We're FavcyVB and we're not an accelerator!

Dear Reader, we are back! With a bang or not, I’d leave that upon you to decide 😊

A lot of you have been associated with us for some time now. However, one question that we get asked by most of you on a regular basis is - ‘are you an accelerator/incubator?’ To this we want to say that 'we are Favcy Venture Builders and we are not an accelerator’. Does that sound like a borrowed dialogue? If yes, then great coz that was the intent. 😉

Ok. So now that it is established that we are venture builders, the next obvious question is how do we differ from accelerators when we are also working with early stage startups and supporting them to expedite their growth journeys.

Well, fair question. I would like to assure you that this is not just a fancy jargon and there is a lot of heavy lifting (read hard work) that goes behind the scenes in building ventures from 0 to 1. To give you an insider view into what goes on at a venture builder read on.

|

|

|

In our Short Take section this week we bring out the differences between a VB and an accelerator.In our Favcy Review section we break down the different types of venture builder models around the globe and list the most popular ones for you. Btw, did you know that Twitter came out of a venture builder? (Oh yeah!)

We further demystify the workings of a venture builder in our Angel Bytes section where we give you a understanding of how do we evaluate idea stage startups (that don’t have a product or traction yet) on the basis of their LTV:CAC (lifetime value vs customer acquisition cost) ratios.

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Yamika

Y-Combinator's known to build world class start-ups. But, is it a venture builder or an accelerator? Also, what's the difference between the two?

This week, we have got you covered. Read on to find out!

.png)

.png)

Venture Builders: A to Z

by PranavHaran Mohanasundaram, Favcy 1stCheque

-

Venture-building has emerged as one of the best ways to build a start-up from the ground up alongside accelerators and incubators.

