Vaul-let of Bankruptcy & The Future of Crypto in India

- It has been a long week for the Indian crypto ecosystem!

- If you were a user of Vauld, our prayers go out to you.

- What is happening at Vauld? Are all crypto-exchange platforms untrustworthy? What is the future of crypto in India?

Just days after this “reassuring tweet”, Singapore-based crypto trading platform Vauld recently suspended all its operations, including withdrawals and deposits, according to various media reports.

Just like many other platforms, Vauld has been facing financial challenges as the global cryptocurrency market finds itself in the middle of excessive volatility. Vauld has now been looking at a potential restructuring.

Vauld’s neat little arrangement that benefitted all, until it didn’t…….

The crypto-exchange platform lets individuals buy, borrow, lend and trade in cryptocurrencies.

Vauld enticed Indians with two propositions - automating their crypto investments and a high-interest rate on their fixed deposits.

An attractive 12.68% compared to the norm (3-5%) - but how can they offer such high-interest rates on a volatile asset?

Well, they used existing investments, turned them to cash and handed out collateral-based loans to others. Naturally, the borrower would pay principal + interest. And if push came to shove - Vauld could simply sell the borrower’s collateral and pay the lender back in full.

It was a neat little arrangement that benefited all parties.

But it’s not as simple as it sounds.

You see, there’s nothing fixed about this transaction. Borrowers could default en masse. The value of the collateral could dip. People may withdraw their deposits all at once. Many things could go wrong.

And they kind of did.

What went wrong with Vauld? What can investors do now? Is it the end of the road for investors?

Vauld could not save itself from macroeconomic downtrends including the crypto winter, Luna collapse, Celcius sage and bankruptcy of Three Arrows Capital. This led to panic among the users, who started to withdraw their funds from various exchanges.

Ultimately, new tax rules and overall pessimism in the crypto market were a final nail in the coffin for Vauld, which saw liquidation worth more than $200 million in less than a month.

Crypto lending platforms, like Vauld, heavily depend upon 'yield farming' which is typically arbitrage. Such institutions lend the crypto from users and arbitrage between the cash and the futures market.

The value of a particular crypto-token in India against another country on another exchange is quite significant and such platforms attempted to be benefitted from the same. This was attempted to generate a higher yield on the tokens lent.

As the selloff in the crypto market triggered, the arbitrage or the so-called yield farming opportunities slumped drastically. Not just the tokens crashed, but even the margin calls were triggered, adding more to the selling pressure.

The verdict for Vauld’s investors

The announcement of an acquisition by Nexo comes as a relief for the investors. However, such processes consume enough time, requiring thorough due diligence and current financial status of the company.

Food for thought…..

Vauld's fiasco also brings forward the pressing issue of investor protection.

In recent weeks, we’ve seen some of the biggest names in the digital currency industry brought to their knees by rapidly falling prices and the tsunami of liquidations that have followed. Celsius, Babel Finance, and Voyager Digital have all found themselves in hot water.

What all of this has shown is that people at the highest levels of the digital currency space are a frightening combination of incompetent and downright dishonest.

In the absence of crypto regulation, crypto investors have no regulatory recourse. Whom do we hold accountable when it is De-fi?

The Future of Crypto in India

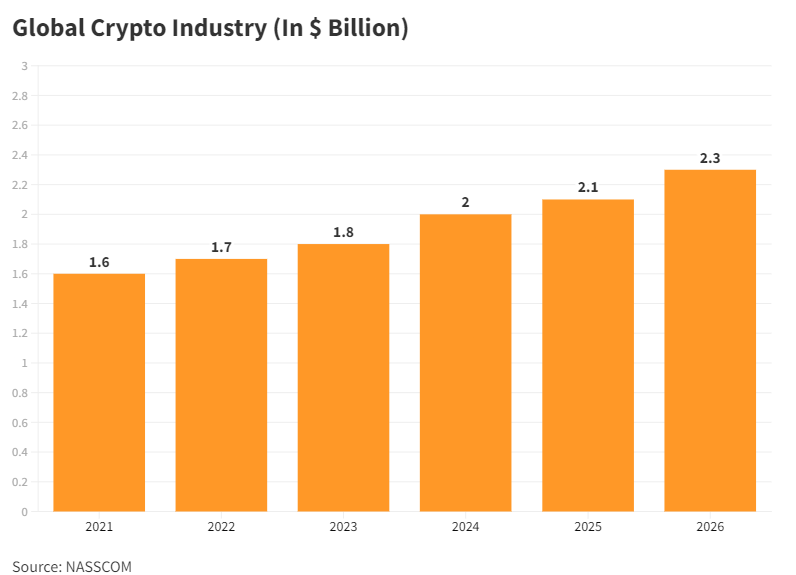

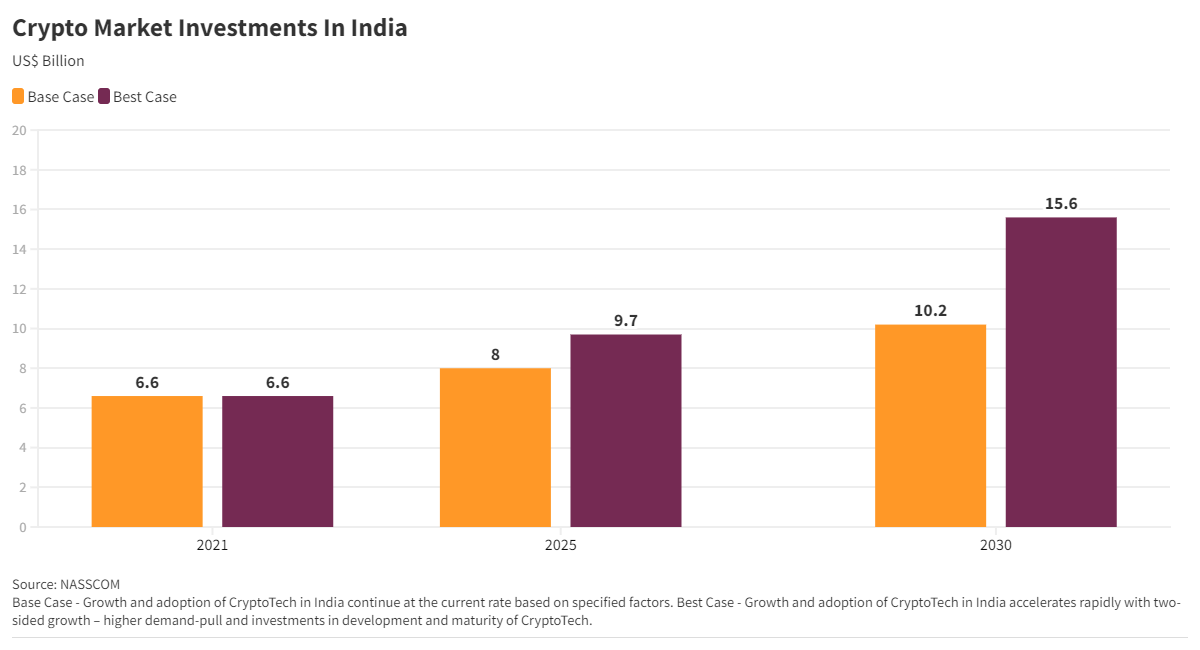

These were the healthy projections before the crypto market took a downfall -

Most Indian crypto exchanges have witnessed noticeable decline in their volumes soon after the 1% TDS came into effect. This means for every purchase, they need to earmark one percent of their price and pay as tax. This was seen to impact adversely the overall crypto market.

However, the future may not be as bleak as it seems...

While crypto has suffered some setbacks recently – the market capitalisation has fallen from its peak of $3 trillion in November 2021 to $996 billion (as of June 2022) – it’s an incredible ecosystem filled with exciting innovations and developments.

We can expect to see more innovation and adoption in the coming years, which will drive market growth across the world, including India. In other words, the future of Crypto is not as dim as critics think!