INSIDER: JUNE 19th, 2021

Dear Reader, lo and behold, this edition is coming to you straight from the ICU along with a confirmation that while covid is bad, the post covid complications are for real and they are ugly. So, keep the mask up and get vaccinated. To keep my mind off the morbidity surrounding me, I decided to focus on something positive for this week's note. And money talk always seems to elevate the mood. So let's begin..

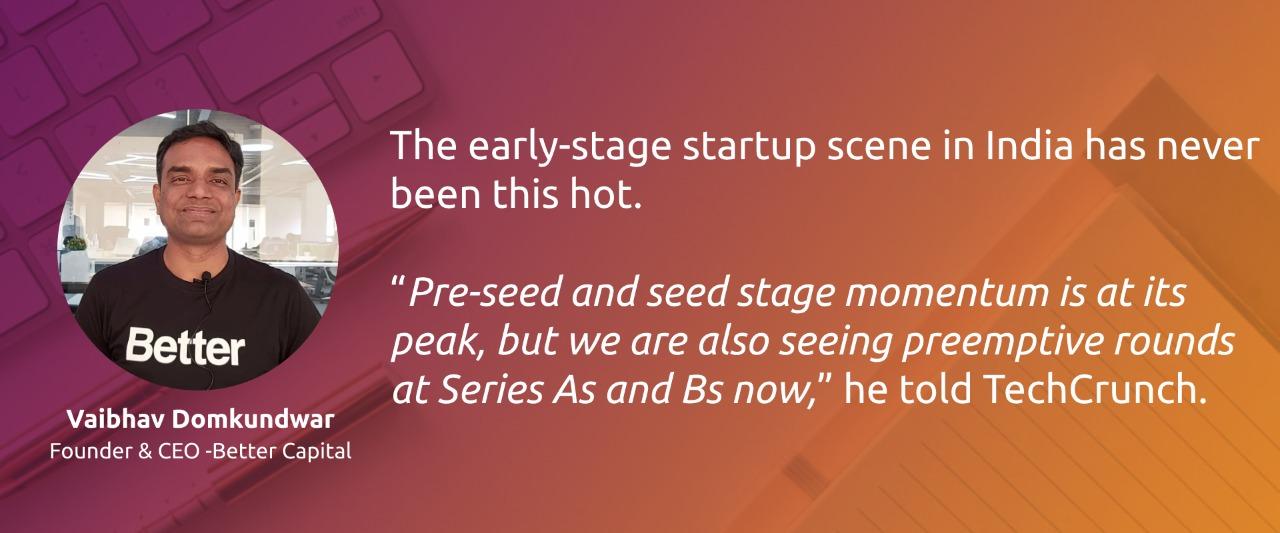

Remember the time when VCs would not entertain founders if they were not making 6 figure revenues or didn't have 7 figures customer base? All that seemed to have changed, with large (typically Series A) VCs like Sequoia and Tiger chasing more and more early stage startups.

The frenetic pace of investments in early-stage deals come as many of the more mature bets have become unicorns in India and many established startups are finally exploring taking the public markets. Read our detailed report on the Zomato IPO from last week here.

With large VCs jumping into the early seed stage rounds, the obvious stage left for angels (even for micro-funds) to pounce on is pre-seed (that could mean pre-revenue and even pre-product in some cases). Coming in early ensures that one can buy a much larger stake in a startup for lower prices before the valuation of the startup (assuming things work out well) soars. With seed stage investments ripe, this also means that the early angels have a much better chance of an early exit.

And here comes a smart plugin - looking for risk-mitigated early stage startup deals? Talk to us at 1stcheque.com 😉

Have you ever wondered what differentiates a VC from a PE and them from a VB (Venture Builder)? In our Favcy Review section this week, by our Founding Partner, Pranav Chaturvedi, we bring to you an insider's take on what sets the three apart. And we talk about valuations and decode convertible notes for you in our Insights and Angel Bytes section.

Do share your feedback on this effort. You can mail us at insider@1stcheque.com

Best,

Yamika Mehra

.png)

Here are the events of this week:

-

SaaS startup BrowserStack turns unicorn; raises $200M.