-

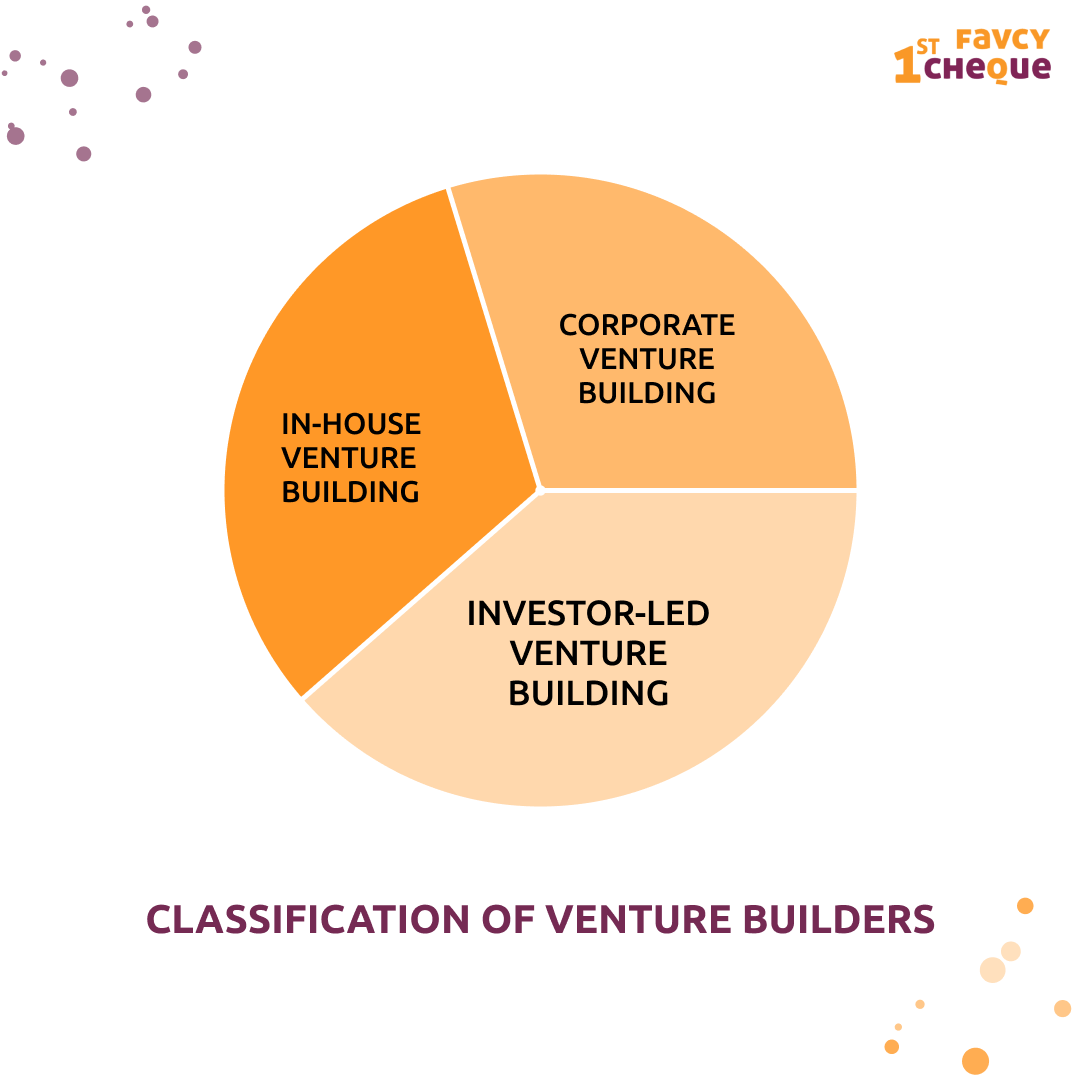

There are 3 main types of venture builders, - in-house, investor-led, and corporate.

-

In this week’s Favcy review, Pranavharan delves deep into these models along with their examples around the globe.

Read on to find out!

.png)

Behind the scenes - Unit Economics

by Khushdeep Sethi, Content Strategist, Favcy 1stCheque

Have you ever played Jenga?

It is based on the simple premise of stacking blocks and the key is to maintain the center of gravity to prevent the entire stack of blocks above from falling. This game is not like throwing darts in the dark but a very strategic game which if done right will keep the stack intact till the end!

Doesn’t this ring a bell? Drumroll, please

Angel Investments!

This might feel confusing for a second but stick till the end to know where this is leading!

Let me channel my inner Lucifer for a bit. As investors, what is the one thing you desire the most? A great startup deal (that’s what we do 💁), isn’t it?

But where does this all come from? How do we present you with healthy, risk mitigated deals?

One of the first steps in the assembly line of mitigating risk in startups is establishing strong economic and financial principles with regard to the startup which prevents the startup from falling like that stack of blocks! ( Reference check, 😉)

How do we establish that? We focus on the missing component in most startups which is the concept of ‘unit economics’. This week, we’re giving you a front-row seat to take a peek at the small slice of magic that goes behind assessing the revenue model.

What is Unit Economics?

In layman's terms, unit economics are the direct costs and revenues inherent with a startup's business model on a per-unit basis. A unit is any measurable item that adds value to a startup. It examines the direct revenues and costs associated with the most fundamental element of a startup's business plan.

Based on this data, it is feasible to forecast how profitable the startup will be (or will not be) and when it will attain profitability.

Why is it important?

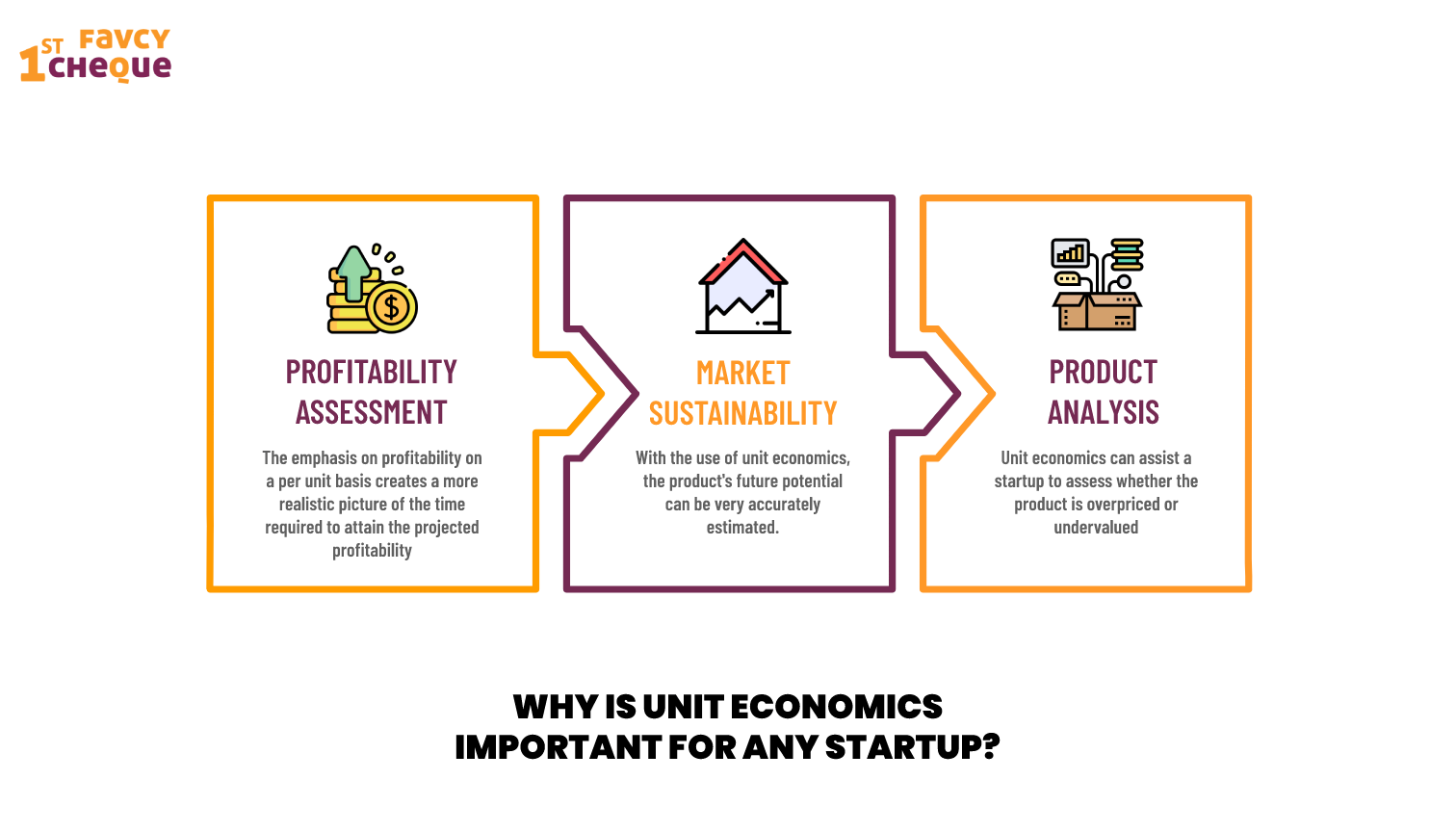

At an idea stage, what we have at our disposal is assessing the assumptions we make for the startup. Unit economics play a vital role in assessing those - like profitability of the startup, its market sustainability, and the financials of the product itself.

Profitability Assessment

The emphasis on the profitability on a per unit basis creates a more realistic picture of the time required to attain the projected profitability. Unit economics measures cost down to their bare minimum unit, boosting the accuracy of these anticipated profit levels.

Market Sustainability

With the use of unit economics, the product's future potential can be very accurately estimated. It is especially useful for startups that make the most of it in the early stages of their business. Unit economics is what allows these startups to get off to a roaring start.

Product Analysis

Unit economics can assist a startup to assess whether the product is overpriced or undervalued. It answers the following questions:

-

Are the expenses incurred with regard to marketing worth every dime?

-

Are there any expenses that can be cut?

-

Is it possible to optimize the product in any way?

How to calculate unit economics?

The two important terms that hold everything together are Customer Lifetime Value (LTV) and Customer Acquisition Costs (CAC). Unit economics can be viewed from two perspectives -

LTV/CAC Model: the ratio of customer lifetime value (LTV) to customer acquisition costs (CAC) or the payback period on CAC. The role of this model is to derive the ratio in which the value obtained from a customer must be at least X times the costs incurred to acquire the customer. This signifies the health of the business.

LTV/CAC Model

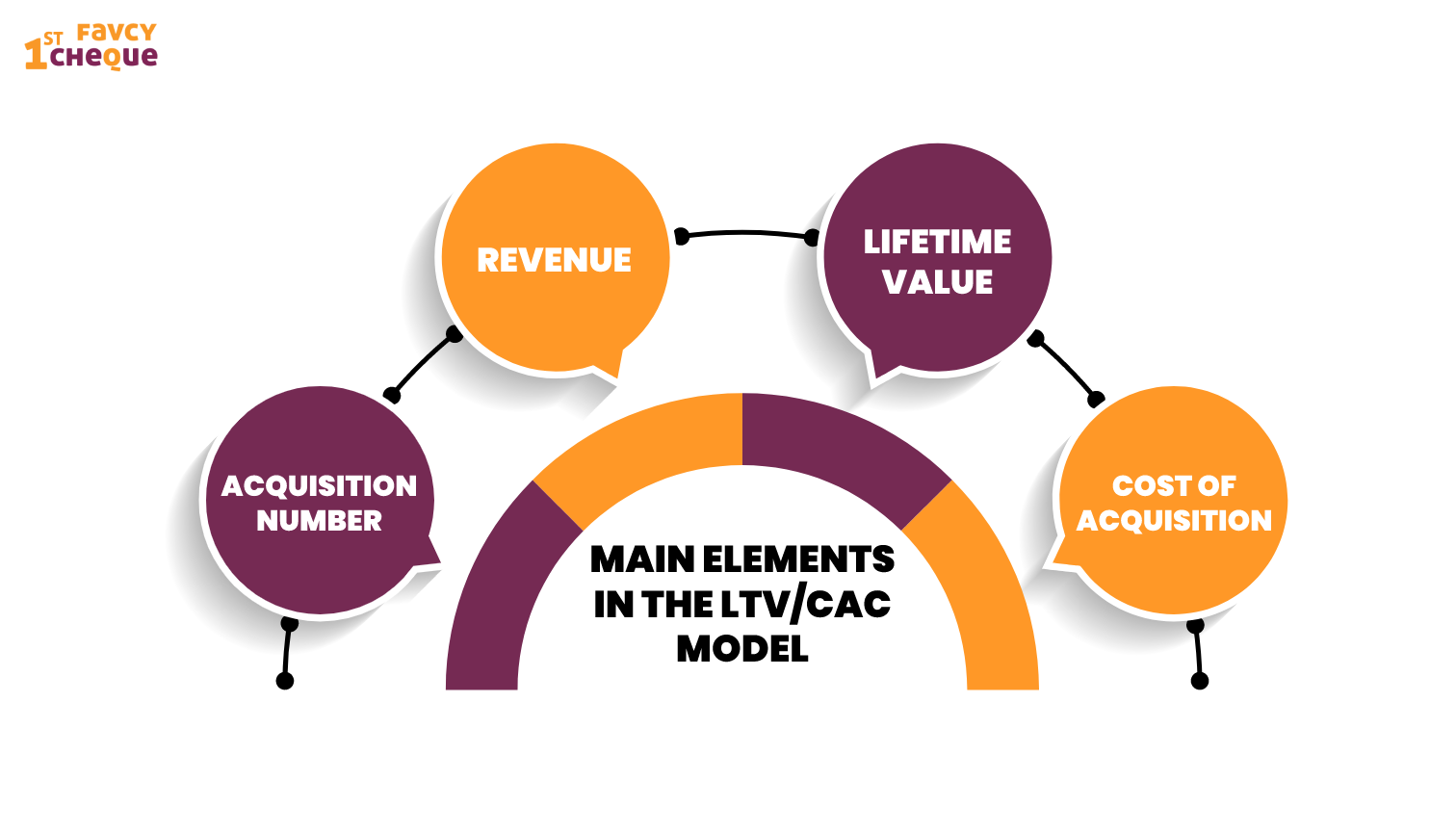

At Favcy, the main elements in the LTV/CAC model are -

-

Acquisition Number (Total number of entities* that the startup can acquire per year)

-

Revenue (Total revenue generated per entity)

-

Lifetime Value (Timespan of association of an entity with the startup)

-

Cost of Acquisition (Money spent on acquiring per entity)

*Entities can be customers/ distributors/ manufacturers/ other businesses and so on

Payback period on CAC

This takes into account how long it takes a business to recoup the expense of acquiring a customer. Shorter payback times are favorable since less moving capital is required, allowing businesses to grow more efficiently. At Favcy, we build a 5-year LTV/CAC Model to work out the health of the business for a 0-5 year period.

Unit economics strengthens the startup's market position and strives for consistency in growth rates. At Favcy, we work with startups whose ratios are more than 4:1 (Pure Digital Businesses) and 6:1 (Digitally Enabled Businesses). Reason being that India is still growing to adopt full-fledged technology and as compared to digitally-enabled startups, it takes a little more money to acquire customers with pure digital products.

.png)

Here are the events of this week:

- Cred valuation nearly doubles after $250-million funding.

- SUN Mobility raises $50 mn from Vitol.

- CredAble raises $30 mn in Series B funding.

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Subscribe to our newsletter 👇🏻 Don't worry, it'll take just few seconds :)

Reach out to us: