Venture Builders: 0 to 1

- Venture-building has emerged as one of the best ways to build a start-up from the ground up alongside accelerators and incubators.

- There are 3 main types of venture builders, - in-house, investor-led, and corporate.

- In this week’s Favcy review, Pranavharan delves deep into these models along with their examples around the globe.

I’m sure you must have sent out or seen a tweet at least once in your lives. The power of content that can be conveyed through 140 characters was brought to us by Twitter. And how was Twitter brought to us? Through Obvious Corp, a venture-building platform. And that leads us to this week’s review - the types of venture builders.

Before we dive into the types of venture builders, let us first make clear - what are venture builders? A venture builder is an organization who builds startups using their own resources. They are also known by the names startup studio or startup factory. Unlike accelerators or incubators, they do not run cohorts or programs which lead up to a demo day. Instead, they work on the product indefinitely till market launch.

In a sense, venture building companies are types of holding companies, with a stake in all the companies that they build. However, the ones that succeed are more on-hand, taking part in every part of the company’s life-cycle, not just building an MVP. They take care of the hiring needs, business development, and funding too. They scale the company up even after launch.

Broadly venture- building can be classified into three types

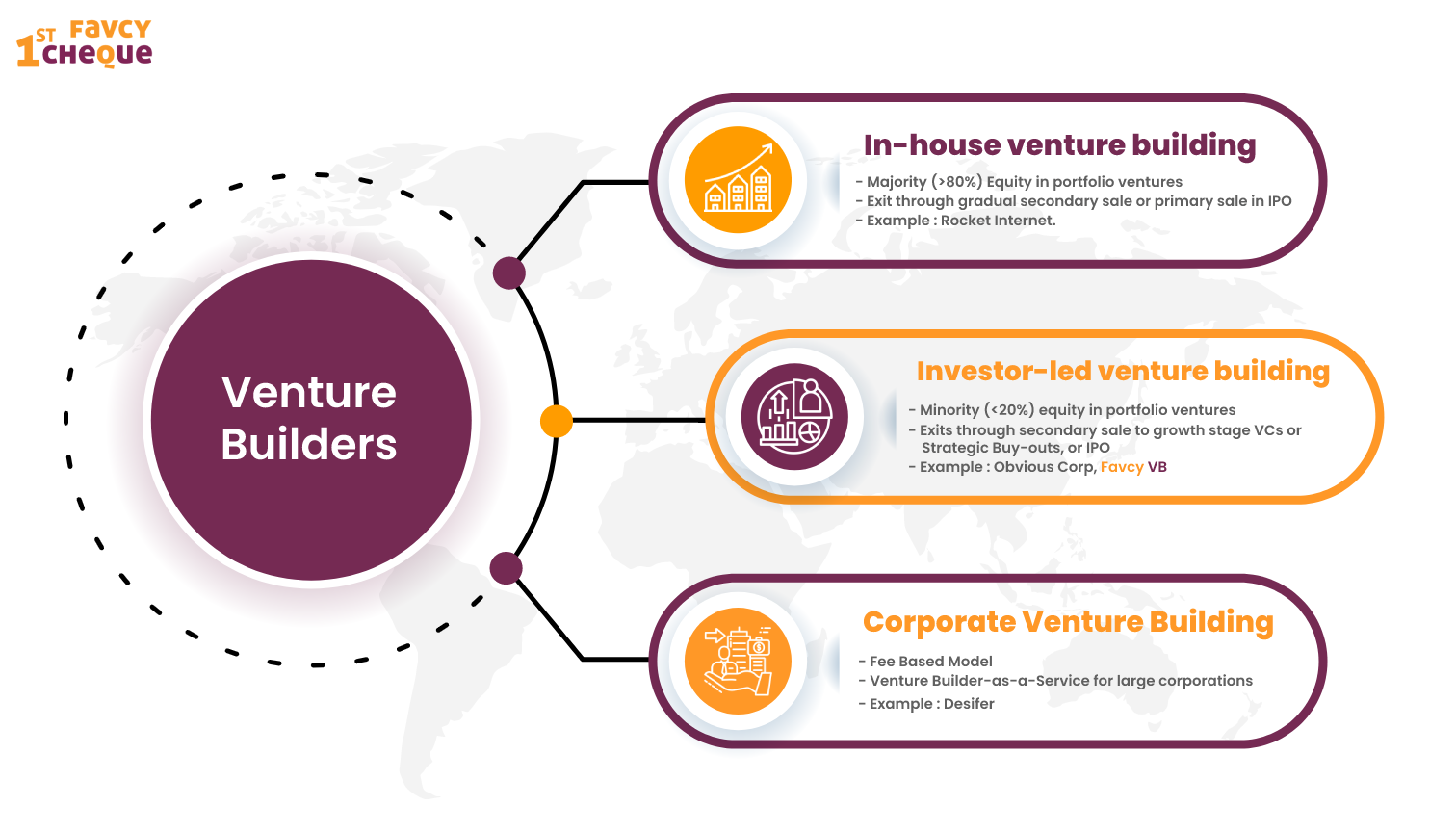

- In-house venture building

- Investor-led venture building

- Corporate venture building

In-house venture building

In this model, the venture builder takes care of everything in-house from ideation to execution. The venture builder owns a majority stake ( 80 % or more) in the startups which it creates. Internal capital is provided to take the company from zero to one. Internal capital is also provided for the growth of the company. The exit is through gradual secondary sale or through the IPO.

An example of a venture builder which follows such a model is Rocket Internet, a European Venture builder headquartered in Berlin. As of 2016, Rocket Internet has more than 28,000 employees across its worldwide network of companies, which consists of over 100 entities active in 110 countries. As of 2021, the company has a market capitalization of 3.7 billion euros.

One thing Rocket Internet has been criticized for is its copying of business models that worked in some countries and replicating them in other ones. For example, in 2008, Rocket Internet founded Zalando, inspired by US online retailer Zappos.com.

Investor-led venture building

In this model, growth in venture-built startups is led by investors. The capital ( human and financial) for going from zero to one is provided by the venture builder but capital for further growth is obtained from investors. Exits are through sales to growth VCs or through strategic buyouts or through IPOs.

An example of this type of venture builder is Obvious - which has built companies such as Medium and Twitter. Obvious is probably the most successful venture builder, having built companies that are known throughout the world. Twitter was later spun out as a separate company. In 2013, Williams and Stone (the founders of obvious) announced that they would be unwinding Obvious Corporation as they focused on individual startups.

Another example of an Investor lead venture builder is our very own - Favcy Venture Builders.

Corporate Venture Building

Corporate venture building is basically a model where the VB builds a startup for an organization for a particular fee. It is venture-building as a service for large corporations. The customer group is large companies looking for digital transformation solutions.

Because the corporation owns the business or businesses that emerge from the engagement, the venture builder and its talent can’t retain equity from the ventures. Corporations are charged fees per hour.

An example of a venture builder involved in corporate venture building is Desifer. They’ve built ventures for organizations like Absolut. Corporate venture building is not just a niche taken by a few companies. Even BCG, one of the top consulting firms in the world has its own corporate venture-building arm called BCG digital ventures. They’ve worked on a number of projects from helping UPS launch a new turn-key fulfillment network offering to help Sartorius, a lab equipment supplier, launch a new digital lab assistant called LabTwin. BCG’s digital ventures by itself is a medium-sized organization. They have 1000+ employees across the world and have built about 100+ companies since 2014.

In conclusion

Each venture builder model serves a specific purpose and therefore it cannot be concluded which is better than the other. However, we firmly believe that the venture building model is the way to go if you want to build a start-up!

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us: