INSIDER: JULY 3RD, 2021

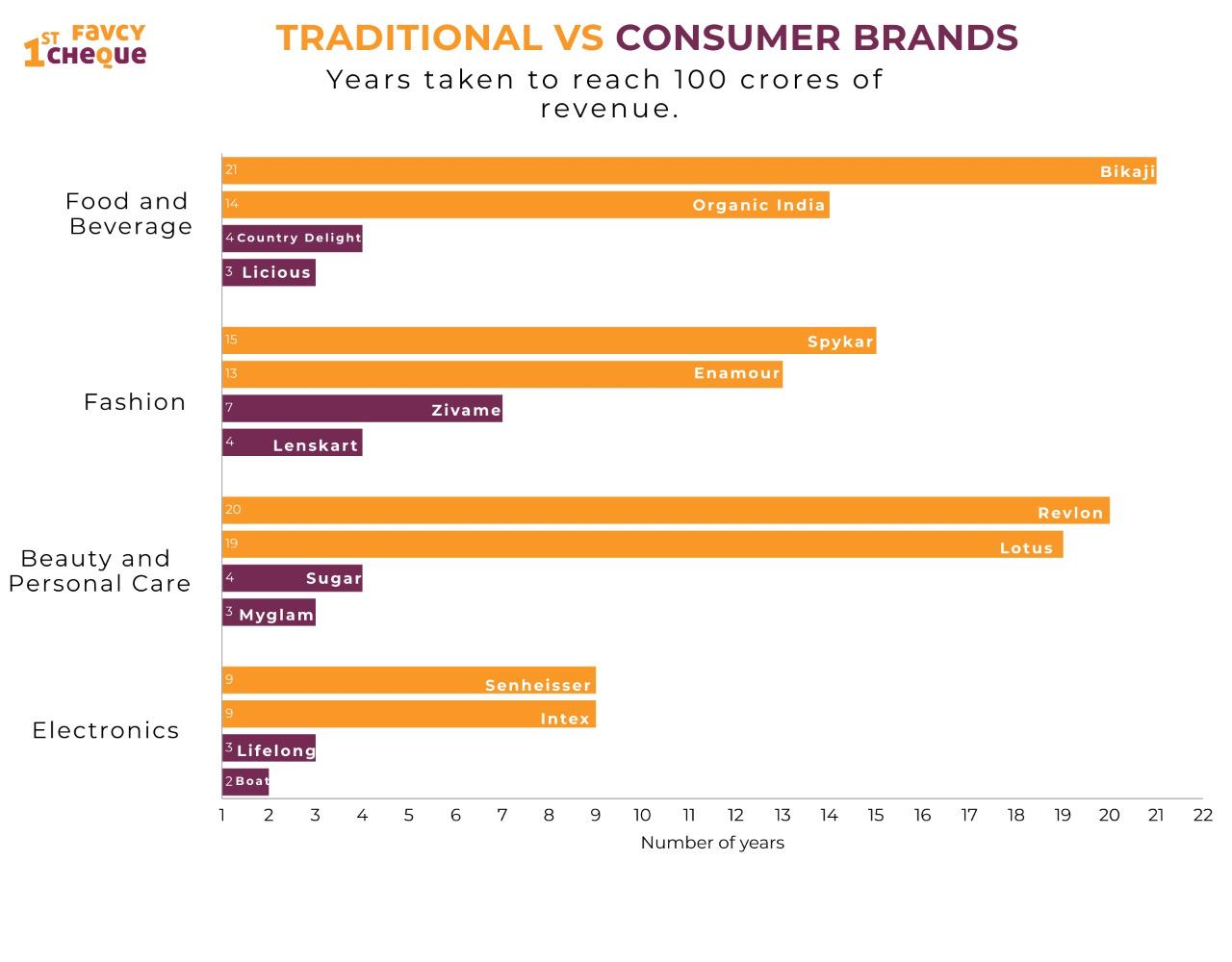

Dear Reader, for the past year or so I am enamoured by the strong wave of Indian consumer (D2C) brands that have taken over the Indian market by storm.

From my grooming supplies (Mama Earth, the Switch Fix, Arata, Plum) to my cleaning supplies (the better HOME), accessories (boat), snacks (the whole truth) and a lot more has been purchased from one or the other recently cropped up D2C brand. These brands have carved a unique positioning for themselves in the traditionally big brand dominated FMCG and FMCD markets in India.

Along with the attention of the average consumer, these brands have also captured the interest of the king makers - businesses that acquire operate and grow e-commerce first businesses. There are a bunch of them now - 10Club, Upscalio, Mensa, Evenflow and more that have come up and are heating up the consumer space more than ever before.

The biggest news of the week has been the $40Mn seed round raise by 10Club (highest ever seed round raise by an Indian startup). The D2C founders are celebrating this raise in their own cheeky ways - as can be seen in the tweets above :)

On the back of this news, in this week’s review section, Hardik Kharga, Investor Associate, Favcy VB, writes an in-depth piece decoding the Thrasio model and its efficacy for the Indian Market.

What else do we have?

We talk about ways, in our Angel Bytes section, to help you minimize/manage your startup portfolio risks and Pinaki Aich, Partner, Forward Investments, talks about the emergence of B2B startups post covid in our Insights section.

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Cheers 🍻

Yamika

.png)

Here are the events of this week:

-

KKR buys $625 million stakes in Vini.

-

Trell set to raise $40 Mn led by Mirae Asset and H&M.

-

Quantela raises $40 million from Digital Alpha.

_2.png)

Building Empires by Buying Kings (a.k.a Ye Thrasio kya hai?)

Hardik Raj Kharga, Investment Associate, Favcy

Not every empire has to be built, some can be bought. If you ask what is one of India’s largest seed-funded companies, look no further because we will tell you. It is 10Club. They raised USD 40 Million. More than USD 250 Million has been pumped into more than 10 startups who have more or less the exact same model. Are we starting at a gold rush?

Let's find out!

_1.png)

Emergence of B2B Startups Post-Covid - Pinaki Aich, Partner, Forward Investments

Some of the earliest success stories in the Indian Startup ecosystem are of B2B focussed Startup. B2B is making a comeback! Pinaki Aich shares his view on why and how B2B ecosystem will re-emerge stronger Post-Covid.

Acquire Expertise in Angel Investment and read our well-researched and in-depth topics about startups and investing

How can you manage/ minimize portfolio risk as an investor?

From humble beginnings, Angel Investing has evolved into one of the best asset classes in the private equity space. Like every investment, it has a risk/return profile that needs to be understood (we covered it last week here). We realise that, yes, Startup Investment is an illiquid high risk asset class but it is still one of the most picked alternative asset classes. The reason behind this is that the risk pairs with the potential for a major win.

Here's an eye-popping figure: 6,000 times. That's investor Garry Tan's return on his $300,000 investment in Coinbase from 2012. His stake was worth about $2 billion at IPO.

That might not happen that often but it certainly is the right incentive to invest.

As newbie investors, what most people fail to understand is that randomly investing in 20 startups is not an investment portfolio but a mistake and a stumbling one. What you need is a portfolio strategy, one which assesses and manages the risk from the investment equation.

Managing a portfolio of early-stage startups can be chaotic. We feel you! However, it’s worth the sweat. Not only will you be managing your portfolio but will also be adding value to your investments.

Well, you don’t have to google it because we already did! (we always back our facts with research)

There are many different ways by which you can manage the portfolio risk.

Let’s get into this:

Invest in pre-vetted startups

If you’re going to invest in a startup, it’s best to go for one that’s pre-vetted (and risk-mitigated as far as possible). It involves digging into all the faucets of the business to learn as much as possible about the venture’s success. While this process cannot be 100% accurate, this significantly reduces the risk of poor investments. Co-investing with larger investors (who have been in the game for some time) brings down the risk when you are starting off as an angel. Conducting due diligence is not everyone’s forte, that’s why prefer startups where all the hard work related to mitigating risks is already done for you just like we do at 1stcheque

Invest in wide range of startups

DIVERSIFY! We have talked about this in the past far too much and still it’s not enough.

Diversification is always a good way to mitigate risk. Rather than conserving yourself on thin ice, expand your investments as wide as you can but don’t do it blindly. There are many different elements to diversification beyond quantity.

-

Invest in varied industries that you understand well

-

Have startups that are at different stages of development

-

Have startups that are undertaking different kinds of key risks.

-

Have some startups that need your in-depth knowledge and involvement and have some where you can afford to be passive.

The key role behind diversification is to create a balance that yields positive outcomes. For every weight, you need a counter-weight. For example, You need to invest in different industries because if one sector is lagging behind, the other will pick up the slack. This way you can dodge any worst case volatility in your portfolio.

Analyze the business model/ Invest in profitable business models

It all comes down to, “Is this business model scalable?”

It is important to understand that there is not one winning strategy for most of the business models. Some startups like Netflix can disrupt the whole market with their model and some can’t even move a rock. What you can do is analyze the business model to see if it’s profitable/scalable or not. Business model takes into account everything from Market Size to Product Differentiation to the Founder's Experience. Invest in those startups that pass this vigorous checklist.

Have a portion of capital to invest in follow-up rounds

Colloquially, this is referred to as keeping ‘Dry Powder’ for follow-on investments. Being part of an early-stage startup may give you the right to invest in further rounds, depending on the terms of offering. You can have early access to these future rounds as you have established relationships with these startups. In some cases, you can have a legal right to invest in follow-on rounds via ‘pro-rata’ rights and maintain your percentage ownership in the company.

The gist of everything is to believe in what you do. After hours of analysis, due diligence, mitigating risks, and whatnot, it all comes down to the trust you have in the idea and the founder you have backed. As far as the risk concerns, you have to go out on a limb to find the fruit.

Besides, you have us!

At Favcy, we offer you pre-vetted and risk-mitigated dealflow to invest in. The minimum ticket sizes are kept low across the portfolio so that you can diversify even with your limited corpus. We give you access to all possible collaterals including our thesis (why did we invest in a startup) to help you evaluate each opportunity in depth. And we earmark a lead pool for you in the larger rounds just, so you can consolidate your positions in your favorite startups.

Want to know more about our open portfolio, let’s talk.

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Reach out to us: