our vision. Come join forces with us!

Currently, we have these openings:

1. Project Manager - Apply Here

2. Product Manager (1stCheque by Favcy) - Apply Here

3. PR Intern (Openbook VC) - Apply Here

Check out all the other openings here!

Can startups make you immortal?

By Ninie Verma, Content Associate, 1stChequebyFavcy

- If you had to choose between a red pill that makes you immortal and a blue pill that promises to make you live a content life while you're alive - would you choose to stay forever?

- Were you aware that there are longevity startups hell-bent on finding a cheat code to reversing ageing and increasing mortality?

- This week in Favcy Review we talk about longevity startups and their quest to conquer death.

-

Read on!

The Science Behind Valuing Pre-revenue Startups

By Ninie Verma, Content Associate, 1stCheque by Favcy

-

Have you ever wondered why we evaluate pre-revenue businesses when we're aware they are not worth much?

-

What makes VCs say seed-stage startup valuation is an art and not a science?

-

In this week’s Angel Bytes we explain the science behind evaluating pre-revenue businesses.

Read away!

Recently, I read in an article that “The science of startup valuation is more art than science.”

Well if it’s art, it has got to be absurdist art because most seed-stage companies have no value, right? I think the reason it is called more art than science is that there is little concrete data and many risk factors that could change the course of the business. It is a grey area, of sorts.

But this does bring up the question ‘Why do we value pre-revenue businesses?’, because technically, if we were to look at seed-stage businesses – firms that have not yet launched a product, regardless of how many rounds they have received — they are most likely worth the bare minimum, according to any rational valuation technique.

At this time, the only certainty is that the firm will continue to spend money until a product is introduced, at which point income may be earned. The likelihood of going out of business is high.

It's not much better for early-stage businesses, which are characterised by how much business progress they've achieved rather than by rounds like Series A or Series B. Once a seed-stage firm has launched a viable product, it has mitigated one of the two key risks that it faces: commercialization.

At this point, a firm must prove that the new product or service can be developed into a scalable business.

Early-stage enterprises, like seed-stage startups, are still relatively fragile, with no certainty of income or cash flows. The company is at the growth or expansion stage after the business has become predictable. Traditional valuation methodologies, such as discounted cash flow (DCF - used to estimate the value of an investment based on its expected future cash flows), are essentially worthless in the absence of predictability.

The Periodic Table of Elemental Properties of Startups

There’s a real estate joke that goes - All the elements of the periodic table would get instantly hired into real estate ‘cause they’ve got lots of properties.

In order to better understand the entire ordeal behind valuing pre-revenue businesses, think of real estate appraisal.

Real estate appraisers use three main methodologies when valuing a property: intrinsic value, income-producing value and market value.

Intrinsic value is often called “replacement cost” in real estate. It’s what it would cost to buy a similar piece of land and rebuild the same house from scratch, estimating the cost of labour and materials. In real estate appraising, this method carries almost no weight, just as in venture capital.

In real estate, another method called the income technique applies to properties that provide consistent cash flow, such as apartment complexes or existing rental properties. This strategy, for obvious reasons, cannot be applied to seed- and early-stage firms when there is no return and nothing is predictable but expenditures. This is why DCF isn't commonly used to evaluate companies.

The third methodology, market value, is the most often utilised in real estate evaluations. This is the closest to valuing pre-revenue businesses. The method aims to determine how the market values similar assets, as characterised by location, style, square footage, and transaction recency. In other words, what have other buyers indicated they are willing to pay for comparable residences in the same neighbourhood in the previous six months?

When using the market value approach, real estate appraisers use comparable sales to calculate an adjusted price per square foot as the primary foundation for determining values.

Venture capitalists operate in a similar manner. There are clear valuation ranges for startups by stage and by round, which represent an established market value.

VCs then look for comparable sales in the exit values of startups with similar business models in the same industry, measuring price-to-revenue for M&A and IPOs. We then apply these multiples to projections of future revenues to determine if we can achieve a “risk-adjusted” multiple at today’s market price.

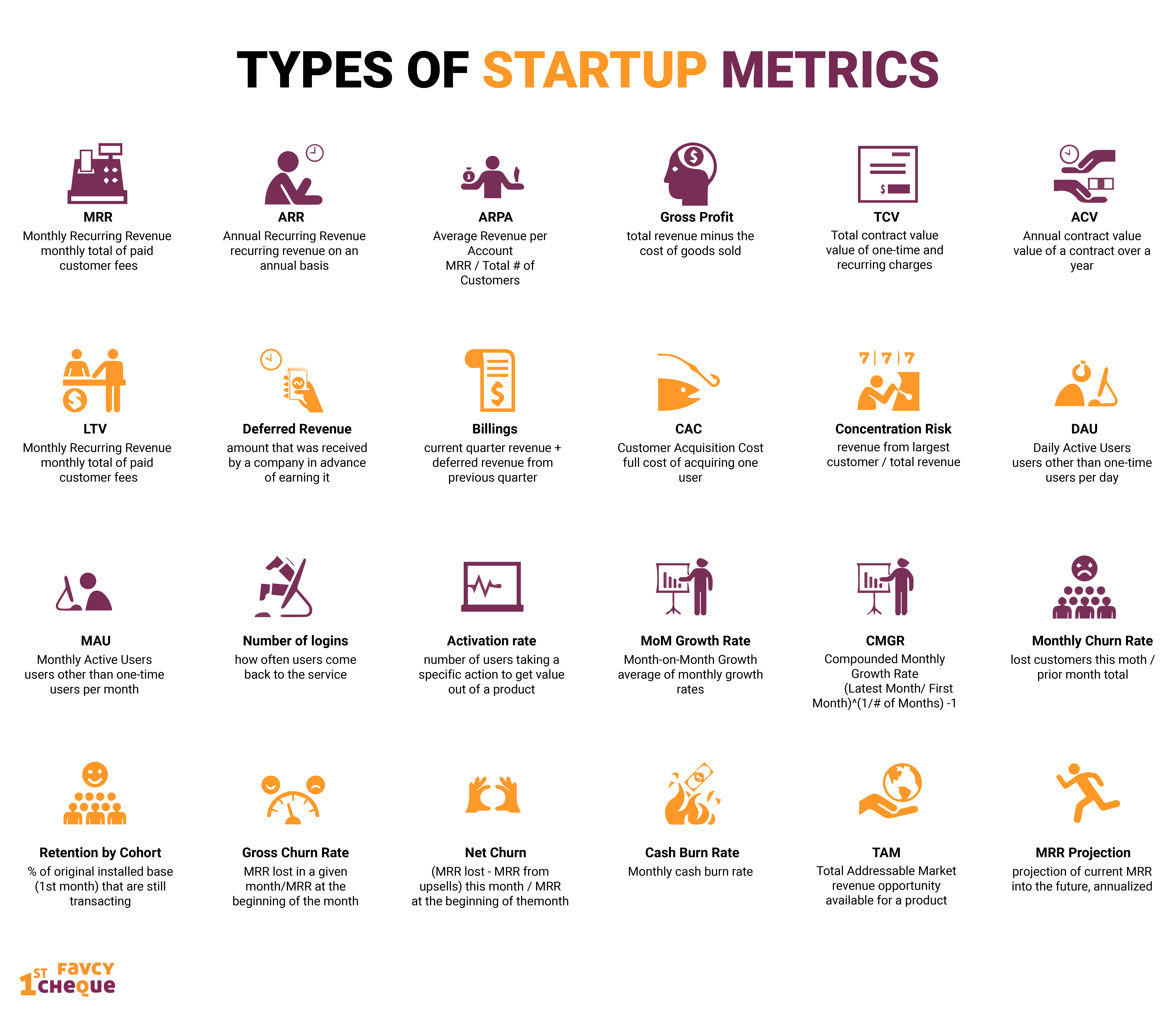

This is the crux of pre-revenue valuation. Most start-up metrics are of no use when it comes to evaluate pre-revenue startups.

Respectfully, we disagree

I’d say it is more science than art. Or at least a healthy combination of both.

Some early-stage investment negotiations resemble a game of Texas Hold-’em poker.

Each player withholds information and tries to convince opponents that his hand is better than it actually is. But valuation negotiations are not card games. Unlike poker, the objective of investment negotiations ought to be for investors and entrepreneurs to share information as transparently and completely as possible and to work together toward a common goal of building a successful venture.

There are different pre-revenue value estimation techniques which each provide a substantial estimate - from Bill Payne’s Model to Risk Factor Summation and the Berkus method.

Valuation for an early-stage company is less about calculating a supposedly 'accurate' value, and more about de-risking the investment as much as possible. It is about establishing the ambition of a company and then scaffolding that vision with enough data and detail to make it palatable for investors at the asked price.

All that’s required to justify a seed- or early-stage investment is to believe that the potential multiple on investment offsets the risk that capital may not be returned. This is based on the premise that the most investors can lose is 1x their money — and the most they can make is unlimited.

Lastly, as we always say, investors need to be rational about whether the potential multiple is realistic and worth the risk.

.png)

Here are the events of this week:

-

Truemeds raises $22Mn in Series B funding round.

-

ideaForge raises $20Mn in Series B funding round.

-

Zenda raises $9.5 Mn in seed round.

|