Why Angel Investing Should Become Your New Year Resolution for 2022

Did you know back in 2014, 80-90% of the Indian population had no idea what a startup or an angel investor is?

Fast Forward 2022, we’re the third largest startup ecosystem around the globe and are estimated to become the world’s third-largest economy by 2030?!

And in this ginormous economy, in 2021 alone, Indian startups raised upward of $20 billion in funding!

Why this massive influx of funds? And why NOW?

We have been transitioning into the new era of Tech-Empowered India. Startups attempting to influence fundamental parts of customer behaviour are increasingly seen as the forerunners of innovation. And innovation has started to gain support like never before, resulting in funding.

The concept that a business must mature and begin making money to attract investors has also been shattered (sort of). How? Angel Investors!

Back in the day, angel investing was narrowed down to HNIs or Ultra HNIs but the wave that transformed angel investment in India was making this investment sector accessible for the general public.

How?

Platforms like LetsVenture, SeedInvest and yours truly 1stCheque.

There has been a paradigm shift in the way people are investing money.

People are willing to fund innovation. They can now invest in cutting-edge technology that were previously only available to venture capitalists and institutional money managers. As a result, they are now willing to diversify their portfolios away from public markets and invest in private enterprises ranging from healthcare and cuisine to education and robotics. And by 2025 start-ups are expected to raise a whopping $100billion!

This makes it the perfect time to hop on the ‘Angel Investing Bandwagon’

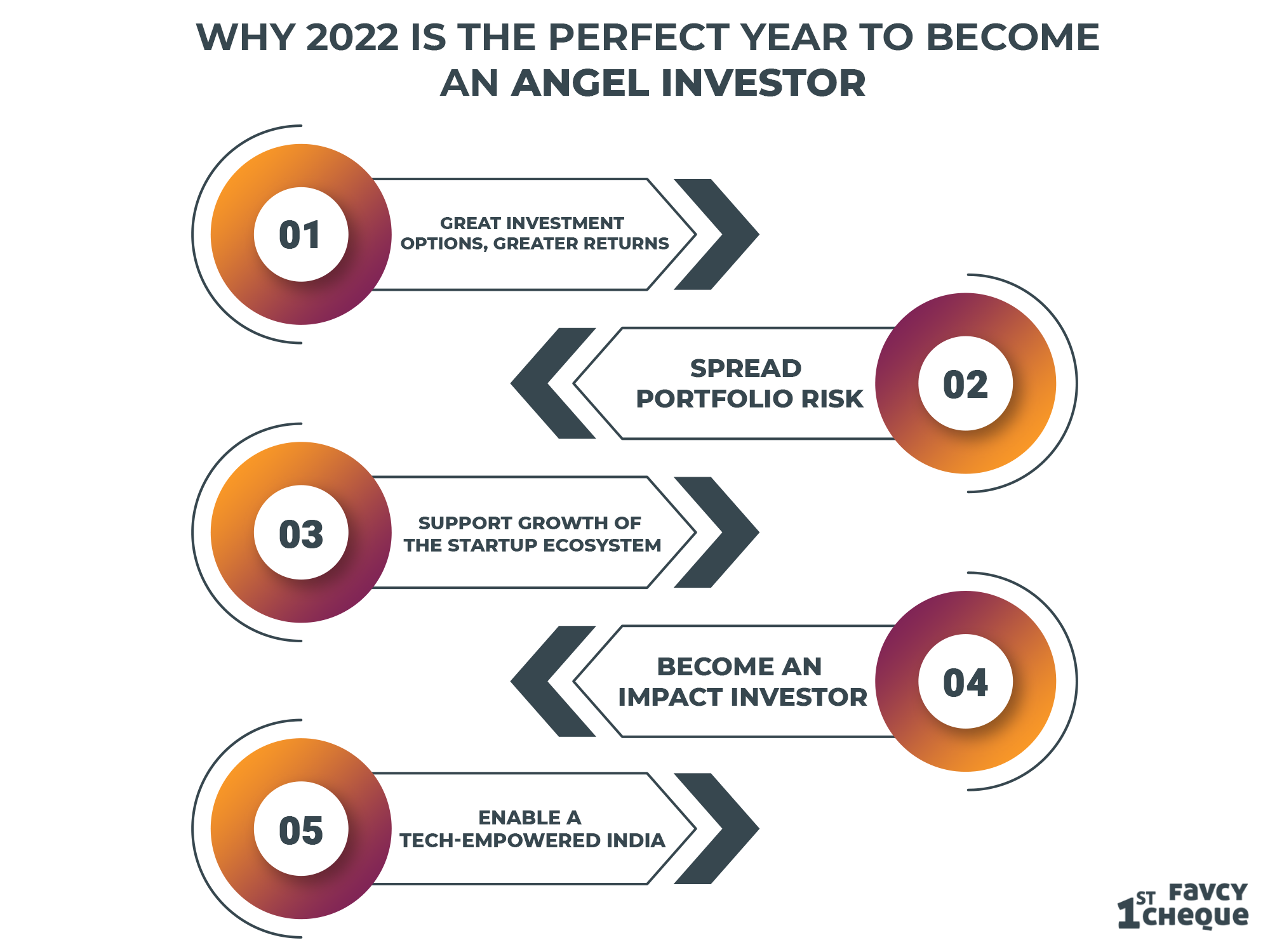

Furthermore, we’ve exclusively compiled the top reasons to why 2022 is the perfect year to become an angel investor -

1. Great Investment Options, Greater Returns

It’s a no brainer to realise the marvels that the startup ecosystem has witnessed in the past year. With 82 unicorns, $38.5B raised, 1400+ deals as one of the top massive startup empires in the entire world!

The IPOs of Zomato, Nykaa, PayTm, and PolicyBazaar have thrust start-up financing into the limelight for all the right reasons. Strong equity market returns are also making their way into private markets. While every investment has a risk-reward ratio, angel investors no longer need to be intimidated by risk if they have the right support.

2. Spread Portfolio Risk

Startup Investment is an illiquid high risk asset class but it is still one of the most picked alternative asset classes. Why? Major Returns!

Contrary to the popular belief, angel investing is a great opportunity to reduce portfolio risk - If done right! Within angel investing, one belief system that goes around is ‘Never put all your eggs in the same basket’ This is evidently true in this case. Want to know how to mitigate portfolio risk, read the article here.

Furthermore, having shares in an unlisted firm implies that the returns from startups are frequently less associated with market movements, lowering the impact of negative shocks to the market and hence the unsystematic risk of a portfolio. 3. Support Growth of the Startup Ecosystem

Think of your investment as rain. And it takes rain, sun and a million different things for a seed to become a sapling. And then years to become a sturdy, fruit-bearing tree. Each startup supports the growth of the startup economy. This results in new business possibilities, innovation, tech-centric initiatives, and employment creation across so many industries. With angel investing, you will not only be helping someone achieve their dream but also contribute to this ecosystem.

4. Become an Impact Investor

Start-ups that make a social impact are also on a roll for 2022. For more socially conscious angel investors, you can choose to back local, innovative businesses that are filling a gap in the market and solving problems that have yet to be addressed by larger businesses.

From sustainable tech to a rise in eco-friendly D2C brands, we are looking towards growth in climate-conscious companies and consumers.

5. Enable a Tech-Empowered India

Tech regulations in China are shifting the focus of global and Indian investors on India’s tech revolution, making it an attractive destination for investments. We are positive that this sector is bound to grow in leaps and bounds in the next decade and the right time to put a finger in the tech pie is NOW.

The most significant reason still remains the fact that angel investing is now accessible to the general public. People now don’t need large cheques to have a seat at the cap table.

At 1stCheque, we offer you pre-vetted and risk-mitigated dealflow to invest in. The minimum ticket sizes are kept low across the portfolio so that you can diversify even with your limited corpus. We give you access to all possible collaterals including our thesis (why did we invest in a startup) to help you evaluate each opportunity in depth. And we earmark a lead pool for you in the larger rounds just, so you can consolidate your positions in your favorite startups.