-

Edtech startup ApplyBoard raises $300M at a valuation of $3.2B.

-

SoftBank Vision Fund 2 leads $140M funding in Vishal Sikka’s Vianai

_2.png)

Between a Venture Builder, a VC and the Private Equity guy — who is the coolest?

Pranav Chaturvedi, Founding Partner, Favcy

_1.png)

You can stop here. None. A Founder of a Startup is the coolest.

But if you still insist, do not like click baits, are ready for some exhaustive reading that separates the chaff from the grains and want to understand the nuances that differentiate the three — please go ahead.

.png)

_1.png)

How do valuations work in an Angel Round? - Rajul Garg, Managing Partner, Leo Capital.

Valuing a venture at an early stage is always tricky, here Rajul Garg from Leo Capital shares his view and on-ground reality on how valuation work at an Angel Round.

Acquire Expertise in Angel Investment and read our well-researched and in-depth topics about startups and investing

%20(1).png)

Why do early stage startups raise via SAFE/Convertible Notes?

Having plunged into the evaluation process for early-stage startups for the last two weeks (we have discussed it here), it’s high time we turn our sails towards investments which is long overdue.

For the past 10 years or so, founders of early-stage startups have been increasingly turning to convertible notes and SAFEs to structure investment rounds, particularly for their first capital raise. But what are convertors? Why not just opt the traditional Priced Equity? What are the primary benefits for founders and their investors to opt for convertible notes and SAFEs? It's important to consider why the convertible notes and SAFEs have made such a big splash in the early-stage financing world.

Convertible Notes

A convertible note is short-term debt that converts into equity. The primary advantage of a convertible note is that it allows founders and investors to postpone the valuation discussion to another day. Convertible notes convert into equity based on the valuation of the company’s next equity financing round. They avoid placing a valuation on the startup, which can be useful particularly for seed stage companies which have not had enough operating history to properly set a valuation and act as a good bridge-capital or intra-round financing options. What is in it for you?

As convertible noteholders, you receive:

1. A creditor's claim to its principal and interest.

2. The right to receive equity of the company under certain specified circumstances.

It usually includes a “valuation cap” — a maximum valuation at which the investment made via the convertible note will convert into equity OR a 'discount on valuation' - where the investment converts to equity at a discounted valuation. This protects the investor against receiving only a minuscule amount of ownership in the company in case the valuation of the future priced equity round gets set so high. More developed startups also use convertible notes as bridge financing to a later-stage equity round or a sale of the company.

SAFEs

The SAFE was introduced by YCombinator and Orrick in 2013 to streamline venture financing for early stage startups. It is a brief investment document that offers a simple way for investors to provide funding to early stage companies. The goal was to avoid the drawn-out negotiations and lengthy paperwork that can often serve to hinder the investment process, by creating standard, pre-agreed terms and conditions that govern the investment.

The core is that investors provide funding to companies in exchange for the right to obtain equity in the company down the road.

A SAFE and convertible note both allow for conversion into equity. The key difference is that SAFEs only allow for conversion into the next round of preferred stock issued by a company in the next priced financing round. On the other hand, convertible notes allow for conversion into the current round of shares or a future financing event where a new series of preferred stock is issued.

It is quite evident that early-stage startups prefer SAFEs and convertible notes over priced equity as it provides them a much more reliable method for raising capital without the Valuation pressure.

At Favcy, we use a slightly modified version of SAFE to raise funds for our early stage portfolio startups. We call them ATFT (Agreement Towards Future Transactions) agreements and offer lucrative multipliers to our early stage investors. For example - if you invest Rs.5L in a startup, at a 2X multiplier, your investment will convert to equity worth Rs.10L(2XRs.5L) at the next valuation. Now if the valuation is Rs.10Cr, for your Rs.5L investment, you get 1% equity.

Want to know more about the topic? Let's get on a call.

Stay tuned to receive the latest industry trends, investor insights, our exclusive angel bytes, and much more!

A platform for first-time angel investors to learn the science of early-stage startup evaluation. Get exclusive access to pre-vetted deal flow and make your first investment.

Reach out to us: